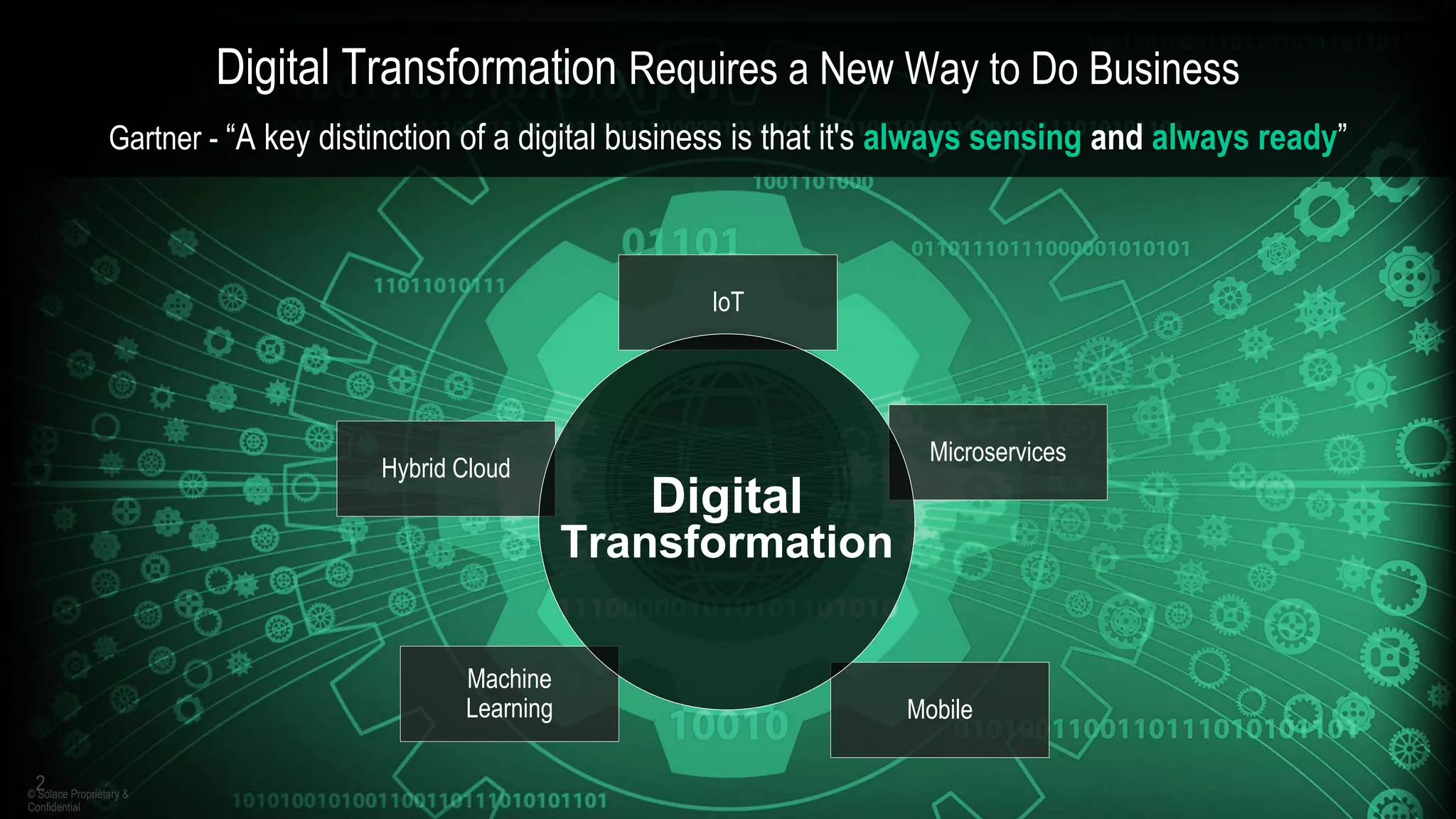

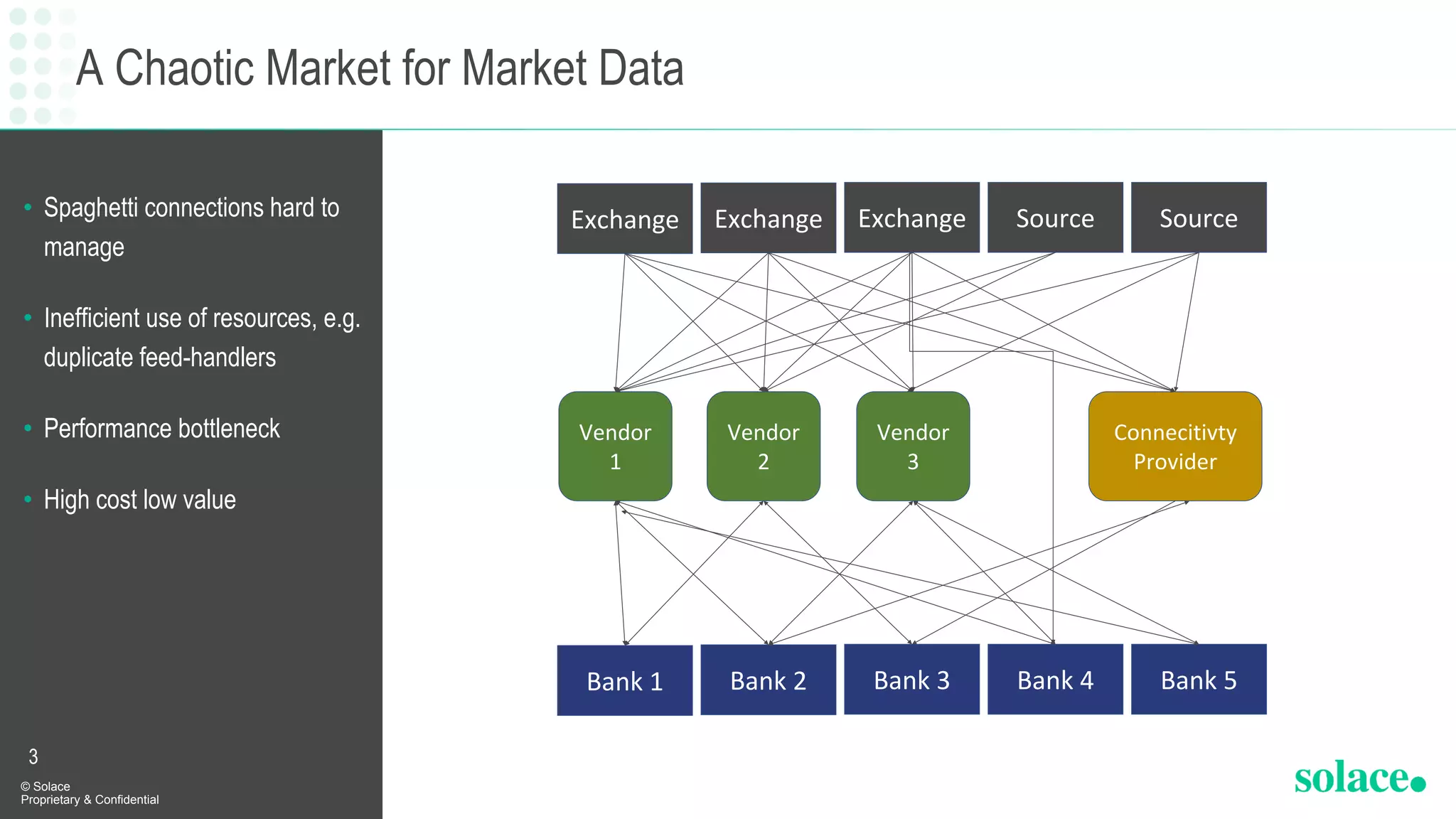

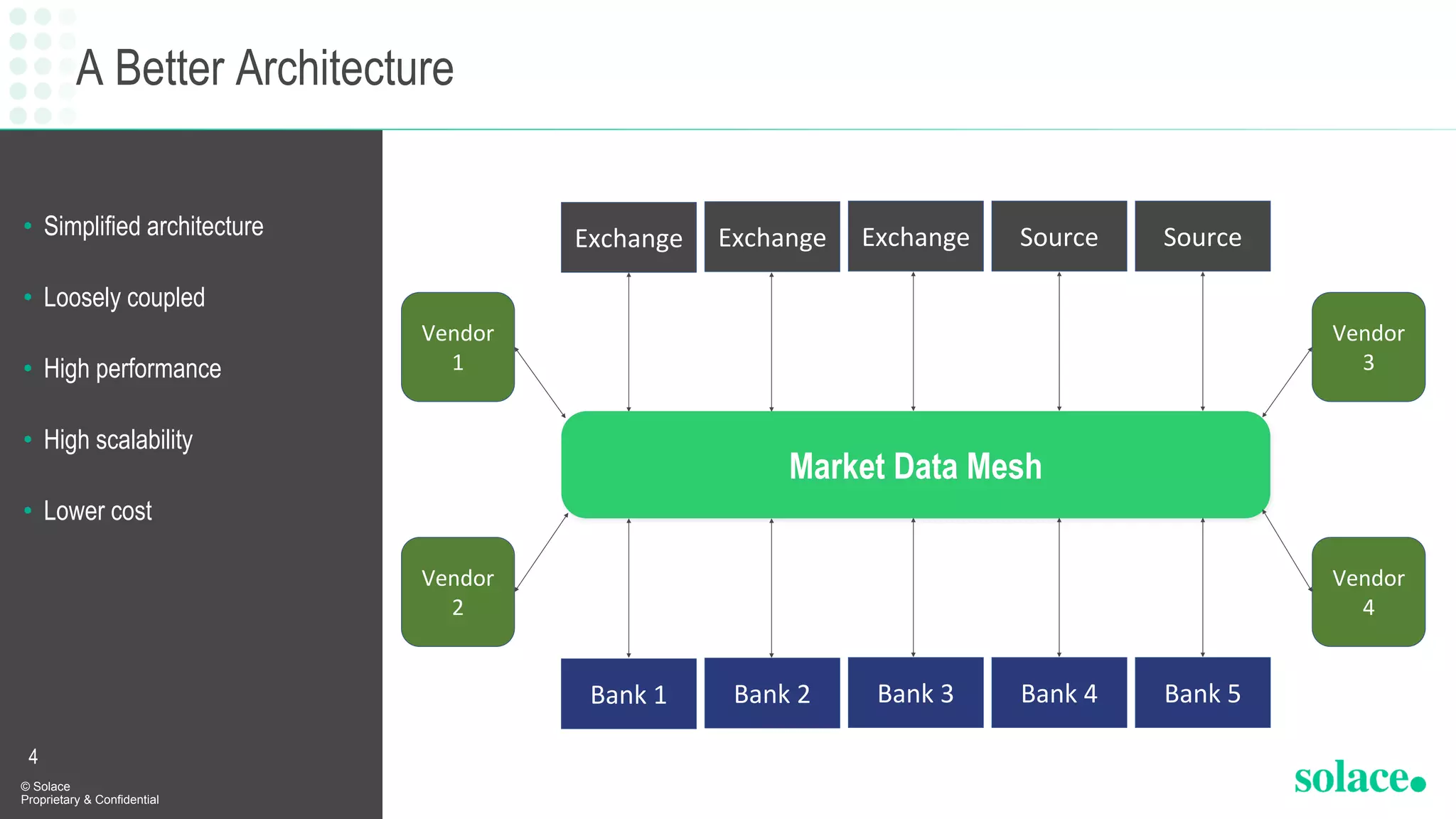

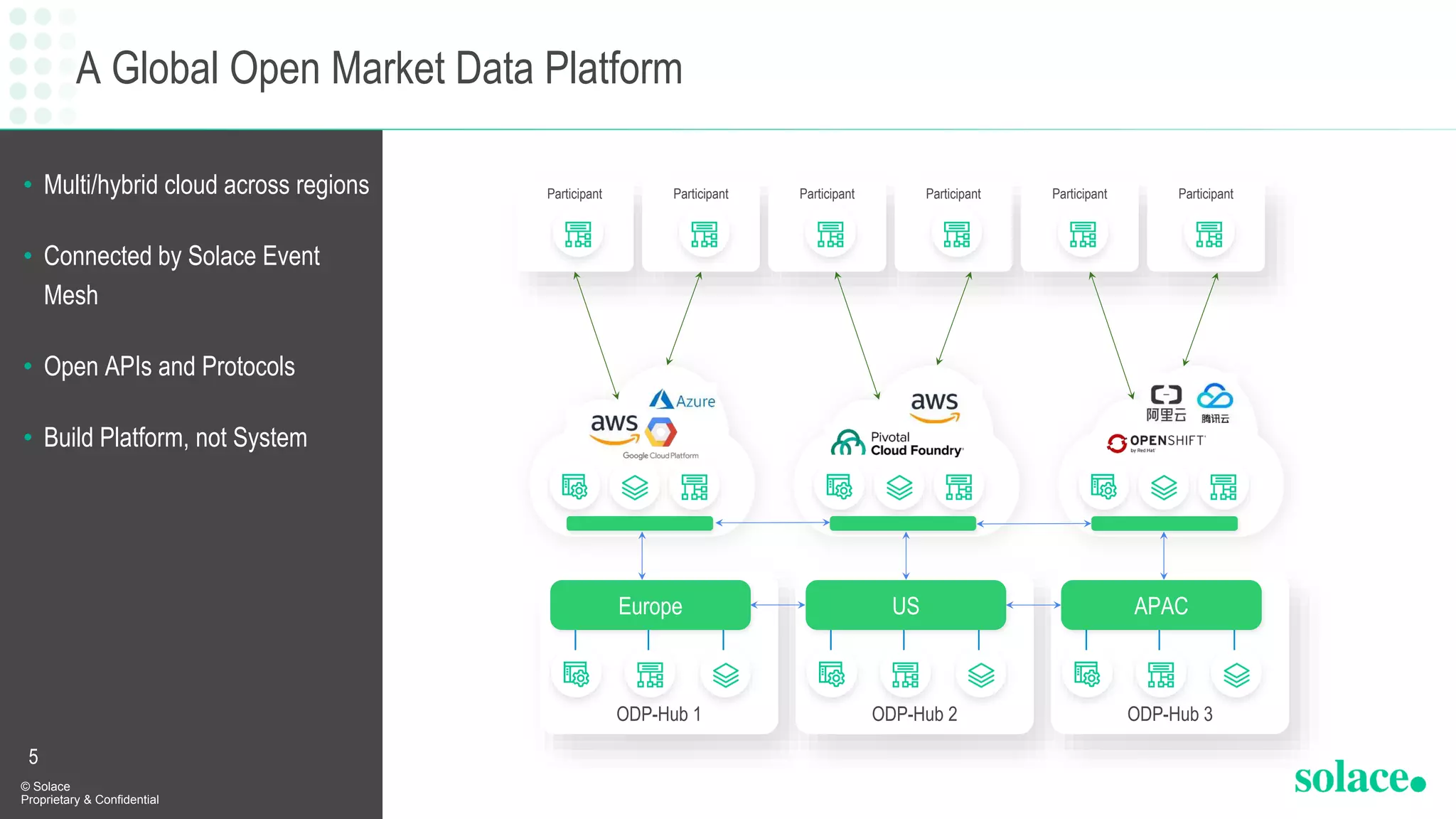

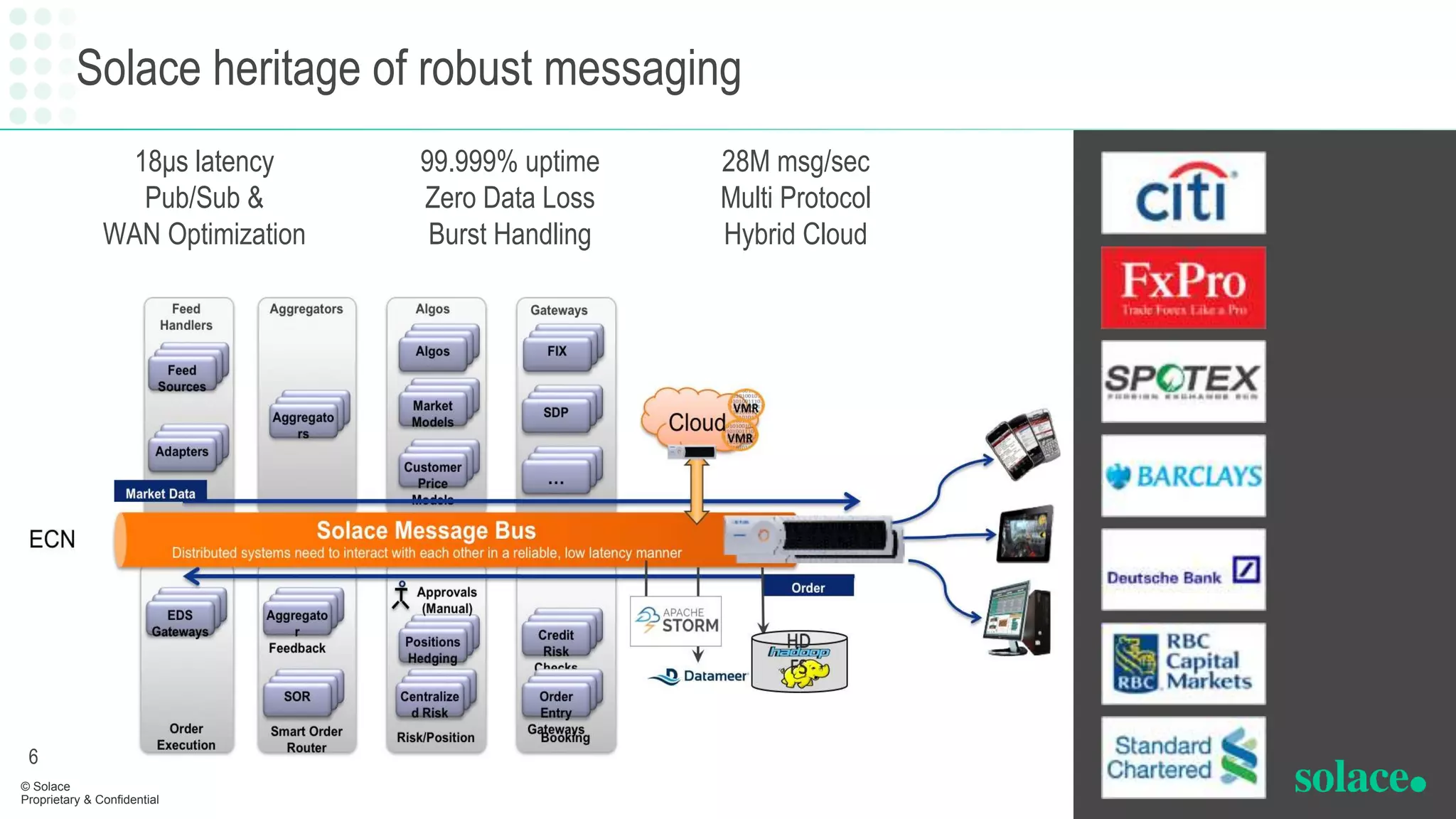

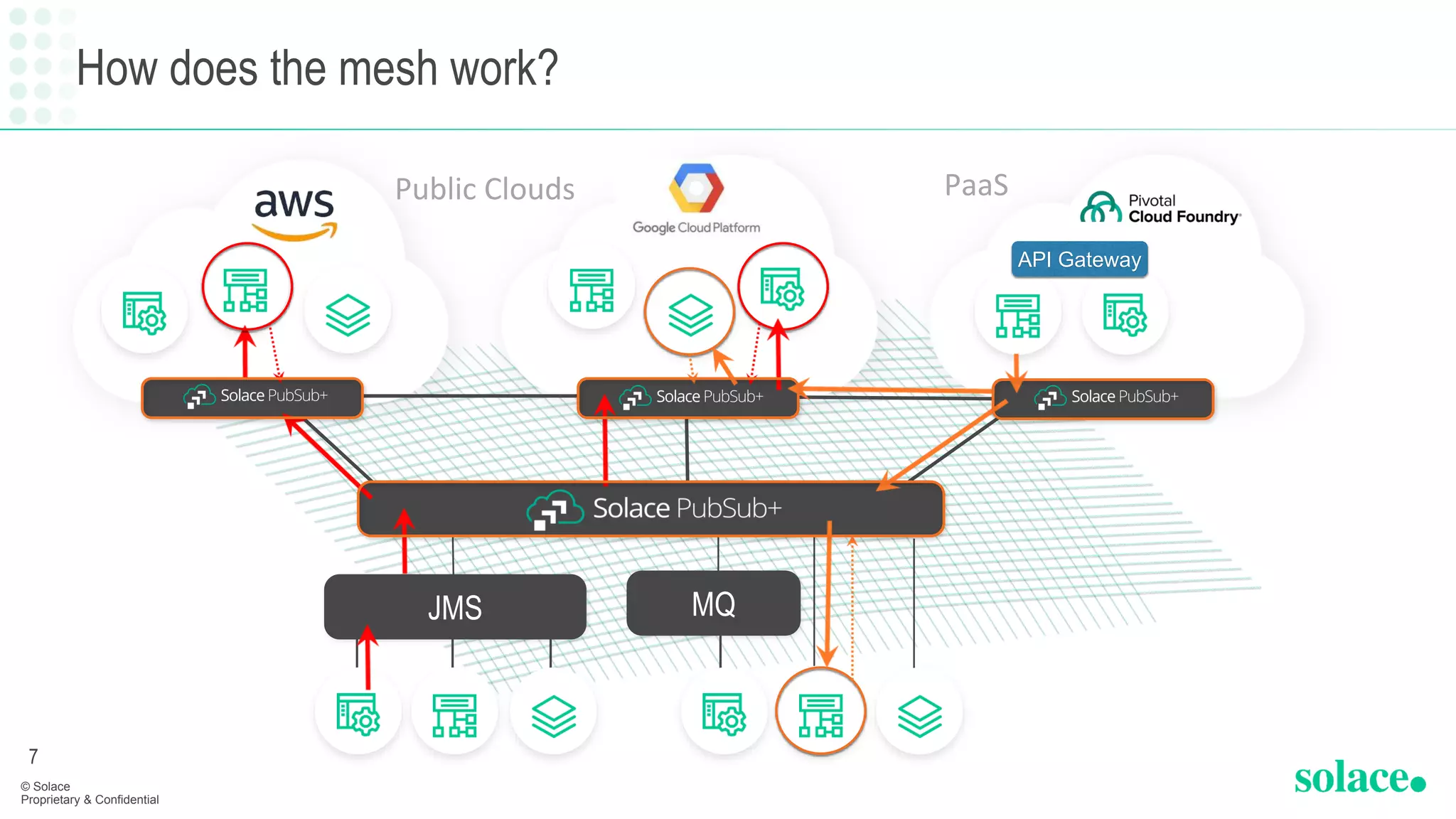

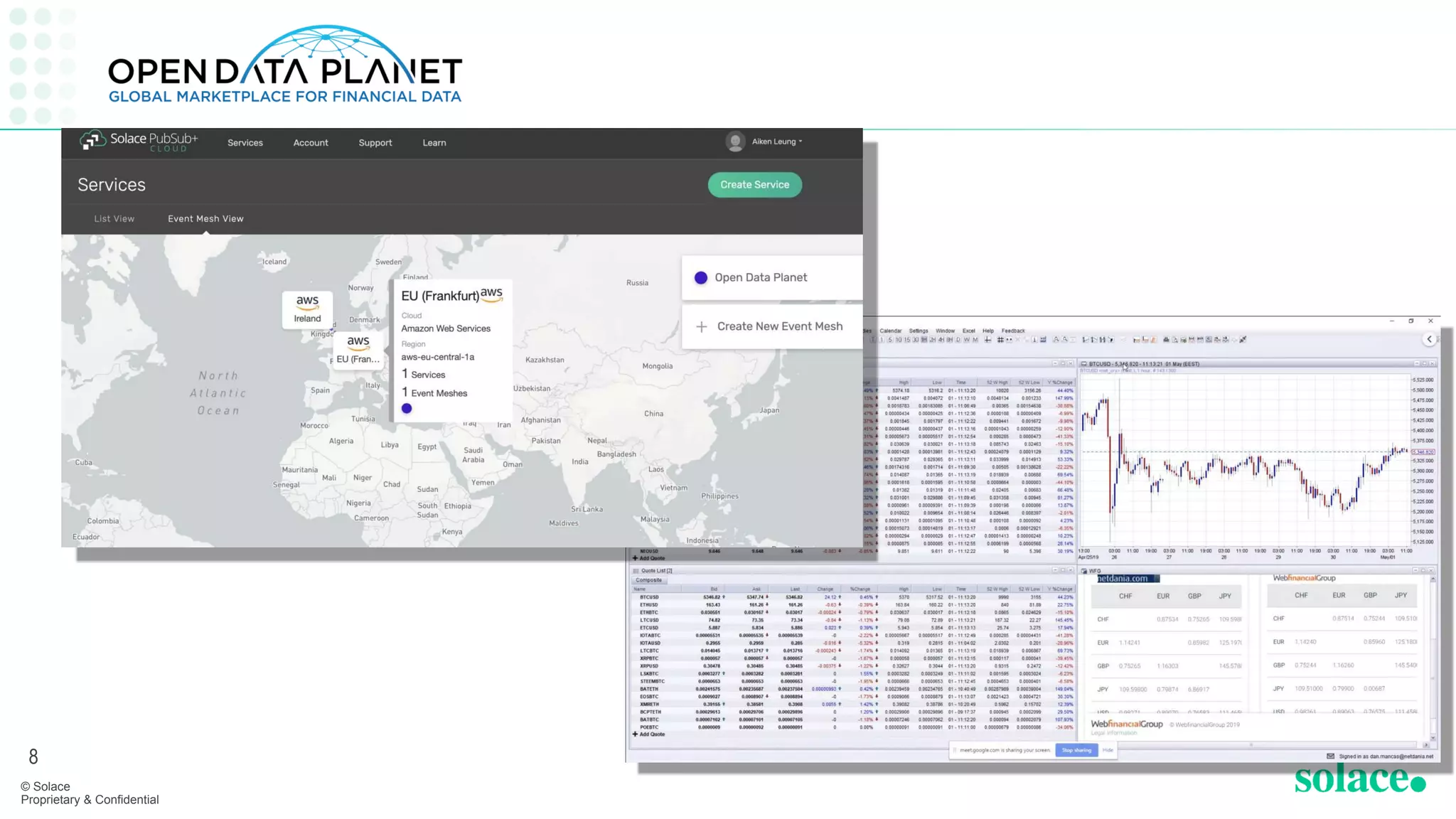

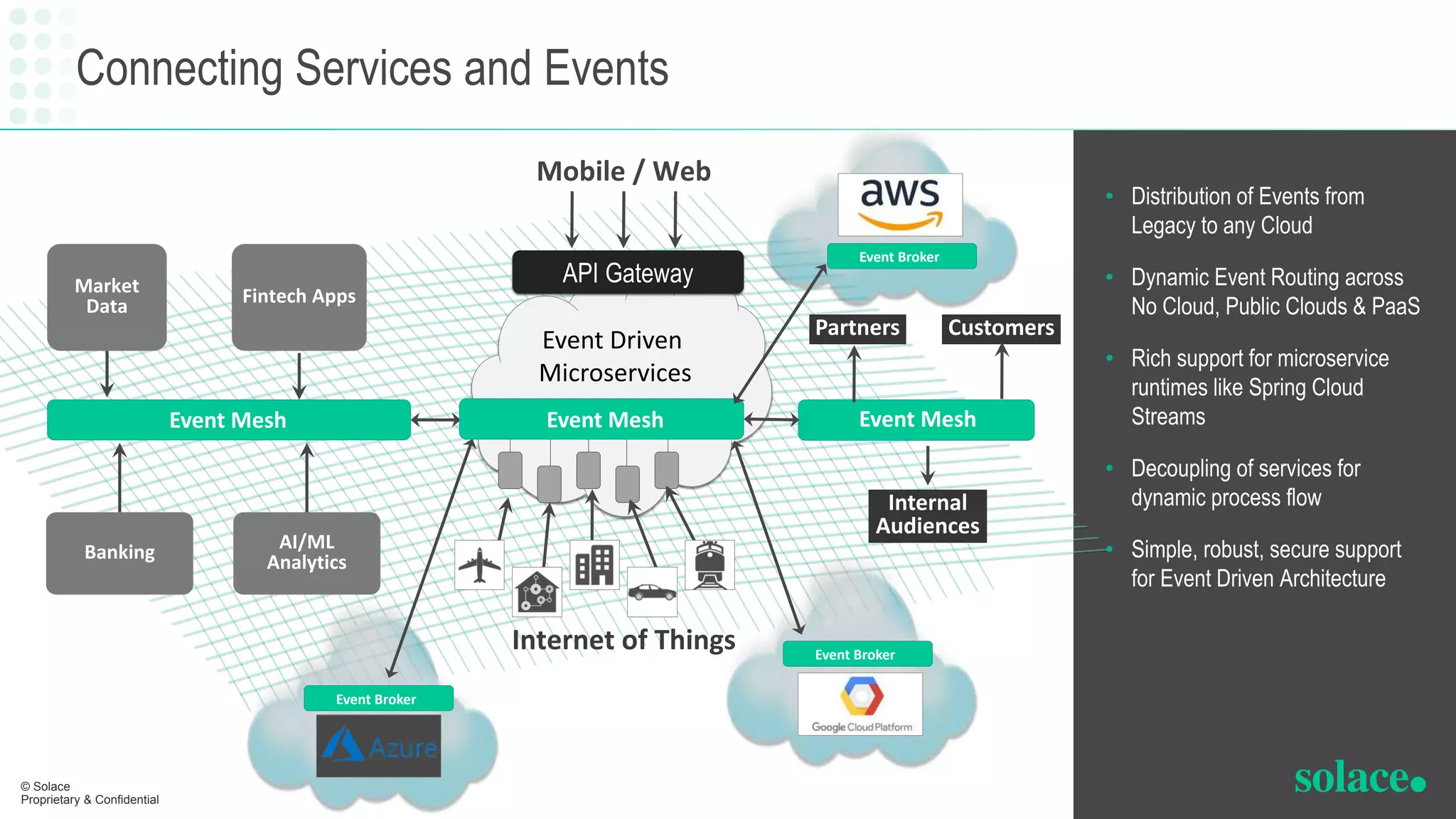

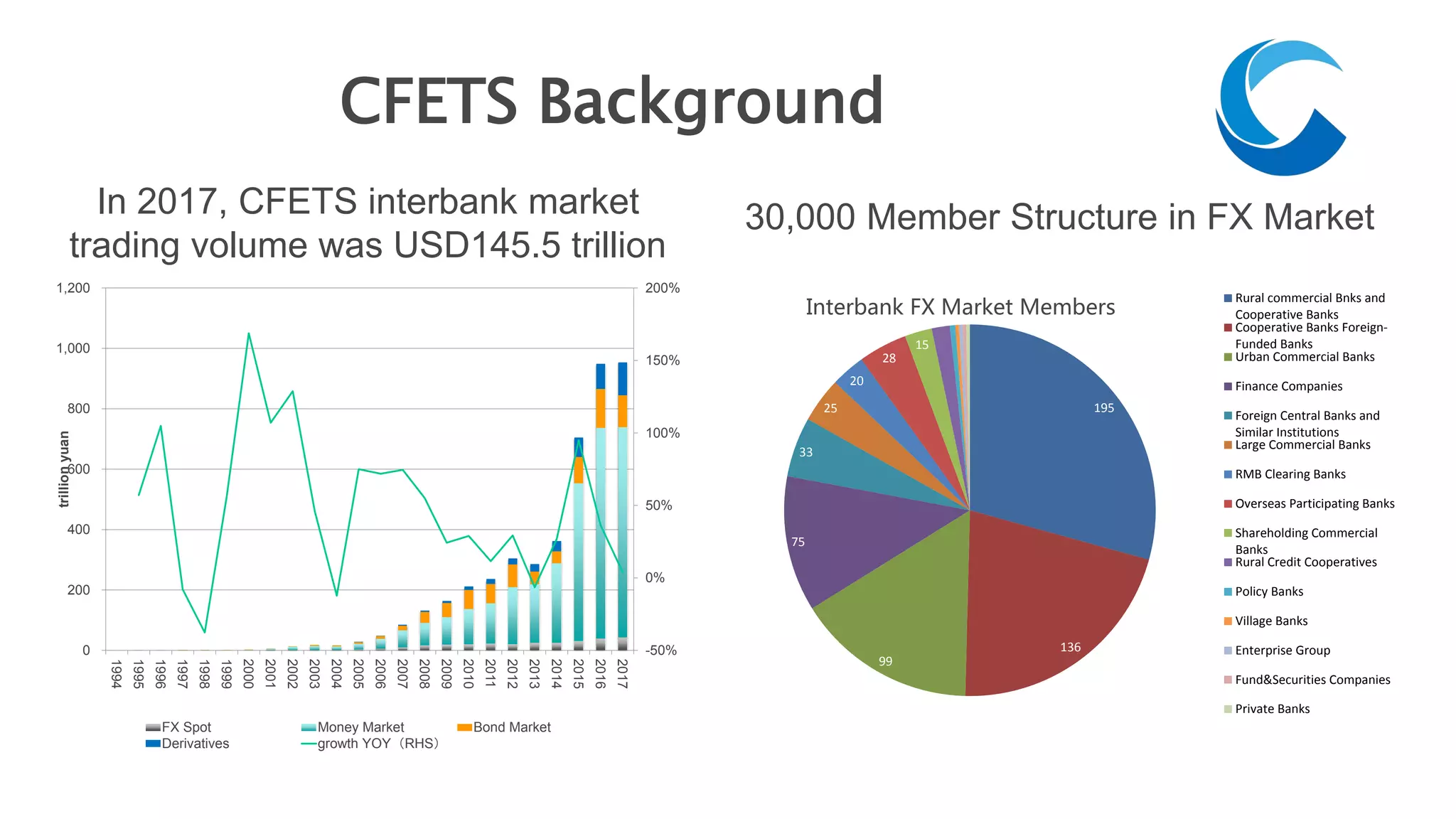

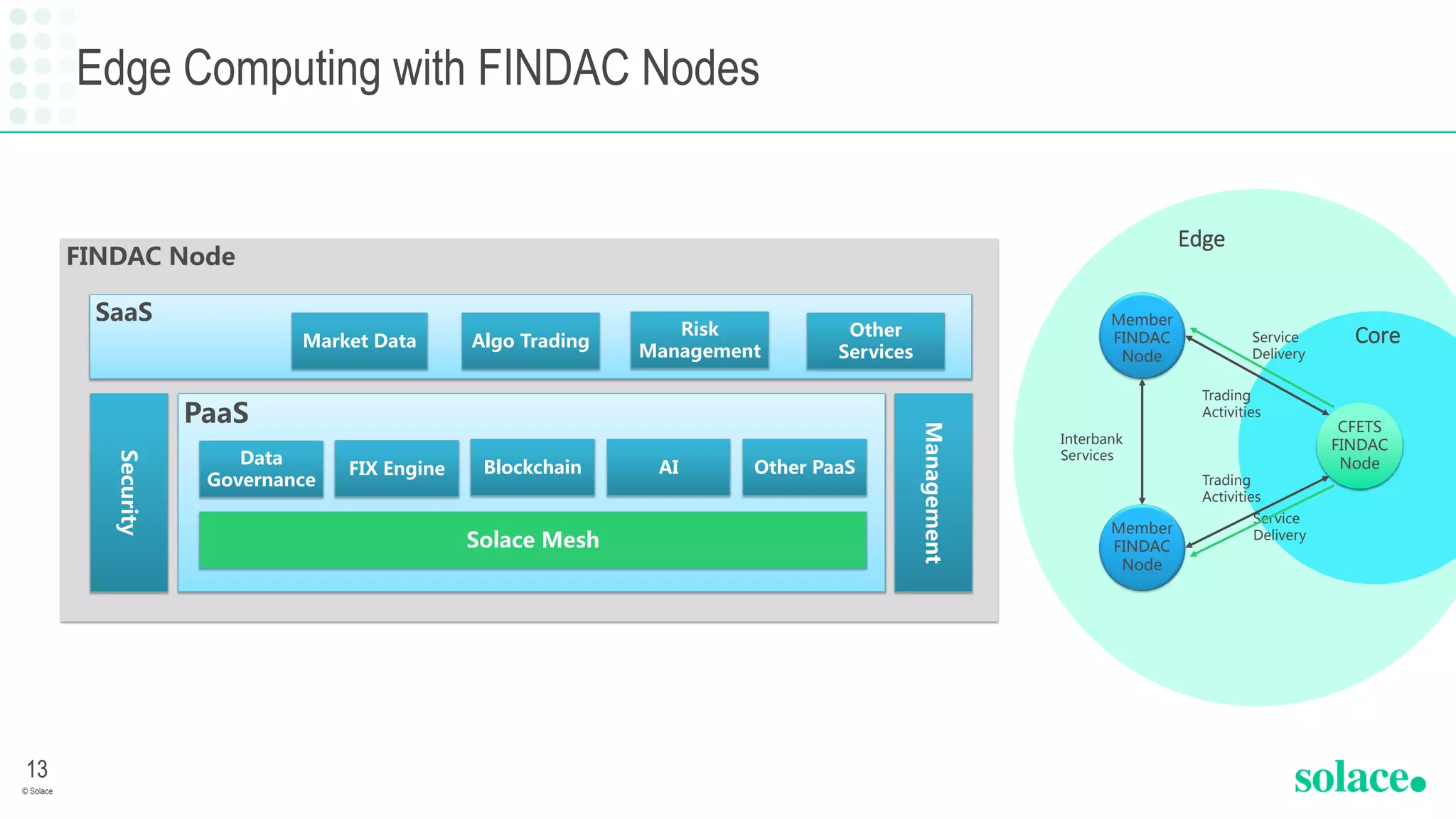

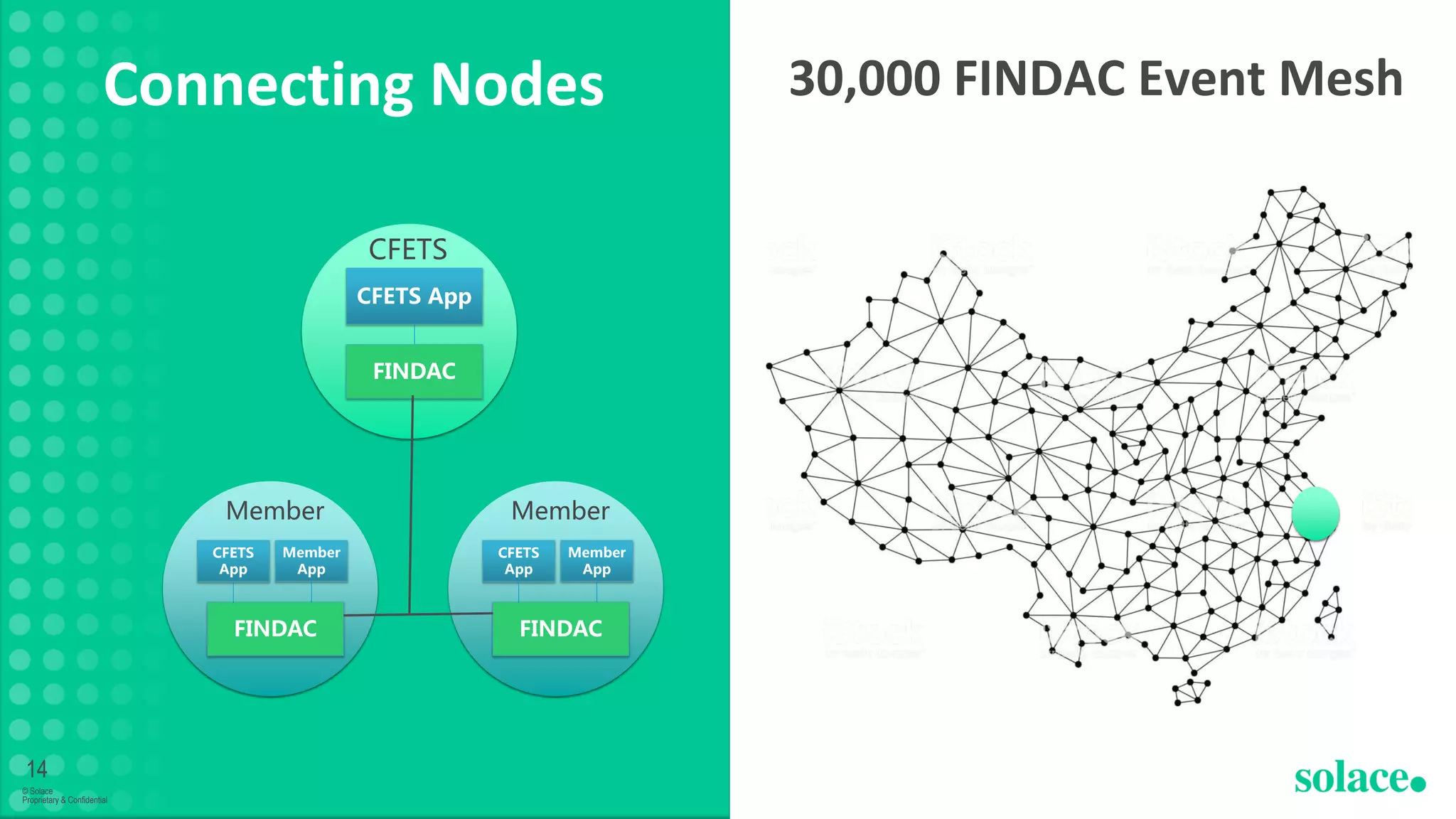

Digital transformation requires adopting a new approach to doing business that is always sensing and ready to change. The document discusses how traditional market data and trading platforms have inefficient spaghetti connections that are difficult to manage and perform poorly. It then proposes adopting a "market data mesh" architecture using an event mesh to connect systems simply and at scale across hybrid cloud environments. This would create an open and global market data platform. The remainder of the document discusses how Solace technology could be used to build an innovative distributed trading platform for the China Foreign Exchange Trade System to modernize China's financial system and interbank markets.