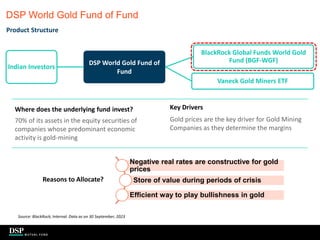

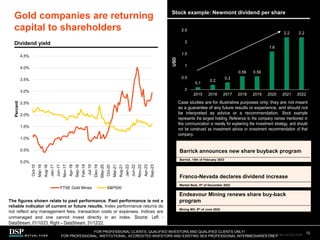

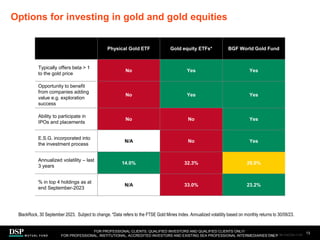

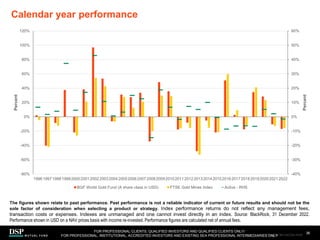

- The document discusses the DSP World Gold Fund of Fund, which invests in the BlackRock Global Funds World Gold Fund and the VanEck Gold Miners ETF.

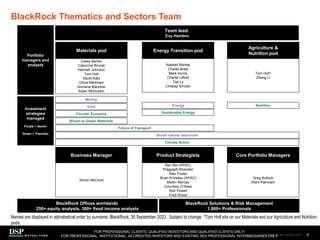

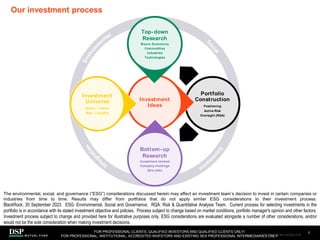

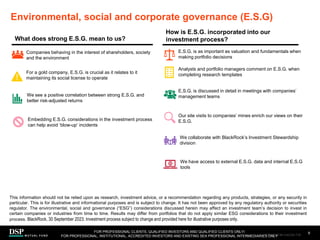

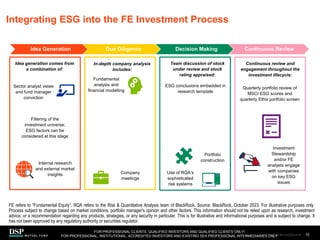

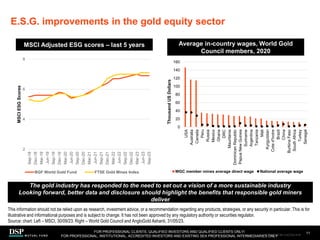

- BlackRock's Natural Resources team incorporates ESG considerations into their investment process, conducting in-depth research on companies' ESG practices.

- They view strong ESG as crucial for gold mining companies to maintain their "social license to operate" and believe it can help lead to better risk-adjusted returns.

![[Title to come]

[Sub-Title to come]

Strictly for Intended Recipients Only

Date

* DSP India Fund is the Company incorporated in Mauritius, under which ILSF is the corresponding share class

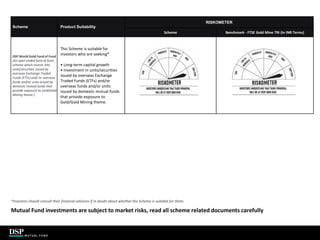

DSP World Gold Fund of Fund

(An open ended fund of fund scheme which invests into units/securities issued by overseas Exchange Traded Funds

(ETFs) and/ or overseas funds and/or units issued by domestic mutual funds that provide exposure to Gold/Gold

Mining theme)

| People | Processes | Performance |

October 2023](https://image.slidesharecdn.com/worldgoldfund-240302210111-dcadcae1/85/DSP-World-Gold-Fund-Presentation-Oct23-pdf-1-320.jpg)