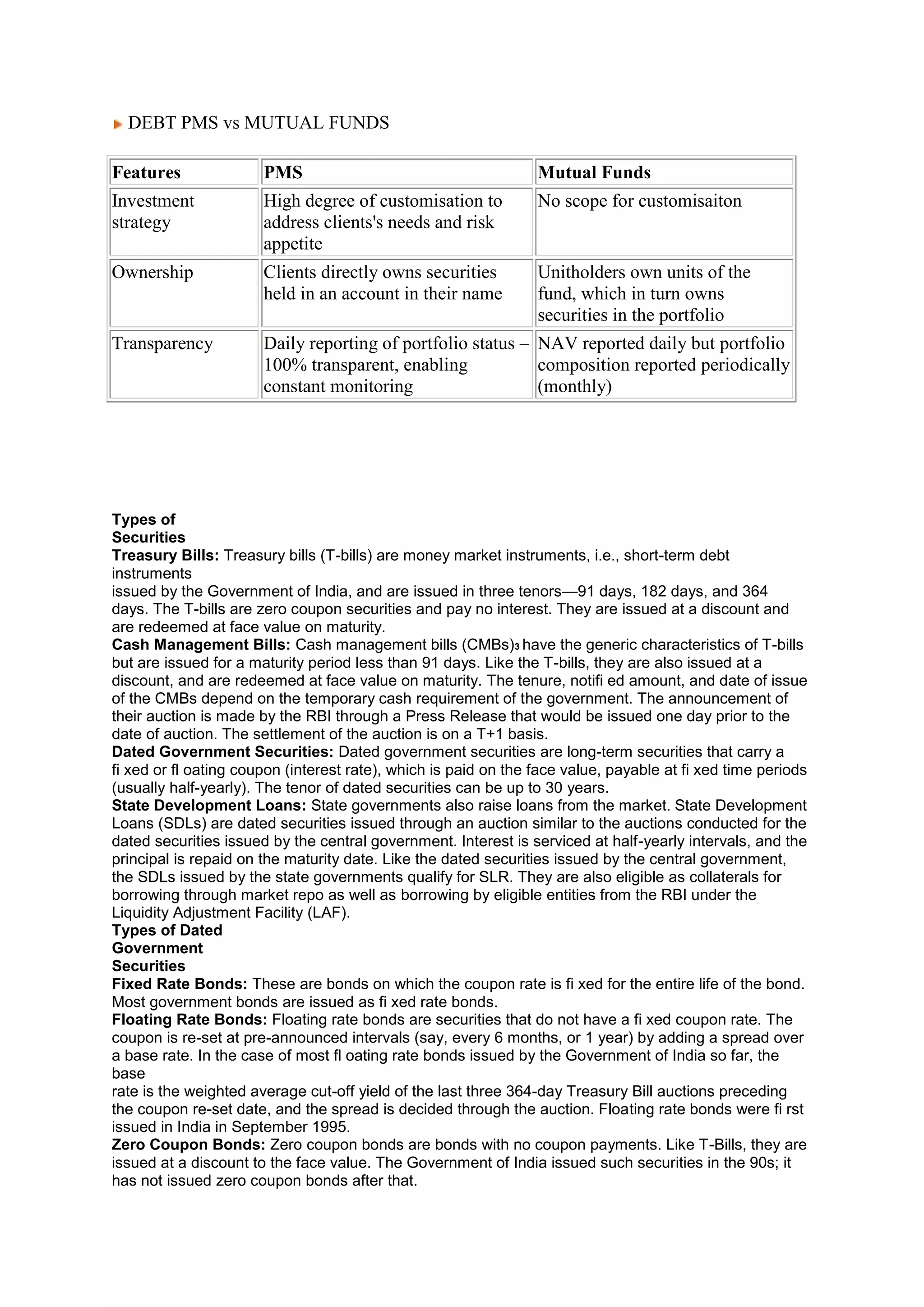

The document compares and contrasts personal money management services (PMS) and mutual funds, noting that PMS allows for a higher degree of customization to meet client needs and risk appetite compared to mutual funds, and that with PMS clients directly own the securities in their portfolio while with mutual funds investors own units of a fund which owns securities. It also notes that while PMS provides daily portfolio transparency, mutual funds only report portfolio composition periodically, usually monthly.