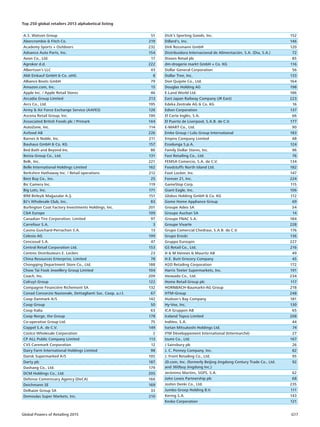

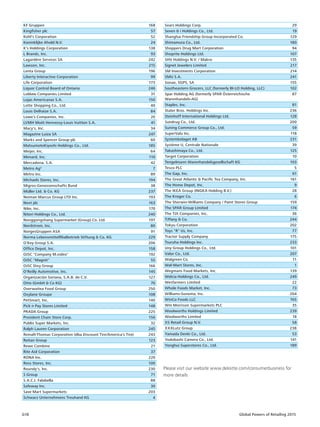

This document provides an overview of retail trends for 2015 and analyzes the performance of the top 250 global retailers based on fiscal 2013 data. It discusses key trends shaping retail in 2015, including travel retailing, mobile retailing, faster retailing, experience retailing, and innovative retailing. It also provides a brief outlook on the global economy and factors impacting it.