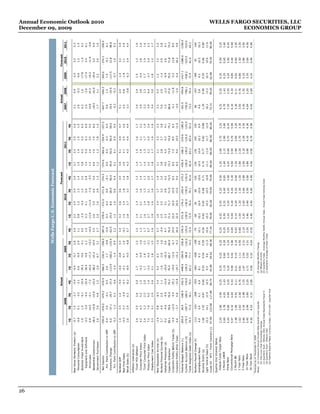

This document provides an economic outlook for 2010 from Wells Fargo Economics Group. It discusses three main problems facing the economic recovery: 1) how to stabilize the economy using policy tools, 2) determining the pace and composition of economic growth, and 3) how goals for growth, inflation, employment, and the dollar have changed. While the recession may be over, growth in 2010 will be subpar and uneven. Risks include high unemployment, weakness in housing and consumer spending, and the sustainability of the recovery without government support. Policymakers must determine how long expansionary policies can continue given rising public debt and dependence on foreign capital.