FinSec Consulting provides expert consulting services across many areas of the financial services industry, including clearing and settlement, custody, securities lending, payments, technology solutions, treasury and cash management, and performance and risk management. The presentation discusses several topics in detail, including:

1. TARGET2-Securities, the EU initiative to create a single capital market and settlement system to compete with other regions.

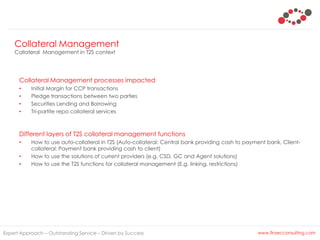

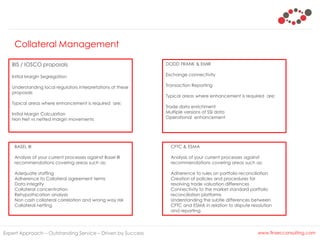

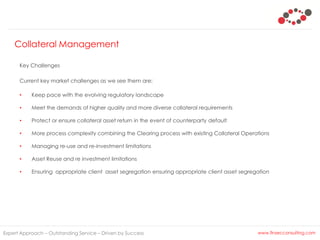

2. Collateral management processes that will be impacted by TARGET2-Securities and how to address changes required by various global market regulations.

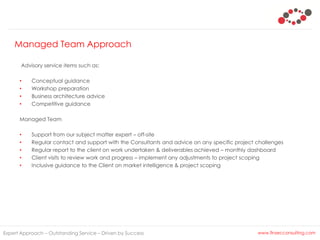

3. FinSec's managed team approach, which provides advisory services, subject matter expertise, regular support and reports, and guidance on market intelligence and project scoping.