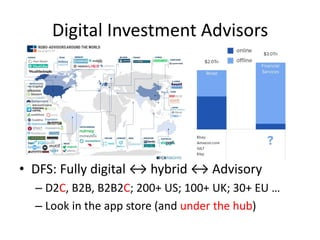

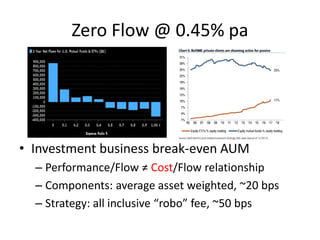

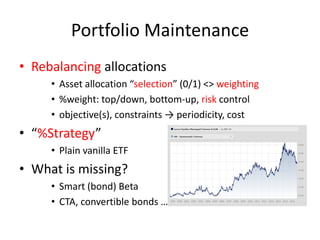

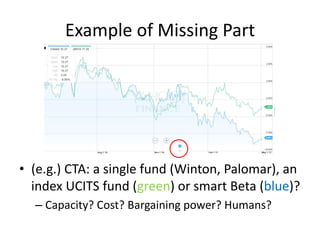

Digital Wealth Product Design discusses the shift towards digital investment advisors and personal investment solutions. It notes the demand for help managing the thousands of investment products and high costs of customer acquisition. It also discusses how digital advisors can provide low-cost, personalized investment advice and portfolios through techniques like risk profiling, periodic rebalancing, and using ETFs and other low-cost products. The document advocates for digital advisors to provide transparent, engaging investment experiences while controlling risks.