Embed presentation

Download to read offline

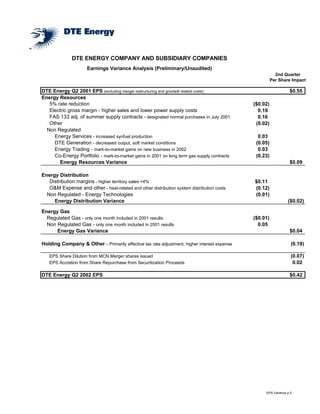

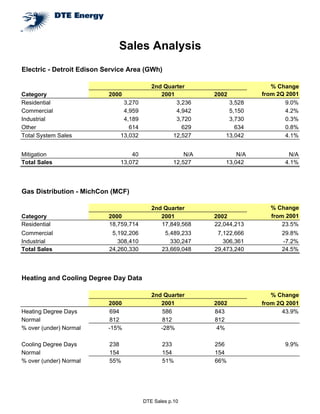

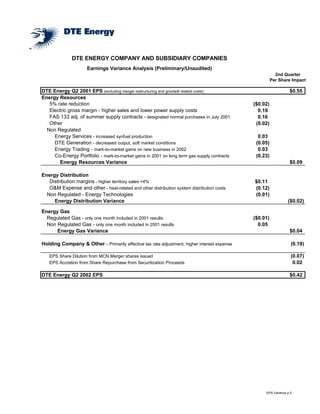

DTE Energy reported second quarter earnings of $0.42 per share, down from $0.55 per share in the second quarter of 2001, excluding merger and restructuring expenses. For the first six months of 2002, earnings per share increased 8% compared to 2001. DTE Energy narrowed its full-year 2002 earnings guidance to $3.75-$3.95 per share and initiated 2003 guidance of $3.90-$4.10 per share. Solid performance from the electric utility and contributions from non-regulated businesses such as coal-based fuels helped achieve results despite uncertain impacts from weather and economic conditions.