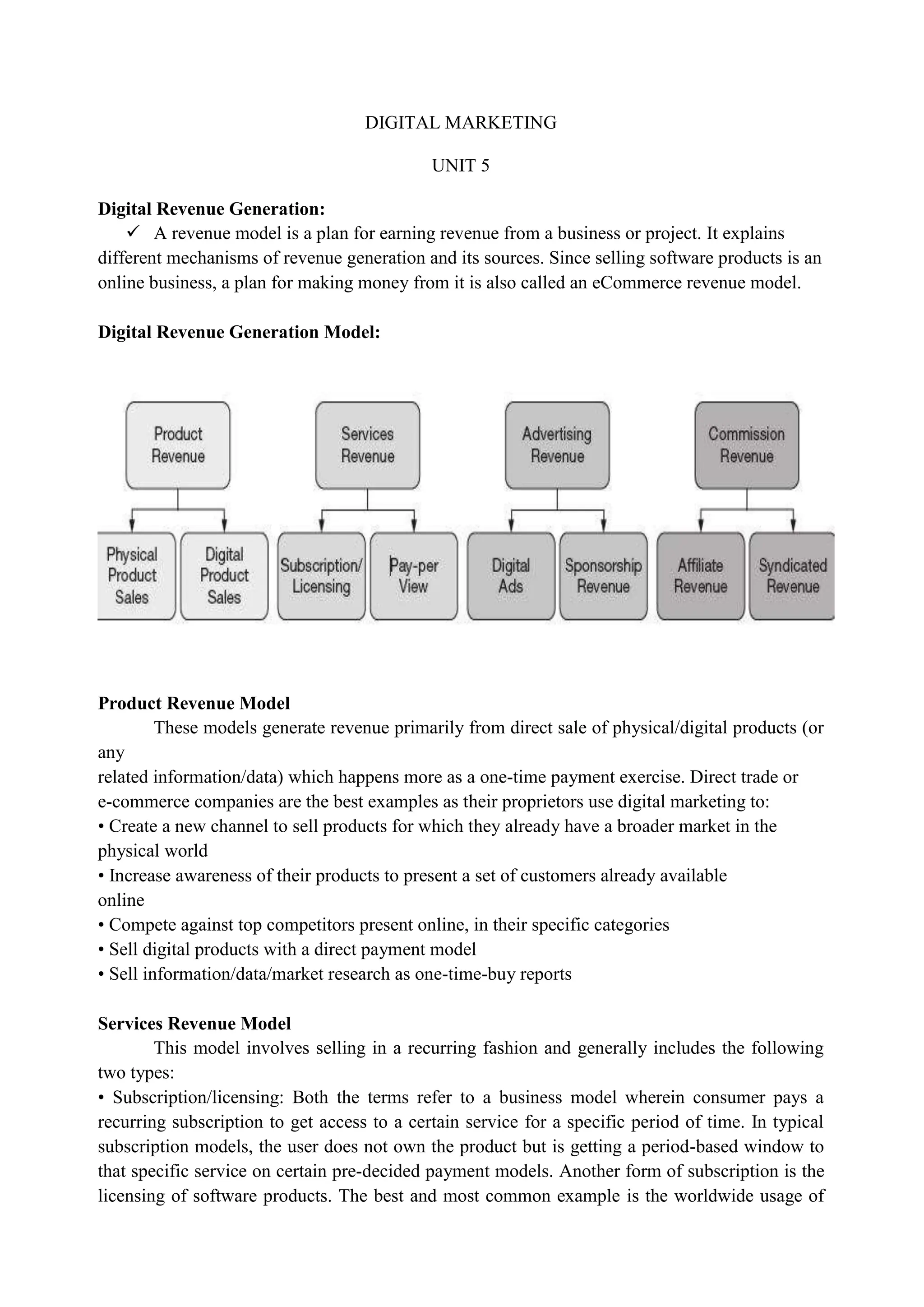

The document discusses various digital revenue generation models including product revenue from direct sales, services revenue from subscriptions and pay-per-view, advertising revenue, and commission-based models. It also covers customer loyalty management and the evolution from transactional loyalty programs to personalized approaches using big data and gamification. Finally, it outlines emerging digital payment solutions such as credit cards, e-cash, mobile payments using SMS, NFC, and WAP, as well as peer-to-peer payments and social media payments.