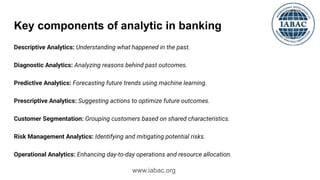

Data analytics in banking involves leveraging computer power to analyze vast amounts of financial information, aiding in fraud detection, loan repayment assessments, and customer preferences. Key components include various types of analytics such as descriptive, predictive, and prescriptive analytics, which help banks make informed decisions and enhance operational efficiency. The process encompasses data collection, processing, and analysis, ultimately leading to improved customer insights and compliance, making analytics crucial for the banking sector's future.