Embed presentation

Download to read offline

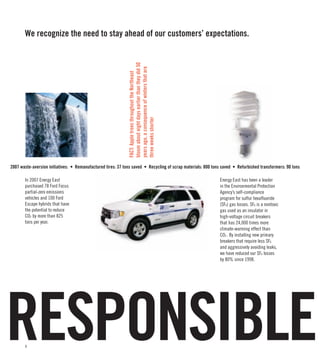

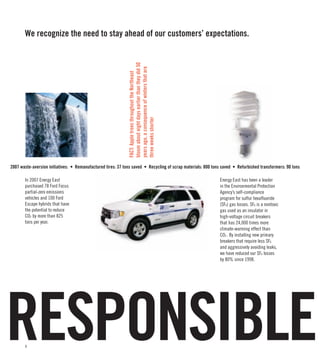

Energy East Corporation achieved several goals in 2007 that positioned it for long-term success and sustainability. It exceeded earnings targets, increased its dividend for the 10th straight year, and maintained high customer satisfaction ratings. Energy East also made progress on key infrastructure initiatives and acquired more fuel-efficient vehicles. Most significantly, Energy East agreed to be acquired by Iberdrola, one of the world's largest renewable energy producers, a deal that will provide expertise and funding to achieve Energy East's sustainability goals over the coming decades.