Embed presentation

Download to read offline

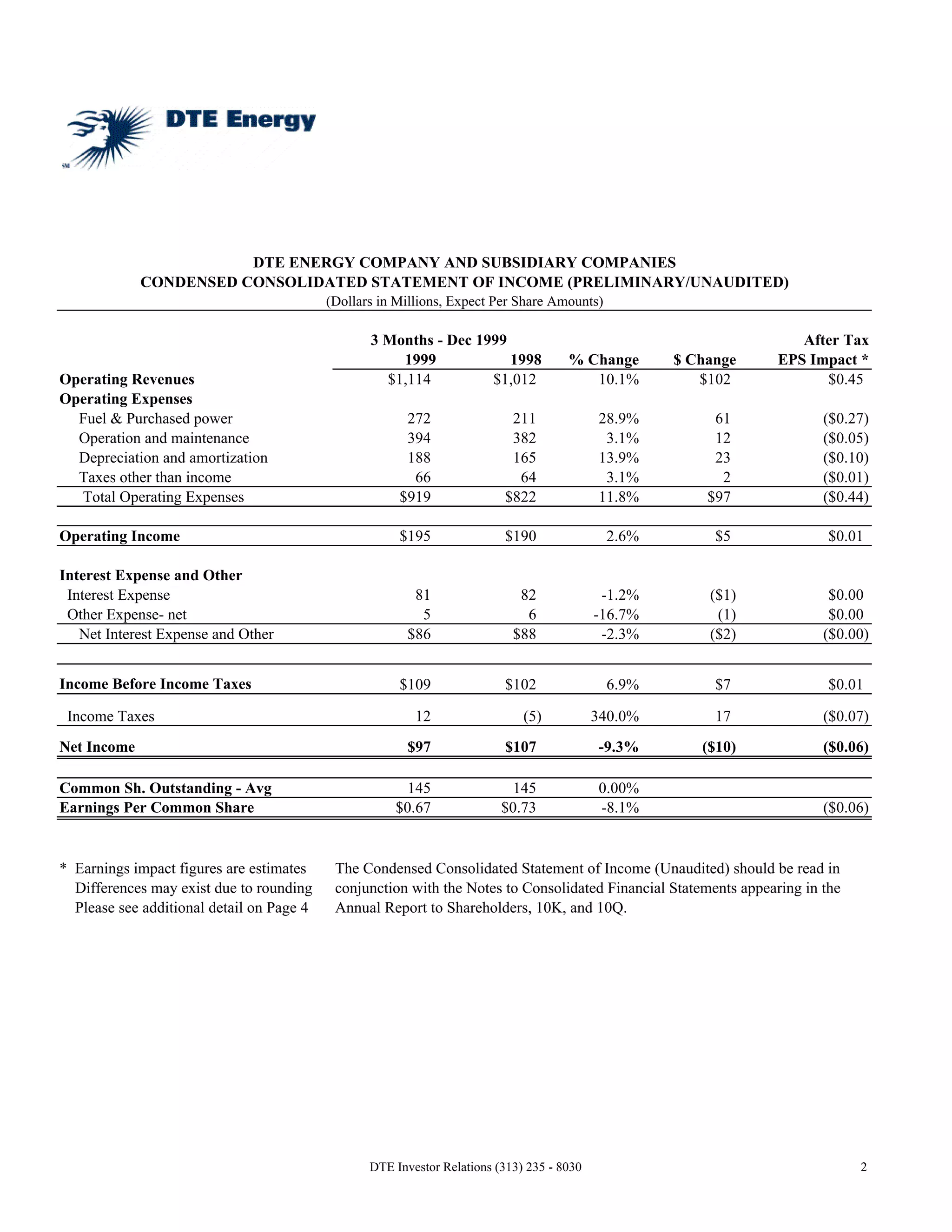

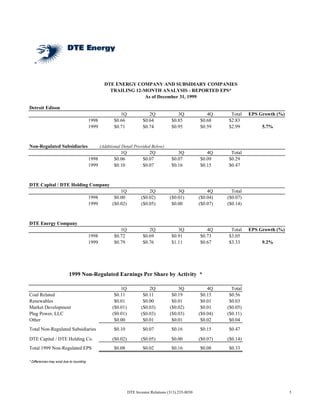

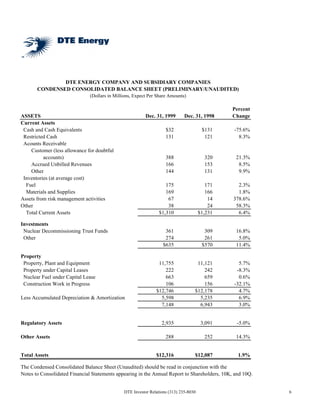

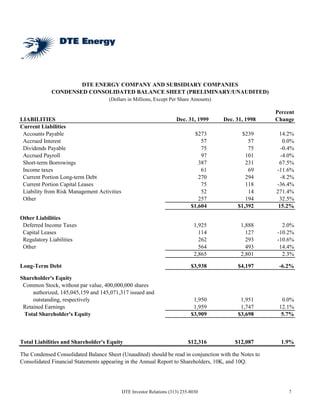

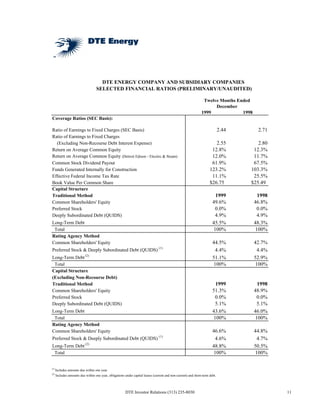

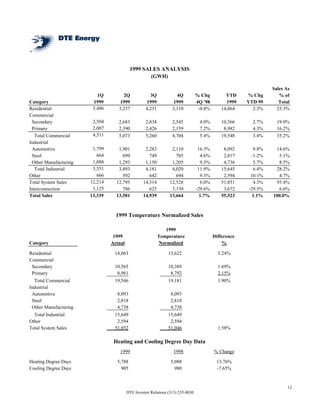

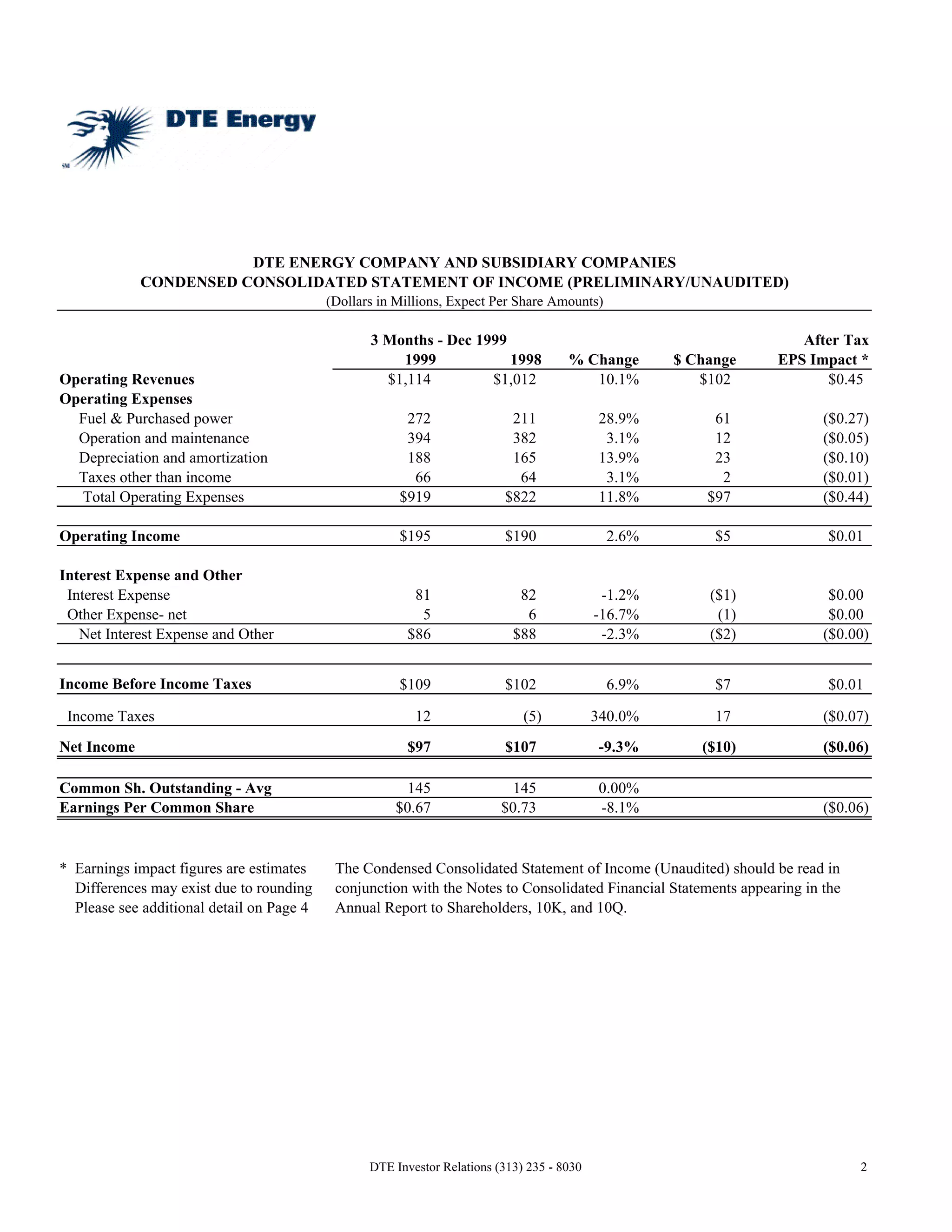

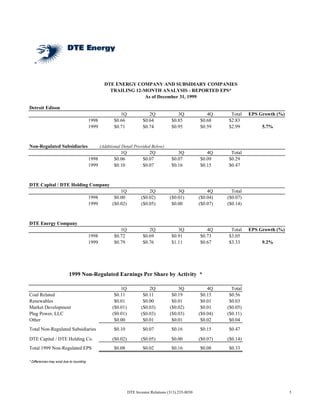

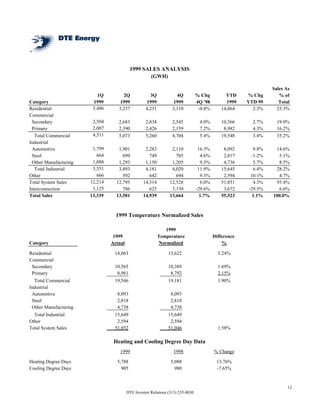

DTE Energy reported financial results for the fourth quarter and full year 1999. For the quarter, operating revenues increased 10.1% to $1.1 billion but net income decreased 9.3% to $97 million due to higher fuel and operating costs. For the full year, operating revenues rose 12.0% to $4.7 billion while net income grew 9.0% to $483 million due to increased industrial sales and non-regulated business income, partially offset by higher fuel expenses. Cash from operating activities totaled $1.1 billion for 1999.