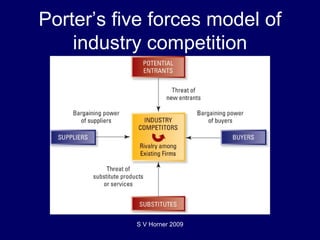

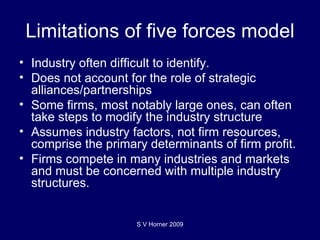

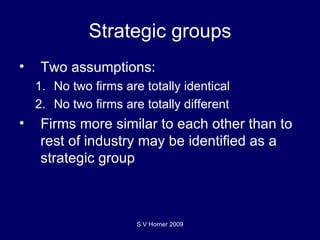

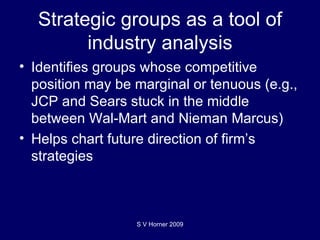

The document discusses the importance of environmental analysis for strategic planning. It describes various tools and methods for analyzing a firm's external environment, including scanning, monitoring, competitive intelligence, and forecasting. These allow a firm to understand factors in the general environment like demographics, technology and the economy. The competitive environment is also important and can be analyzed using Porter's five forces model and strategic groups to understand industry competition and identify opportunities and threats.