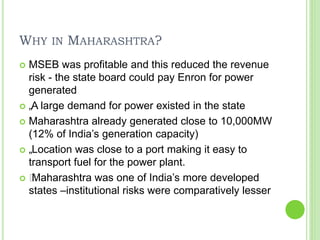

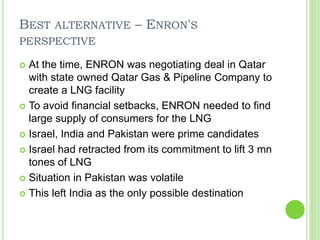

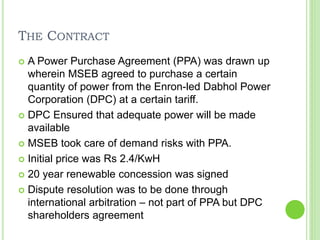

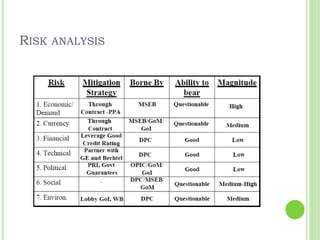

The document summarizes the Dabhol power project in India, which was led by the American energy company Enron. It describes India's growing power needs in the 1990s that led the government to pursue private sector investments. Enron proposed a large natural gas power plant in Maharashtra. The project faced issues including a lack of transparency, high costs, and tariffs. This led the new BJP government to cancel the project in 1995, though it was later renegotiated. The deal ultimately failed due to payment disputes, leading to international arbitration proceedings between Enron and the Indian government.