This document provides an overview of the hospitality industry in India. It discusses the nature of the industry, key players such as Taj, Leela, Oberoi, and ITC hotels. It analyzes the industry structure and discusses topics like geographical spread of major players, demand-supply dynamics, branding and pricing strategies. It also provides details on market capitalization of top hotel companies and profiles of promoters and management groups of some major Indian hotel brands.

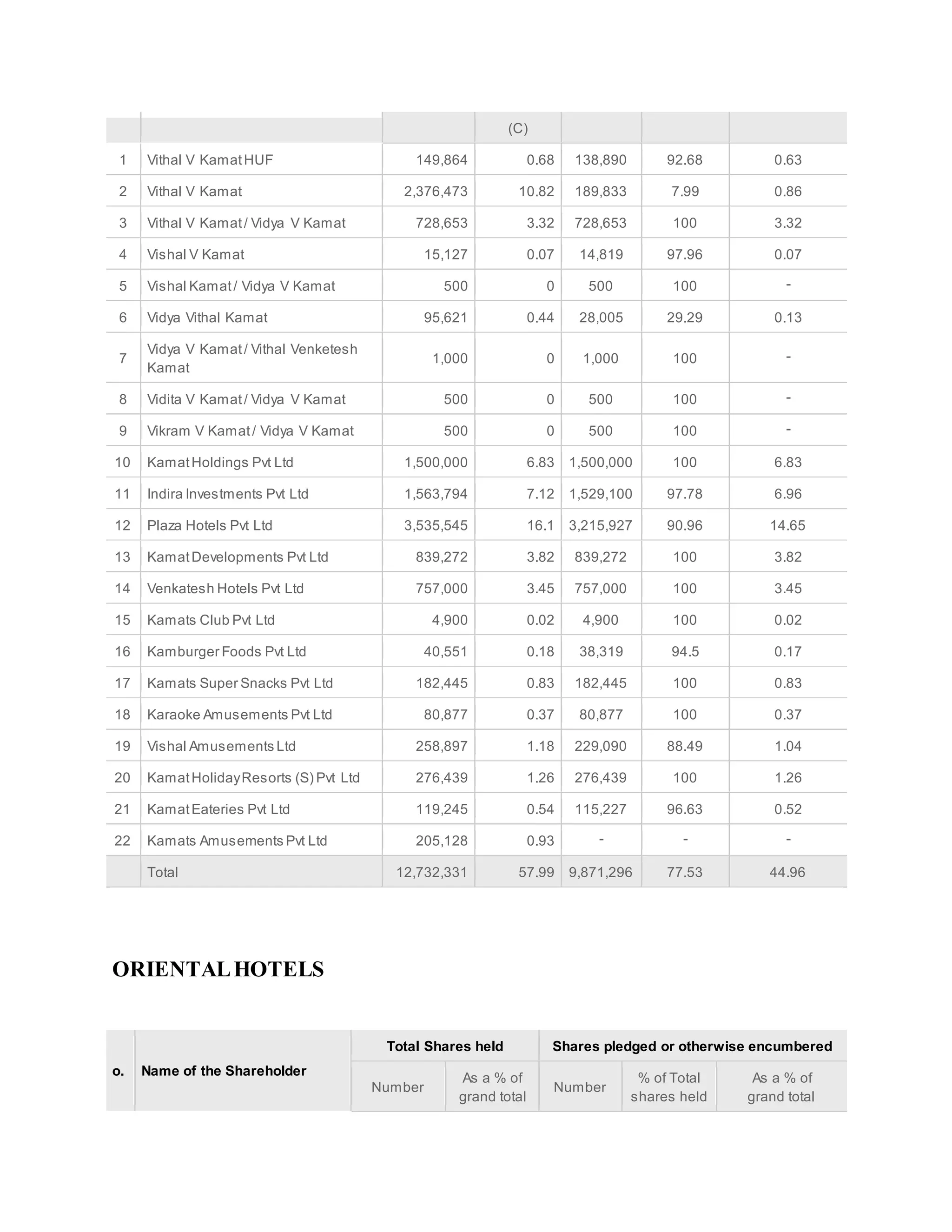

![Capt. Chittarath Poovakkatt Krishnan Nair (February 9, 1922) is an Indian businessman, who

founded Leela Lace Ltd., a textile company in 1957 and later became the Founder-Chairman of

the Leela Group of Hotels, established in 1986.[2][3][4] and a 2010 recipient of the Padma

Bhushan, given by Government of India. He served in the Indian National Army under Netaji

Subhash Chandra Bose. In 1950, he married Leela, the daughter of a handloom owner from

Kannur, subsequently, he started helping his father-in-law in the latter's garment export business,

eventually taking it over and developing export markets, becoming one of the pioneers of

the Bleeding Madras fabric, which became much popular in the 1960s. By 1980s his textile

business, called "Leela Lace" after his wife, was flourishing and had built textile factory in North

Mumbai

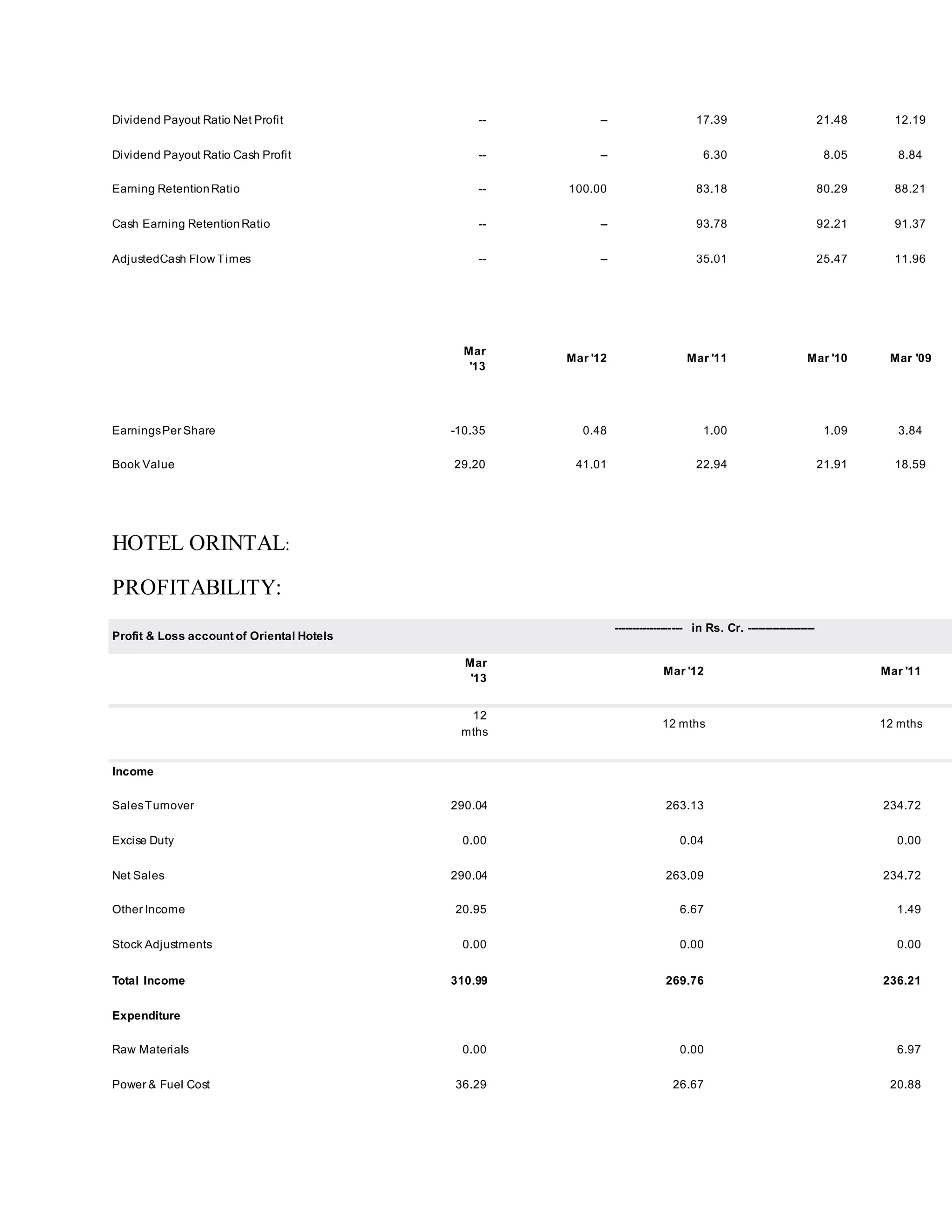

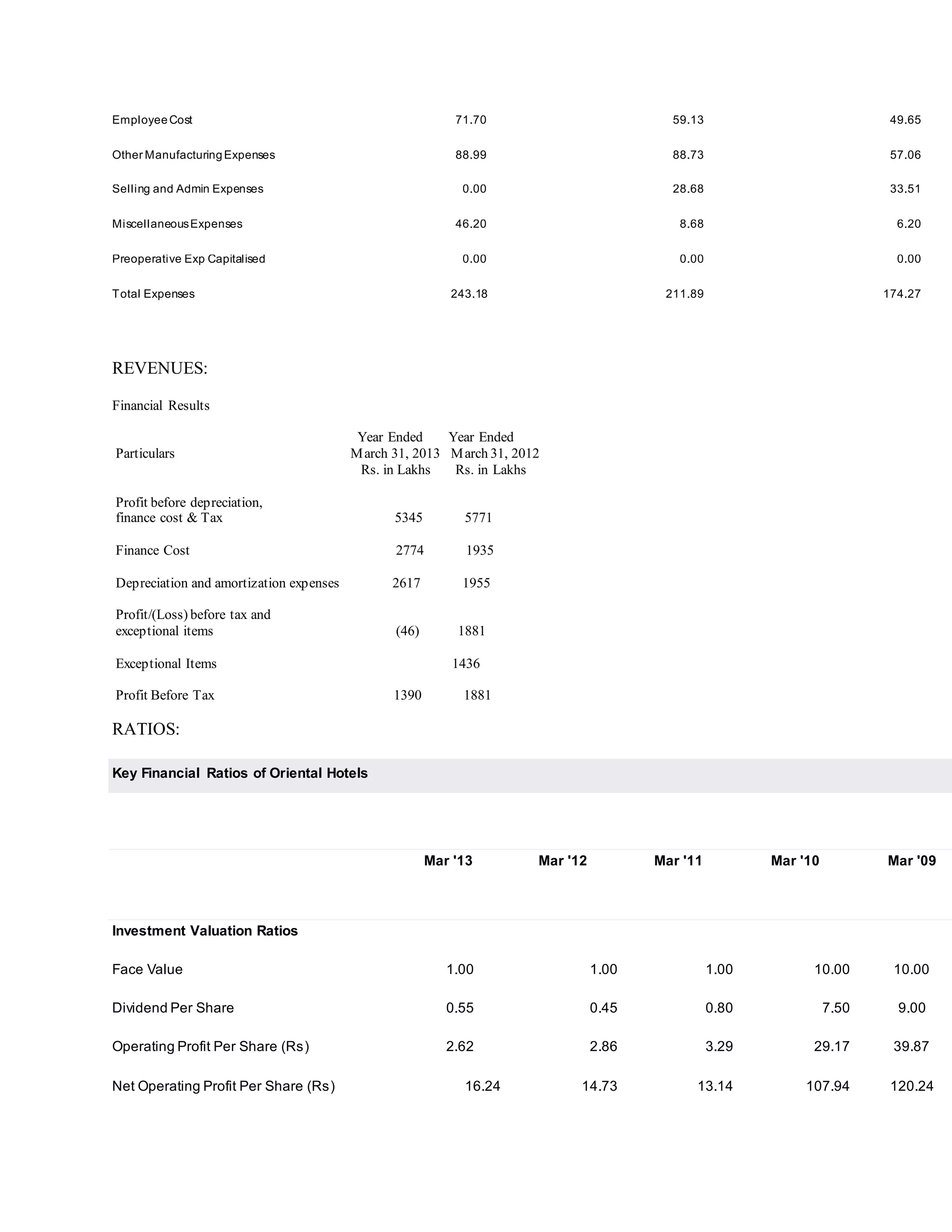

HOTEL ORIENTAL

SimonKeswick ,ChairmanEdouard Ettedgui, Group Chief Executive;Stuart Dickie, Chief

Financial OfficerMichael Hobson, Sales and Marketing Director; Terry Stinson, Development

Director and President, The Americas.

Simon Lindley Keswick (born 20 May 1942) is a Scottish businessman and the younger brother

of Sir Chips Keswick and Sir Henry Keswick.

He is a director of Matheson & Co. (owned by Jardine Matheson Holdings), Fleming Mercantile

Investment Trust, Hanson plc, Jardine Lloyd Thompson Group plc. and theMandarin Oriental

Hotel Group. He was previously Chairman of the Kwik Save Group plc

CORPORATE SOCIAL RESPONSIBILITY

The Tata Group has always held that what comes from the society, must, in reasonable measure,

go back to it. The Taj is proud to be a part of this legacy, and is deeply committed to serve the

community. We recognize that the community is not just another stakeholder in our businesses,

but serving the community, especially the underprivileged sections, is central to our core values.

We further believe that serving people in the form of corporate volunteering has positive spin-offs

by way of reviving a sense of bonding and the spirit of learning in our employees.

CORPORATE GOVERNANCE

The Indian Hotels Company Limited (“the Company”) has been practicing good Corporate

Governance even before Securities Exchange Board of India (SEBI) made it a mandatory](https://image.slidesharecdn.com/deskreportnew-140912112352-phpapp01/75/Desk-report-new-11-2048.jpg)