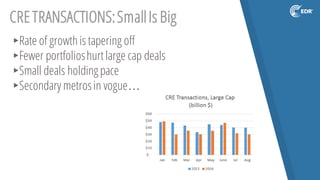

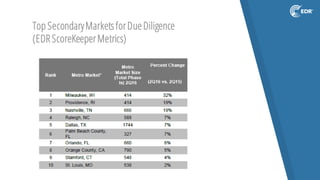

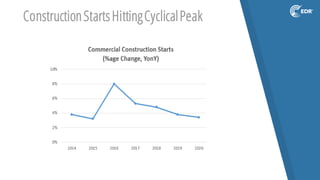

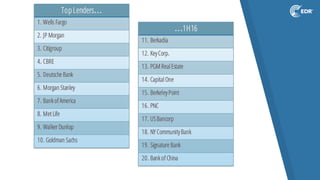

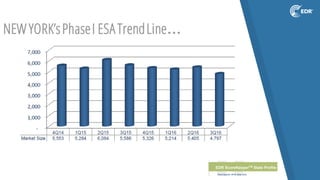

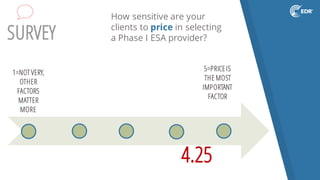

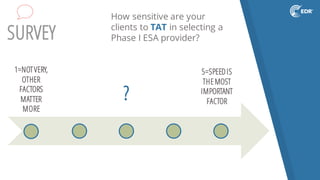

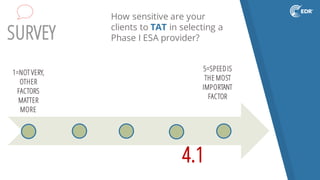

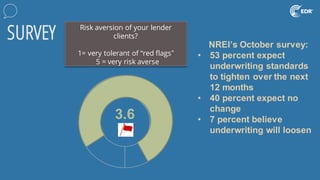

The CRE market is seeing slowing growth with fewer large portfolio deals and construction starts hitting a cyclical peak. While small deals are holding pace, secondary markets are becoming more popular. Lending is becoming more cautious as underwriting standards tighten and regulators emphasize concentrated risk management. The Phase I environmental market in New York is progressing along the long top of the recovery, mirroring national trends, with Brooklyn and Long Island City becoming attractive alternative office locations to Manhattan for technology companies. There is growing pressure on the industry to increase efficiency and speed while maintaining or improving quality as clients rate turnaround time and price as important factors in selecting providers. The near-term market forecast expects transactions to decline over the next two years with modest lending growth