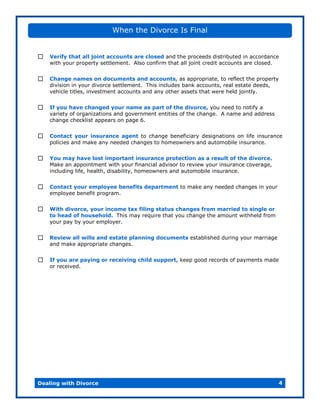

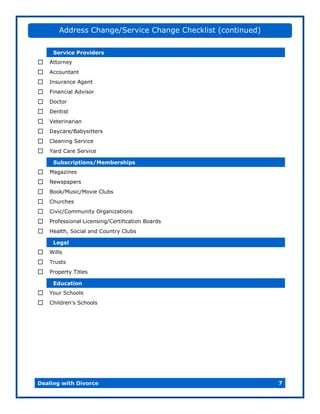

The document provides information to help guide those dealing with divorce. It discusses taking steps before initiating divorce like counseling and financial preparation. It outlines the divorce initiation process including legal matters and agreements. Finally, it notes important post-divorce tasks like changing names and accounts, reviewing insurance, and maintaining child support records. Checklists are included for documents and notifying entities of name and address changes.