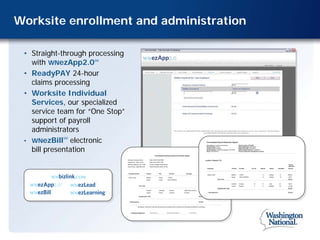

Washington National Insurance Company provides supplemental health and life insurance products to middle-income Americans. It offers a variety of individual and group insurance products, including critical illness, accident, hospital indemnity, disability, dental, life and vision insurance. Washington National has over 5,000 agents across the U.S. and distributes primarily through the worksite channel, serving approximately 1 million policyholders and 25,000 groups. It has a strong financial profile with $4.4 billion in assets and $586 million in annual premiums.