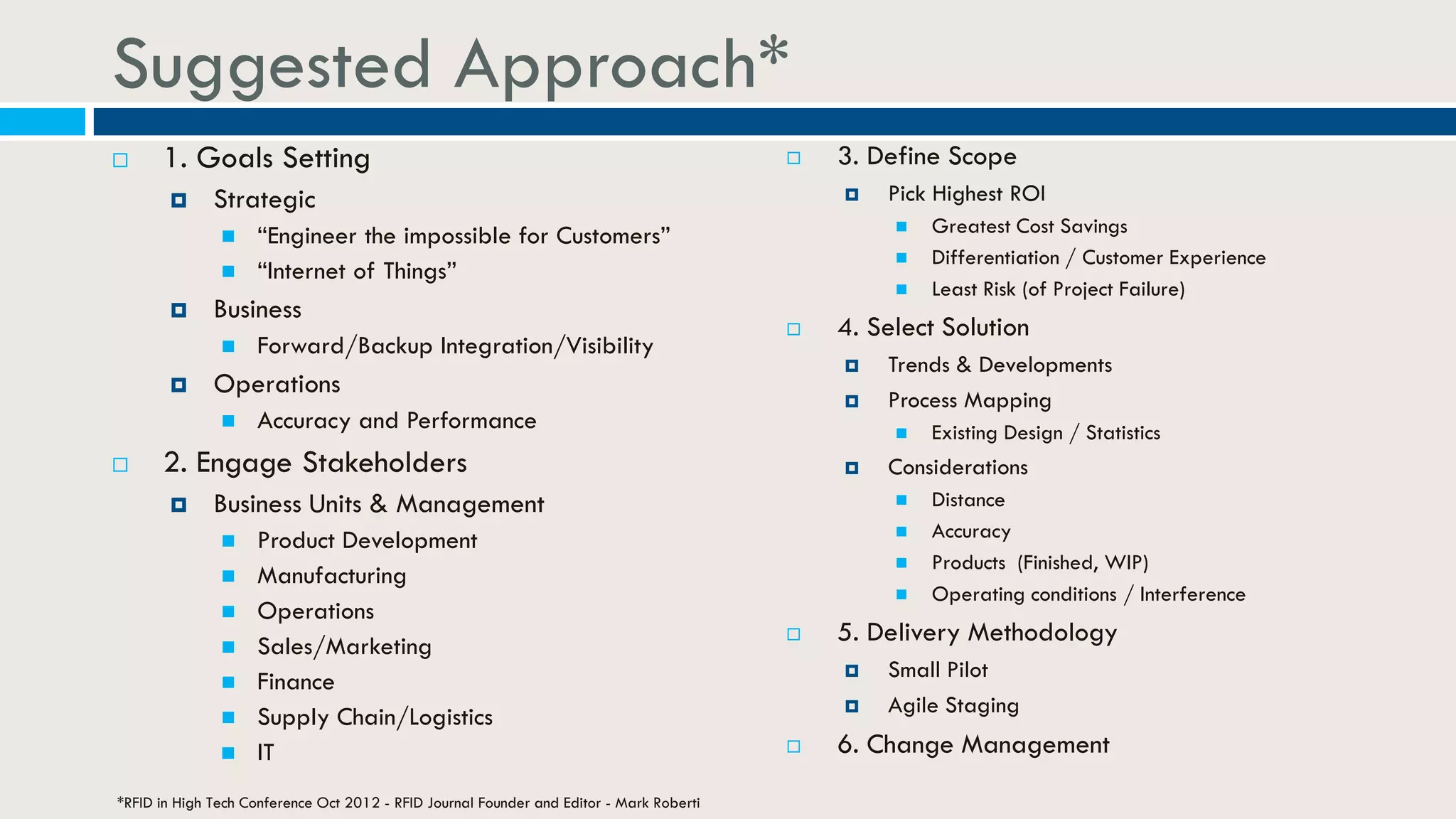

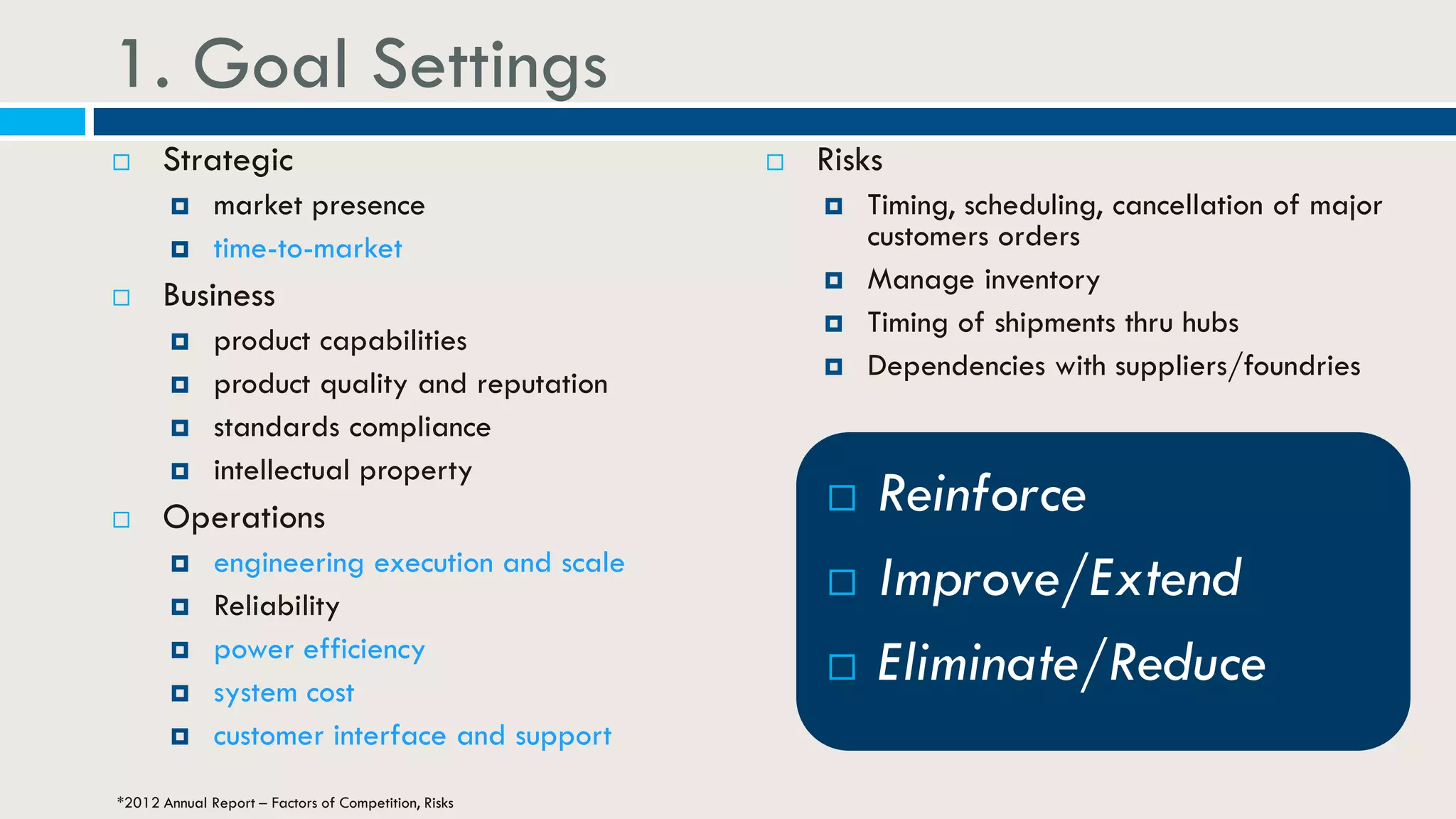

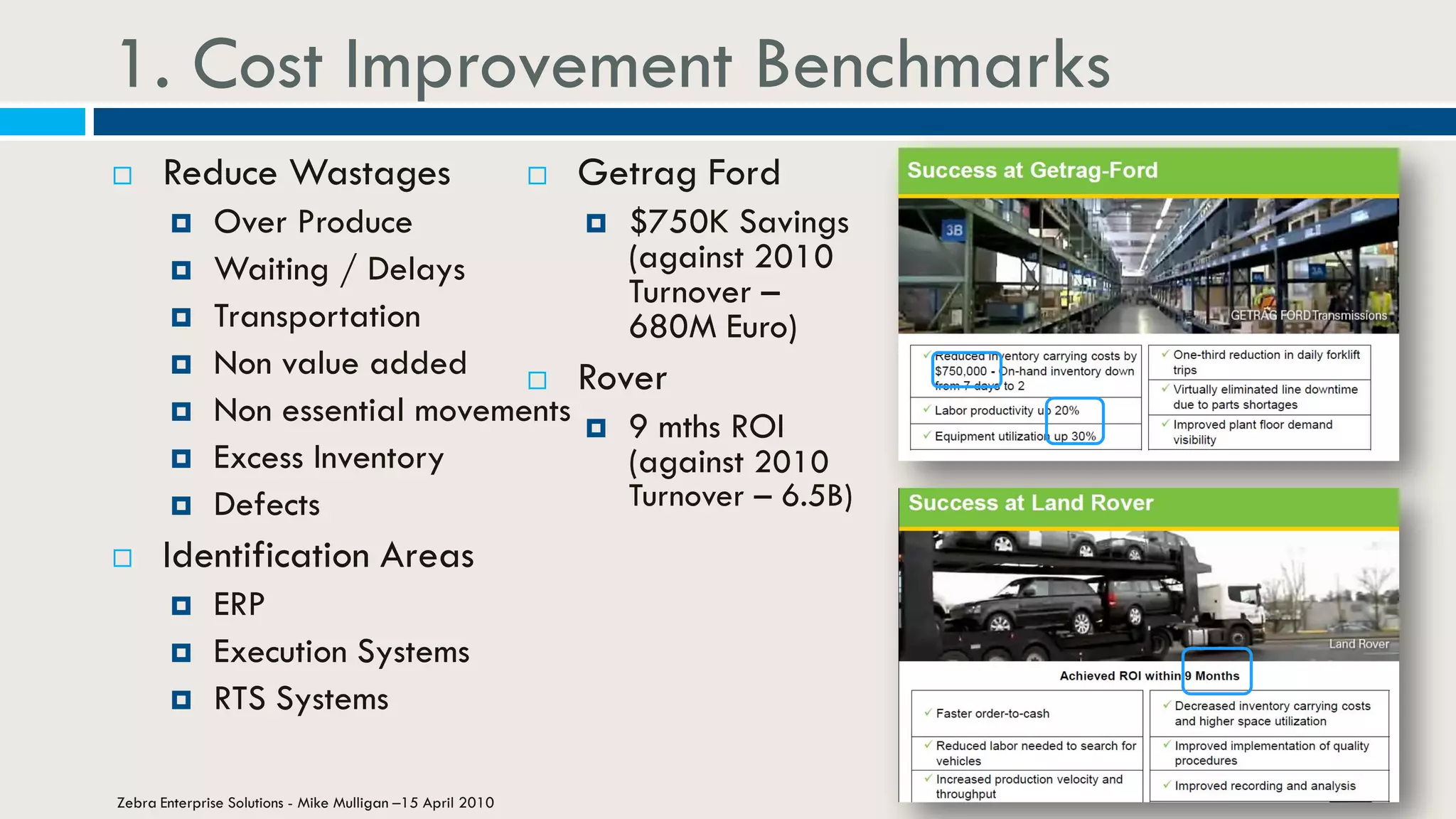

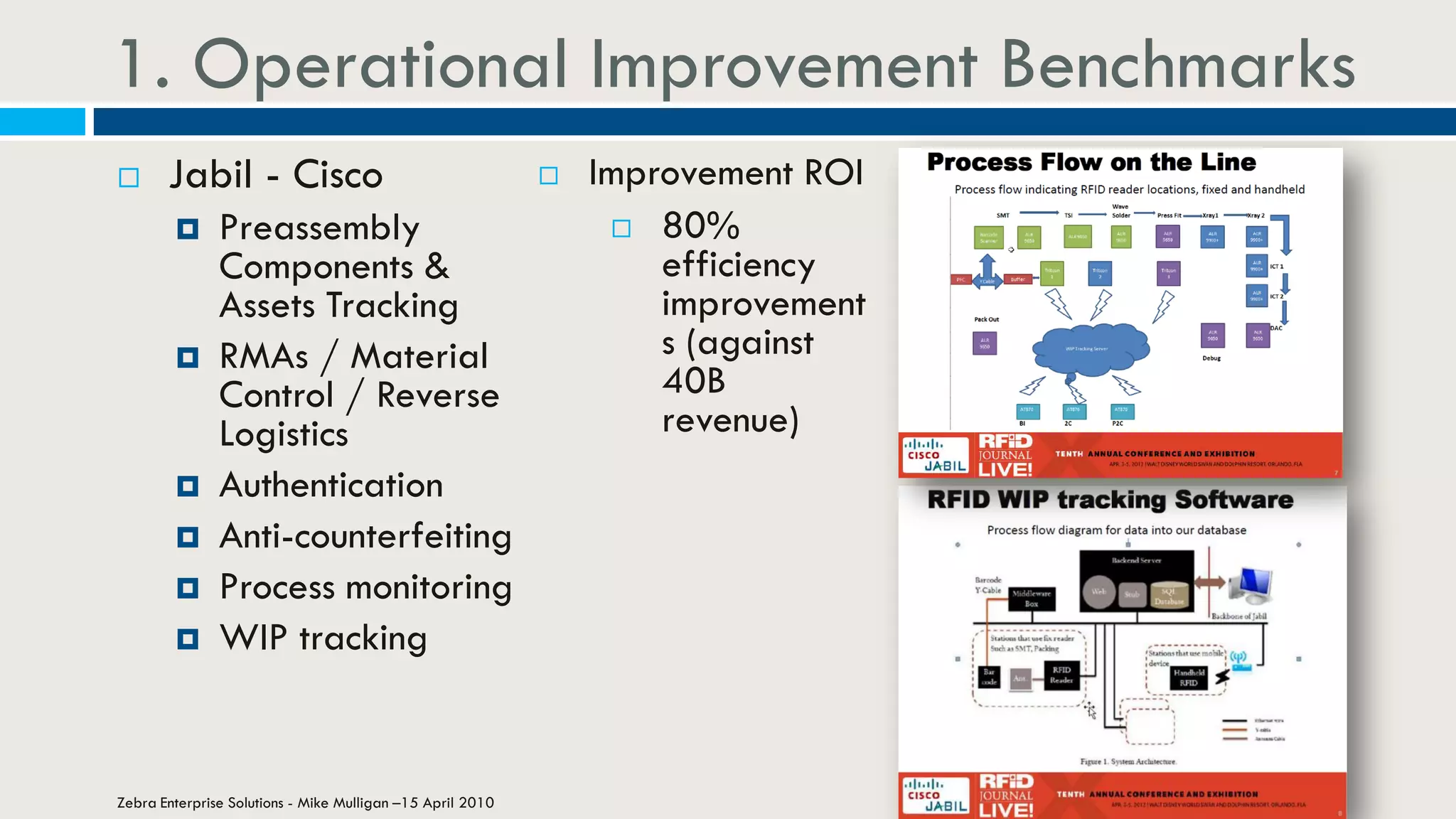

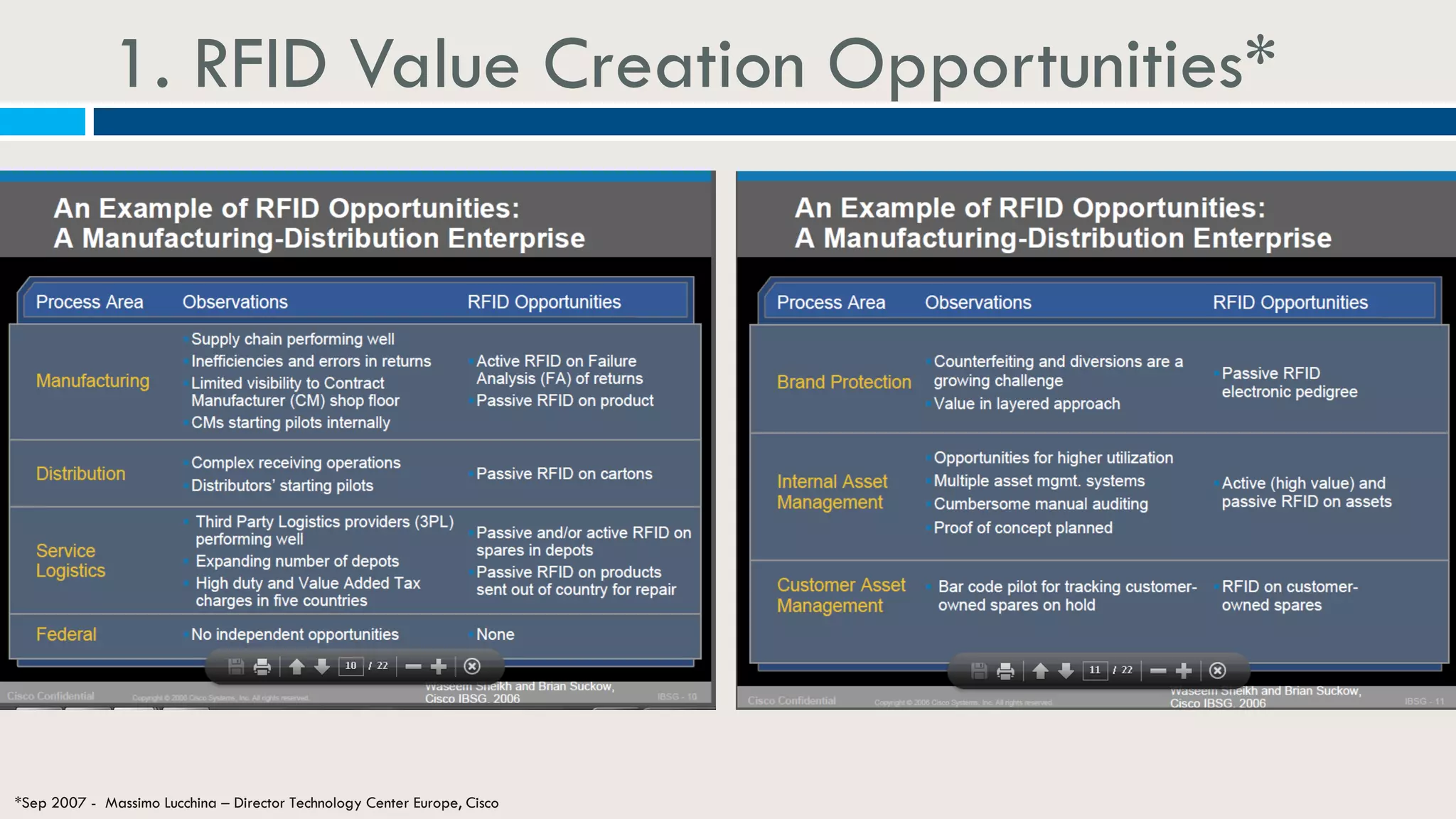

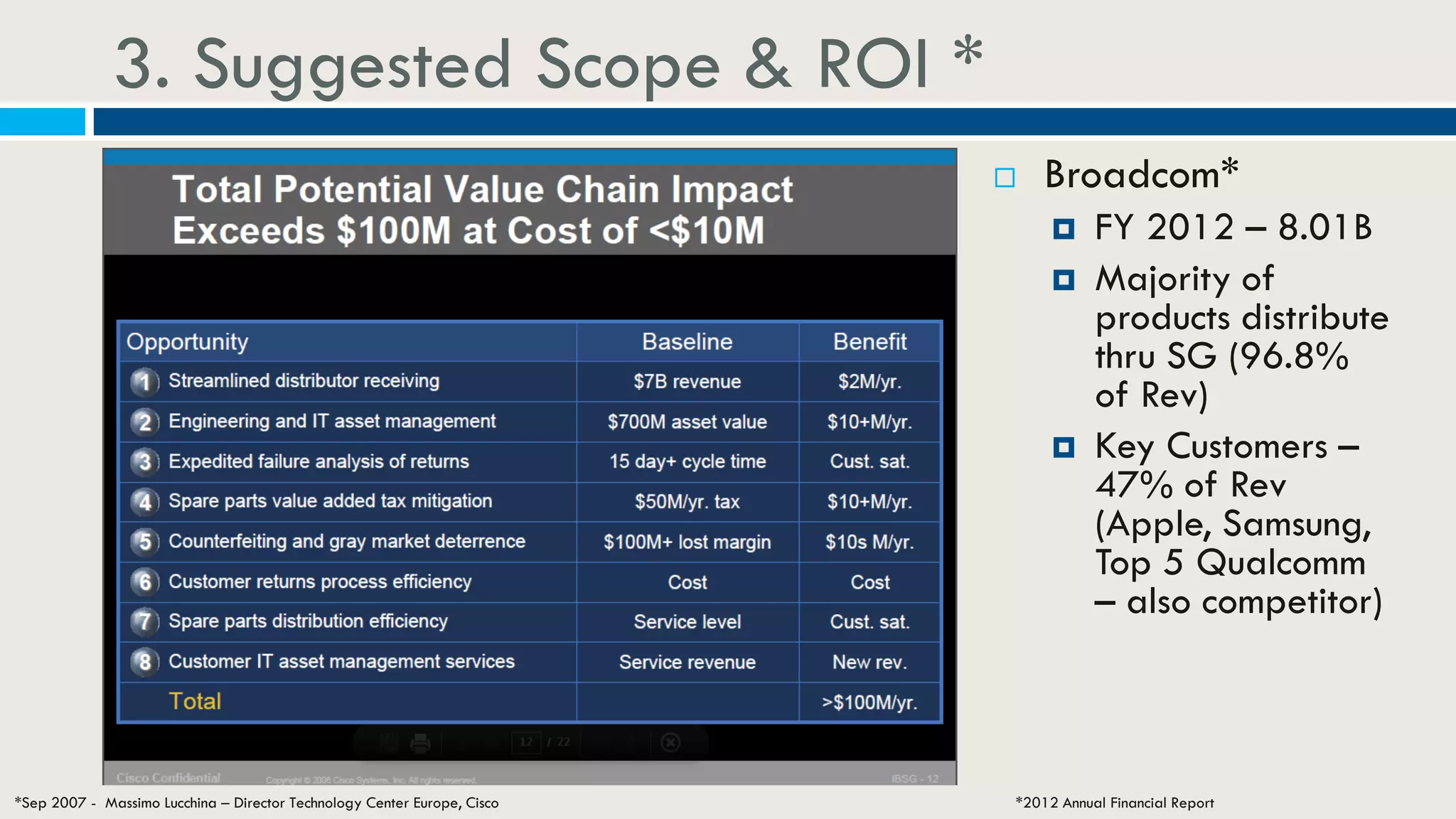

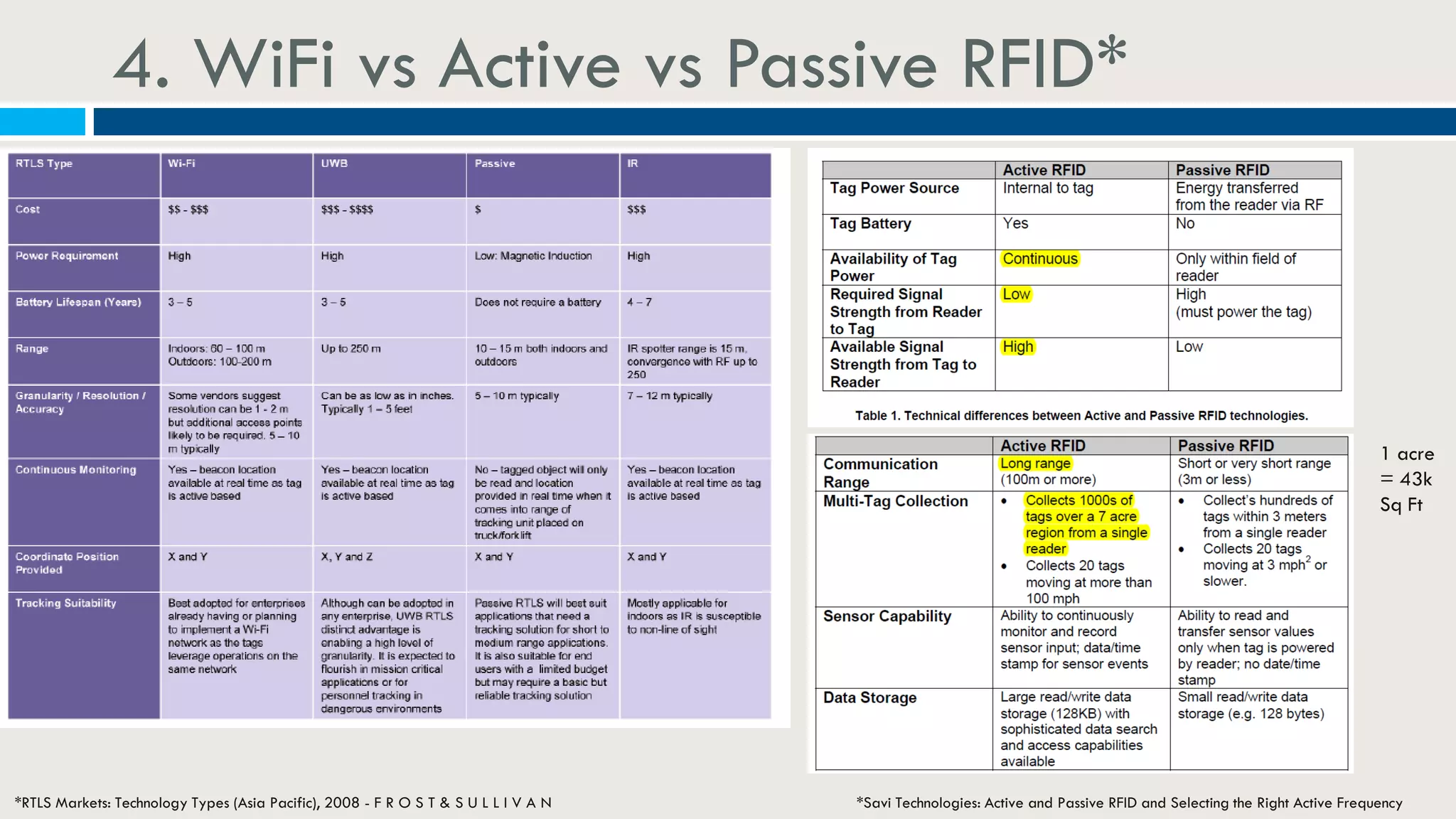

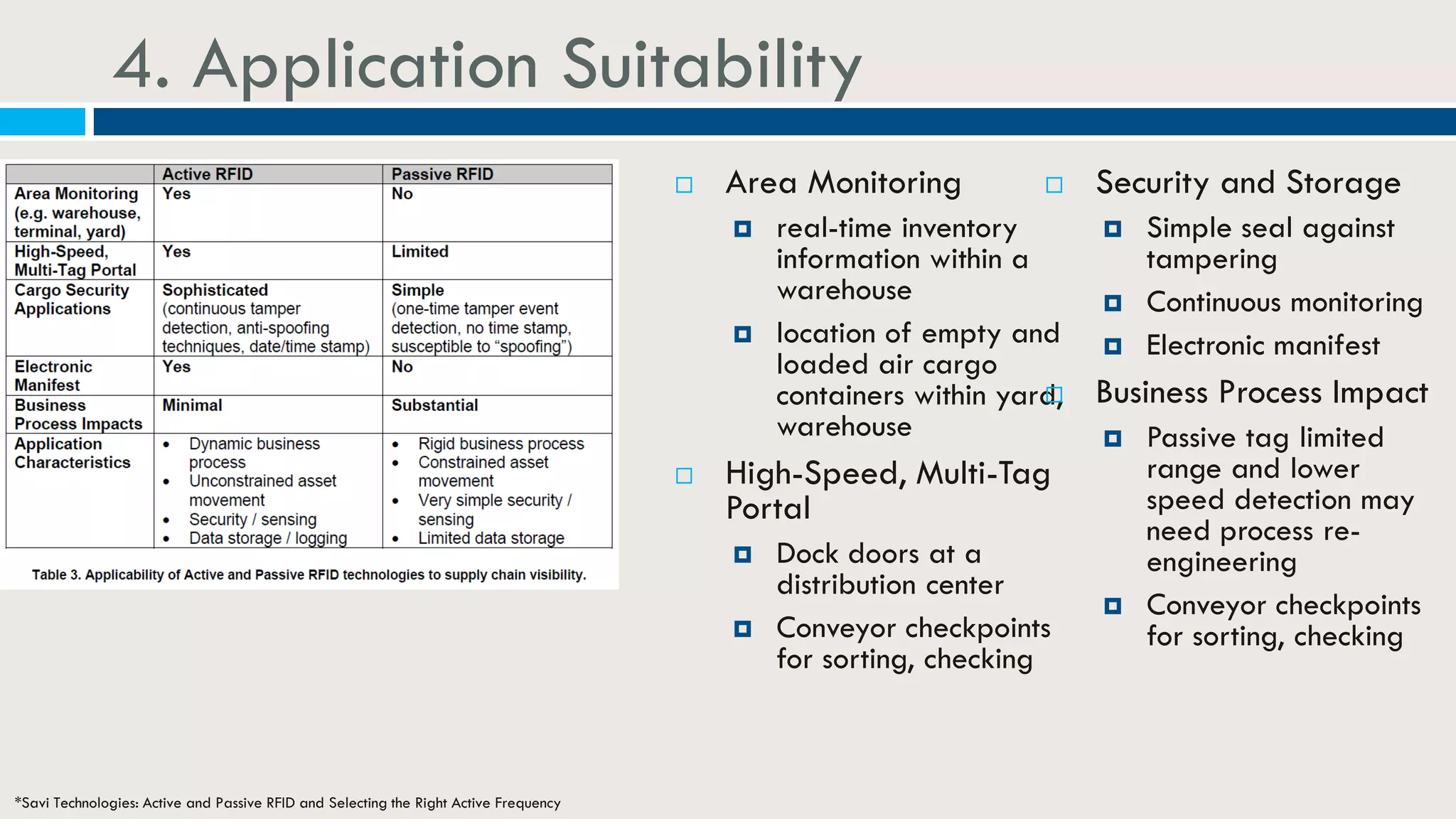

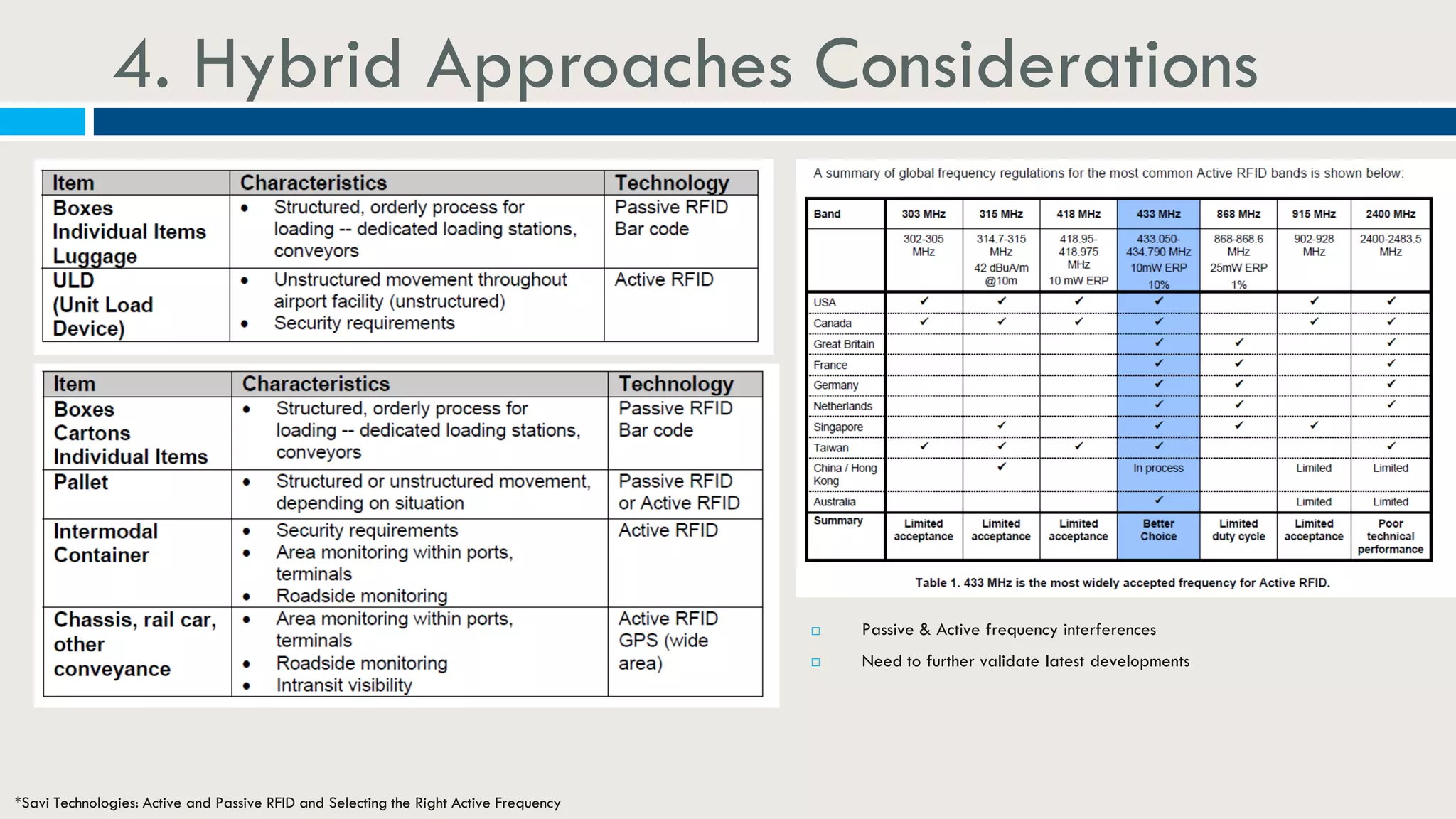

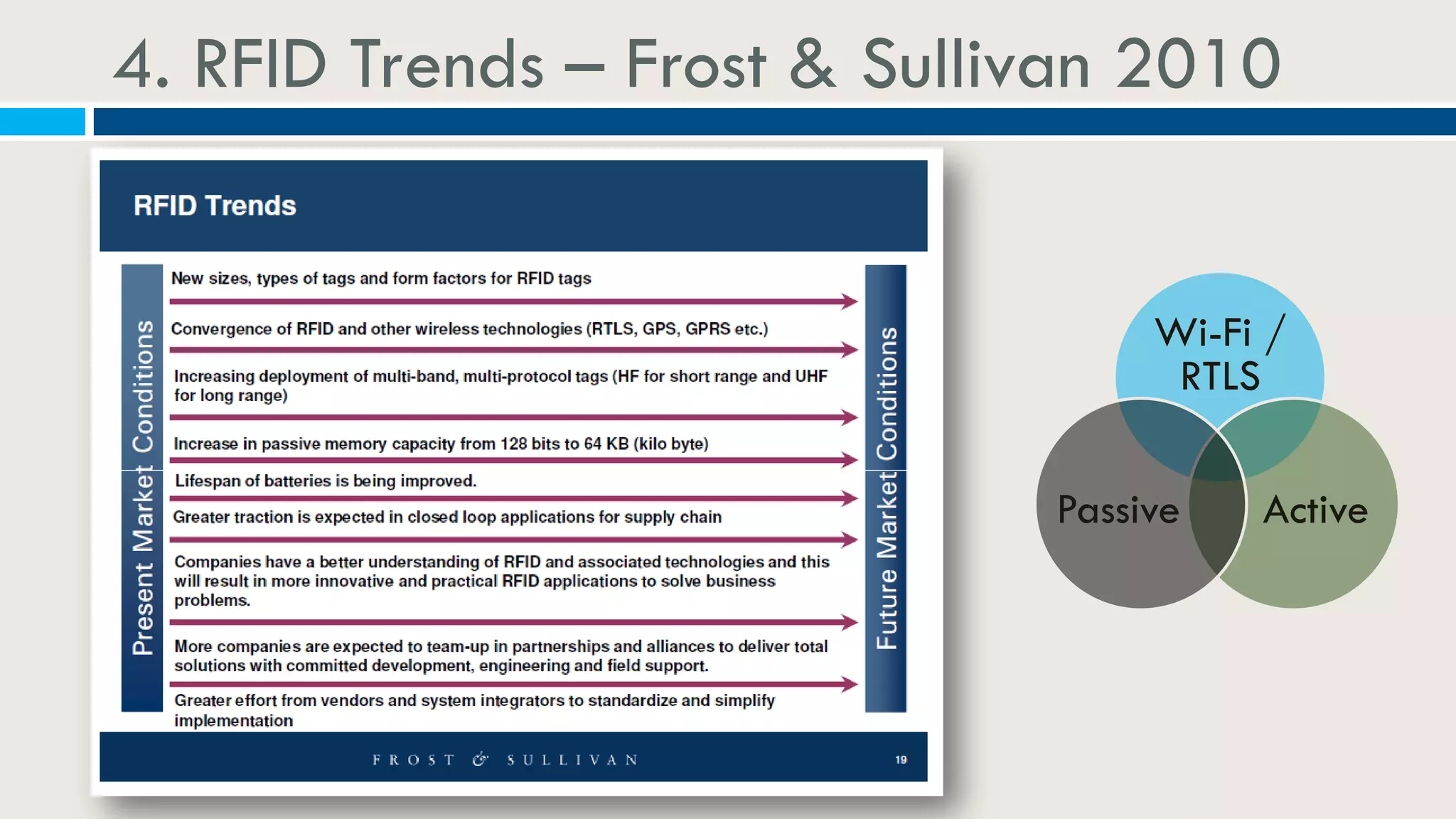

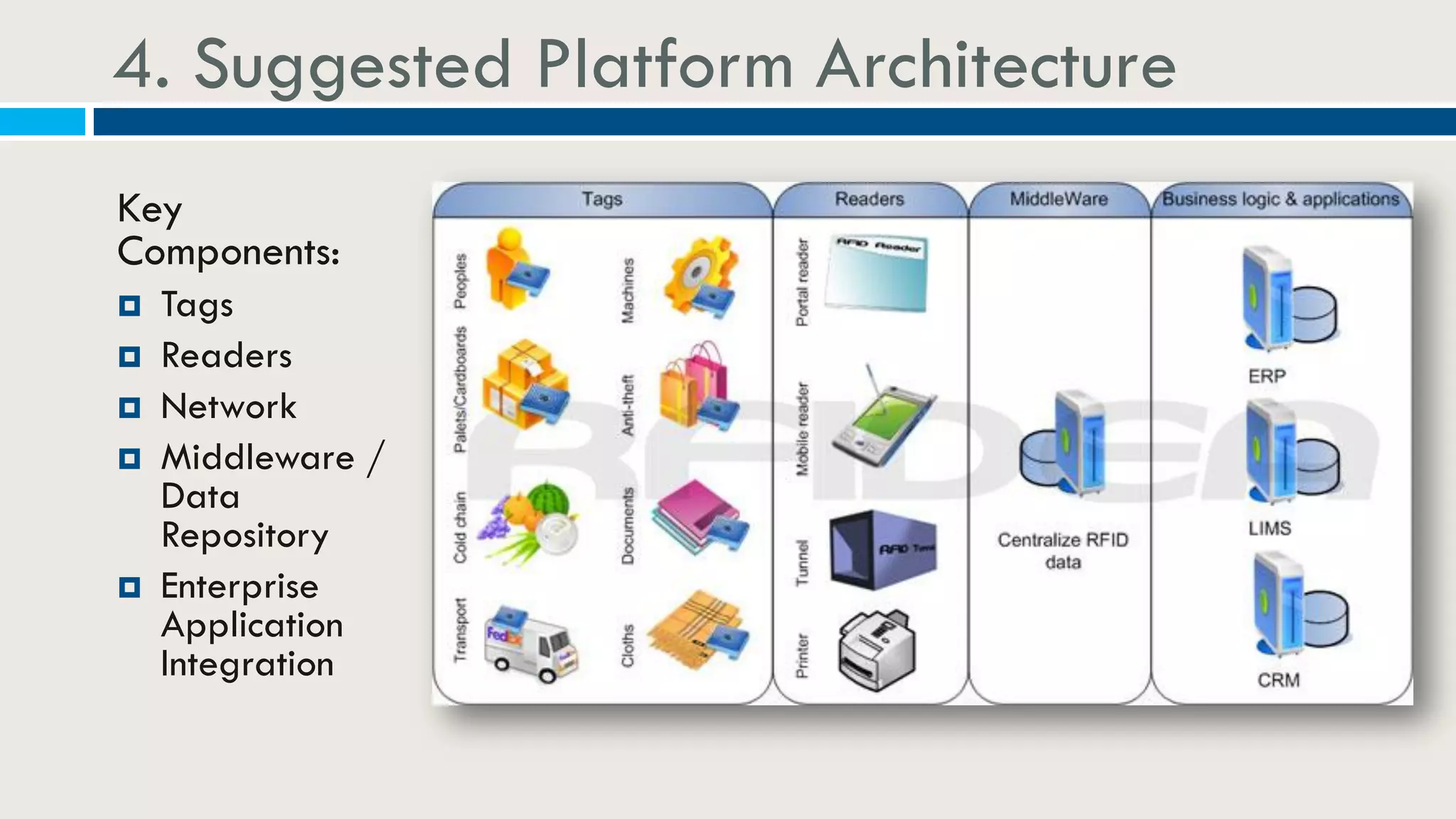

The document outlines a strategic approach to supply chain visualization services, emphasizing goal setting, stakeholder engagement, and defined scopes to enhance operational efficiency. It discusses the selection of appropriate solutions based on ROI and operational benchmarks while noting the importance of change management and potential risks. Additionally, it highlights the integration of RFID technology for tracking, monitoring, and streamlining processes in various industries.