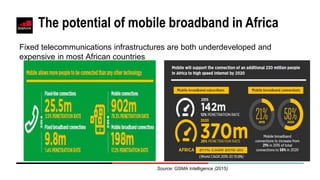

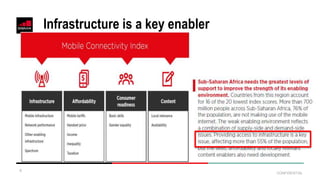

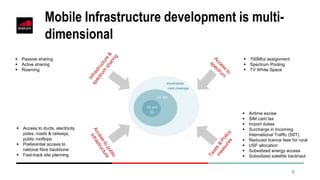

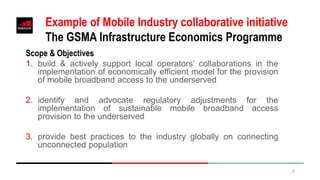

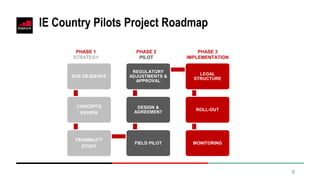

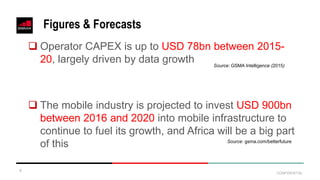

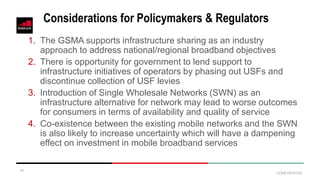

The document discusses the potential for mobile broadband in Africa and considerations for expanding mobile infrastructure on the continent. It provides an overview of the GSMA and its work promoting mobile infrastructure development. Specifically, it outlines an example collaborative initiative between mobile operators to implement economically efficient models for providing mobile broadband access to underserved areas. The initiative involves feasibility studies, regulatory adjustments, and pilot programs to identify best practices for connecting more people. It also notes that mobile operators are expected to invest $900 billion in infrastructure from 2016-2020, with Africa being a major focus, and highlights policymaker considerations around infrastructure sharing and single wholesale networks.