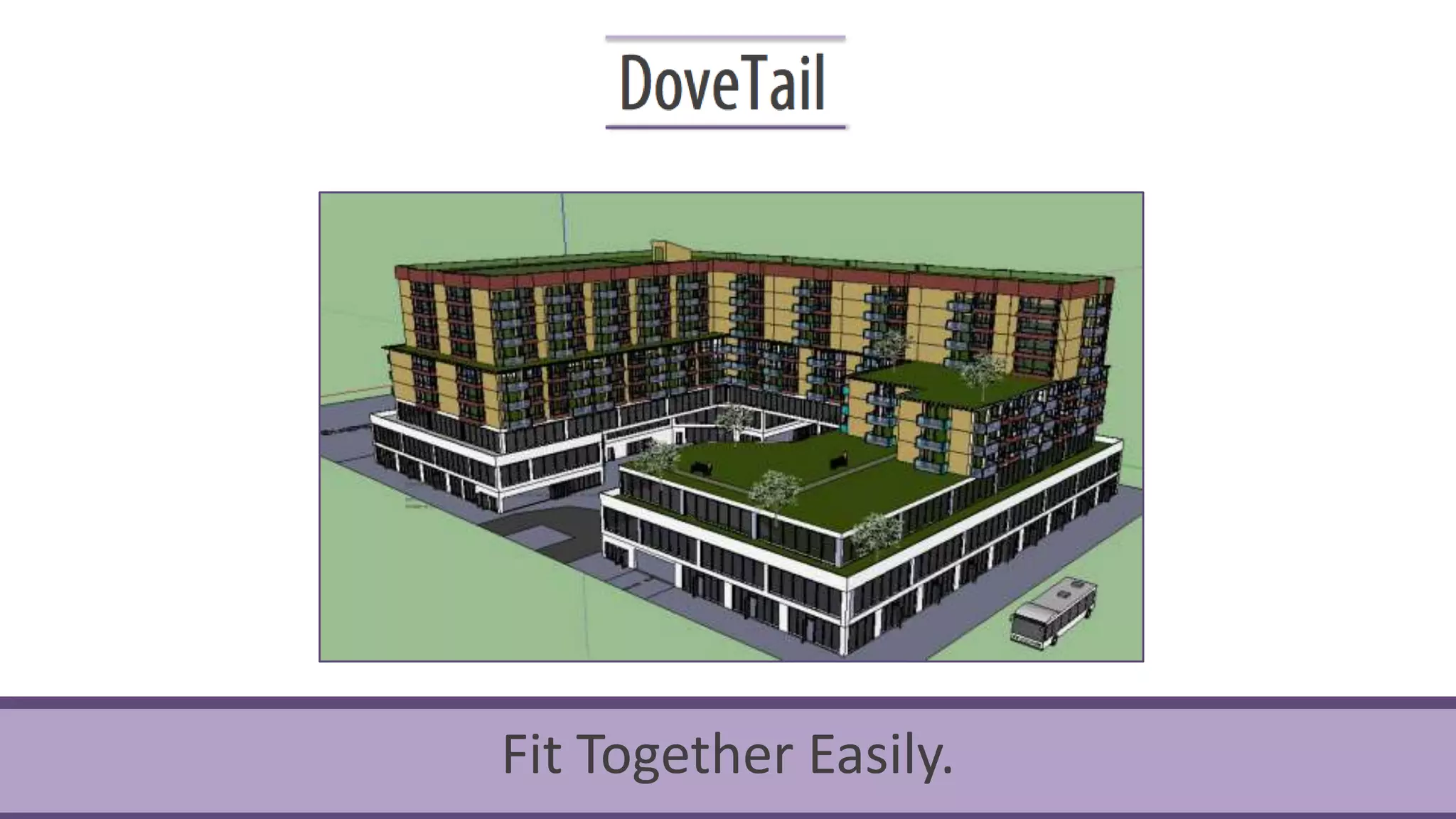

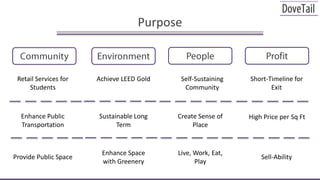

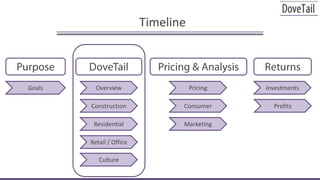

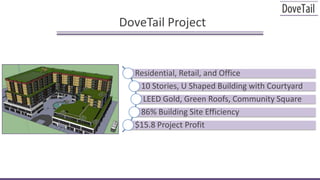

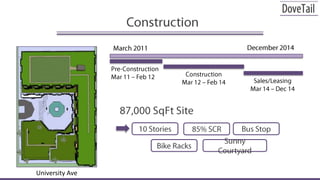

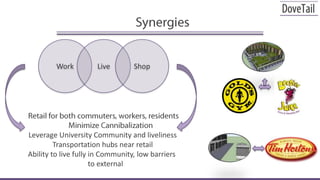

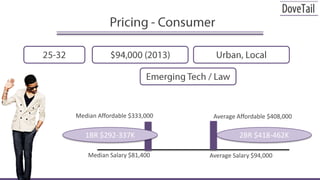

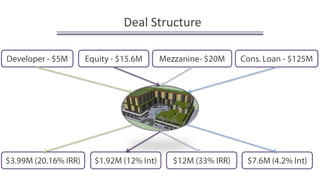

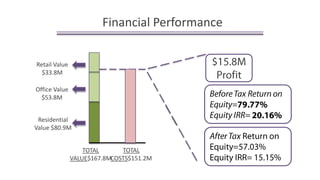

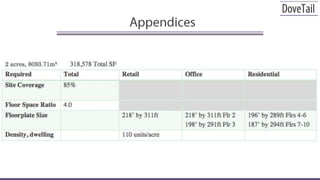

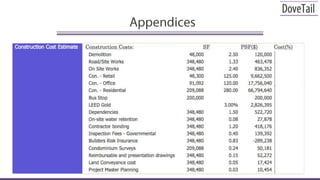

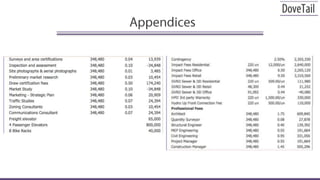

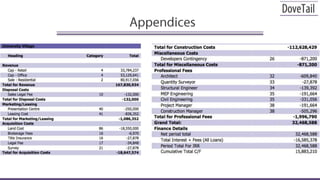

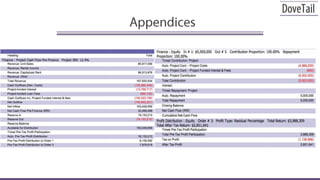

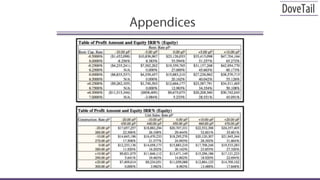

The document describes a proposed mixed-use development called DoveTail Project. It will include 220 residential units, 17 retail spaces totaling 91,000 square feet, and 91,000 square feet of office space across 10 stories. The development aims to be LEED Gold certified and will include amenities like a courtyard, bike racks, and proximity to public transit. Financial projections estimate $15.8 million in profits with residential units selling between $292,000-$462,000 and retail/office space valued at $33.8 million and $53.8 million respectively.