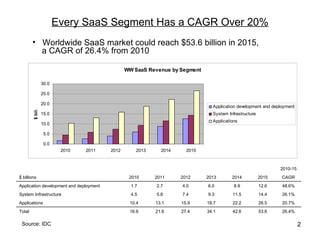

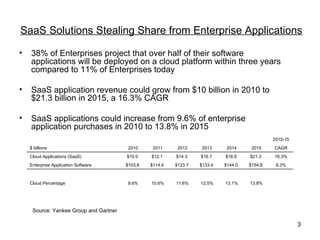

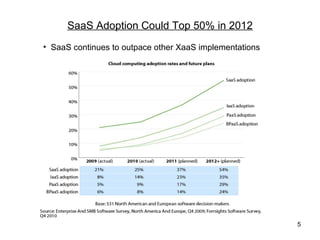

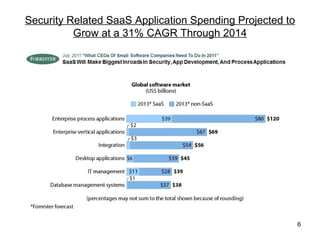

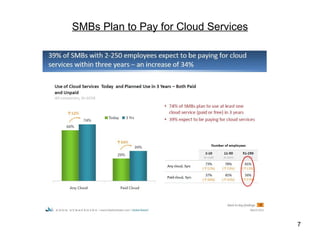

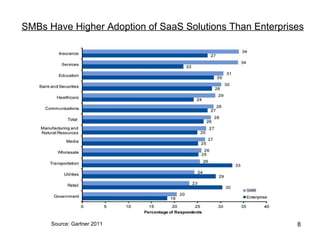

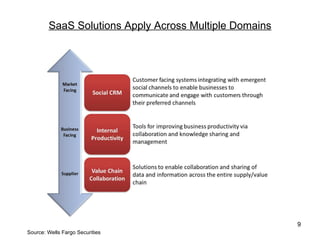

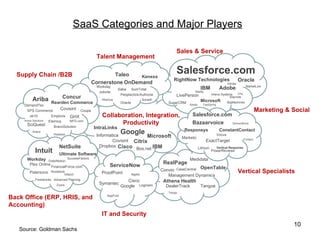

The SaaS enterprise application market is projected to grow significantly, with a CAGR of 26.4%, potentially reaching $53.6 billion by 2015. There is increasing adoption, with 38% of enterprises expecting to deploy over half their applications on cloud platforms within three years, and SaaS applications' share of enterprise application purchases expected to rise from 9.6% to 13.8%. Overall, SaaS solutions are becoming competitive alternatives to traditional on-premise applications and will cover various business needs across industries.