This document provides a summary of Deepakraj Devaraj's work experience and achievements. Some of his key responsibilities and achievements include successfully migrating securities finance processes from London to Chennai, being a single point of contact for process queries, creating documentation and training new employees, and ensuring payments and charges are processed efficiently. He has extensive experience gathering requirements, communicating with management, and ensuring compliance. Deepakraj has expertise in process migration and is proficient in various applications related to securities finance, cash operations, and trade support.

![Project Assignment:

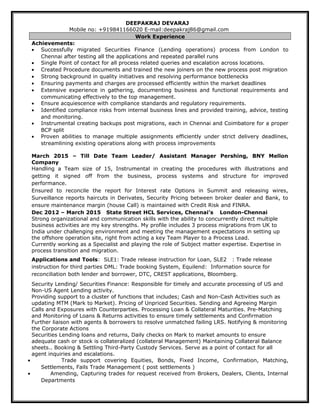

Overview of European & UK trend analysis and structure of its daily flow of volumes.

Process management and Building the internal workflows to minimise escalations and

streamline the process.

Contribution in automating the process flow management

Academic Credentials

• MBA in Finance [2006-2008] from RMD Engineering College, Chennai, India

• Bachelor of Commerce [2003-2006] from DG. Vaishnav College, Chennai, India

• Higher Secondary [2001-03] from St.Marys.A.I.H.Sec.School, Chennai, India

• Senior Secondary [2000-01] from St.Marys.A.I.H.Sec.School, Chennai, India

Extra Curricular Activities

• Participated in the sporting event called “Coliseum” at PG Level

• Instrumental at forming an NGO called “UTSAAH” with college mates at PG Level

• Participated Inter college management fest

• Active member of CSR

OTHER ACCOMPLISHMENTS

• Certified in Transition Management Program awarded to the top 20% performance category

• Adept in building strong counterpart relationship with key stakeholders from the business

group

• Applauded and recognized by the UK business team for successfully migrating 3 complex

processes

INTERESTS

• Photography

• Actively involved in corporate social responsibility activities

• Follow most sports, especially cricket](https://image.slidesharecdn.com/63595a06-5889-490a-bee9-d63b62ec617c-170207023935/85/DEEPAKRAJ-D-4-320.jpg)