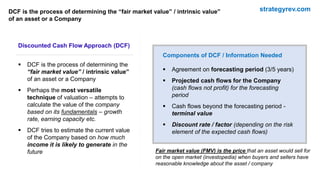

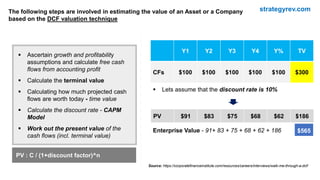

The document provides an overview of discounted cash flow (DCF) analysis as a method to determine the intrinsic value of an asset or company. It outlines the components required for DCF, including projected cash flows, terminal value, and the discount rate, which accounts for the risk of those cash flows. The document emphasizes the DCF's reliance on fundamental factors such as growth rates and earning capacity to estimate the present value of future earnings.