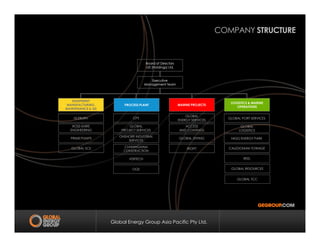

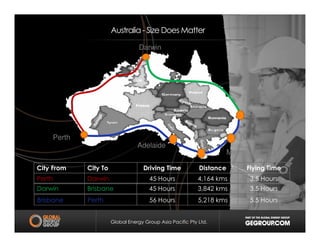

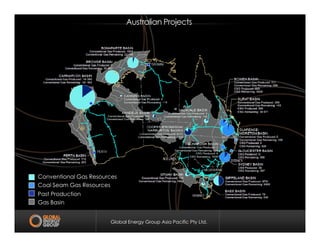

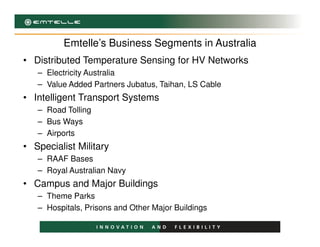

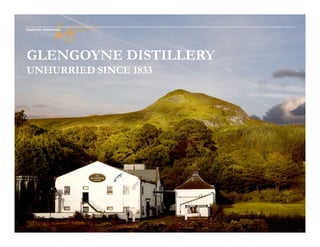

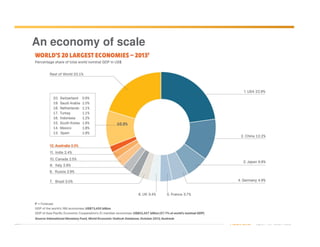

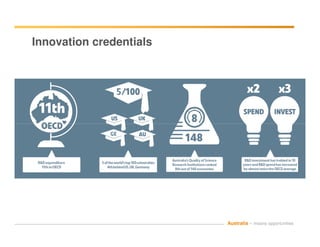

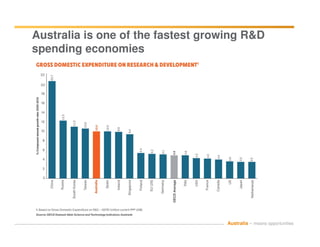

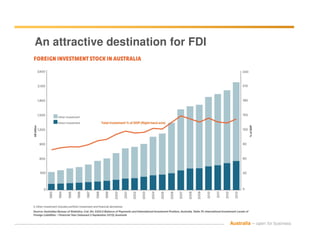

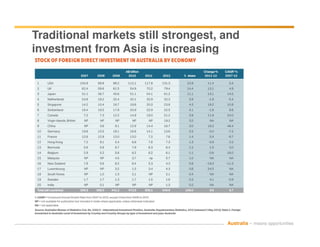

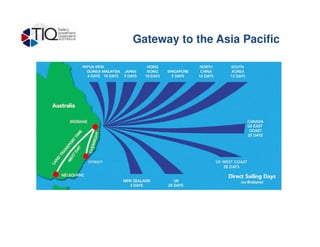

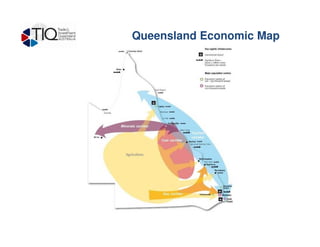

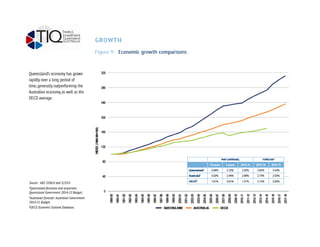

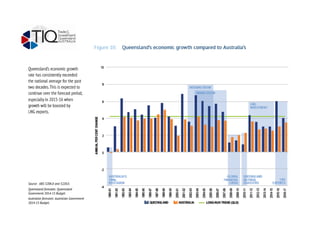

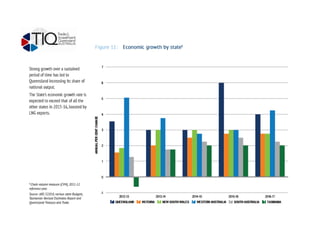

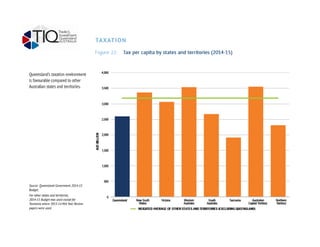

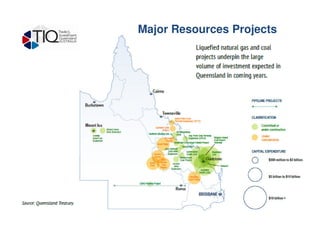

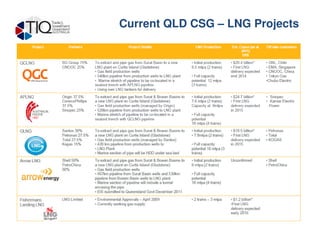

This document provides an overview of doing business in Australia, with a focus on opportunities in Queensland. It discusses Australia's strong economic performance and proximity to fast-growing Asian markets. Several case studies are presented on Scottish companies that have successfully expanded into the Australian market, highlighting both challenges and opportunities. The document also outlines various government initiatives and industry sectors with potential for further investment and trade between Scotland and Australia.