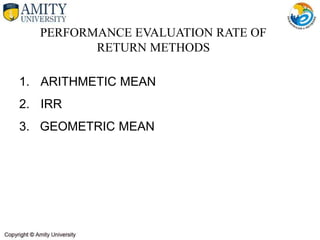

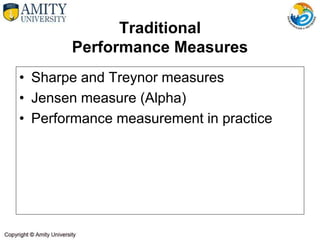

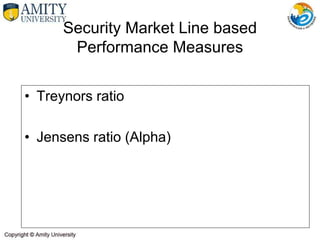

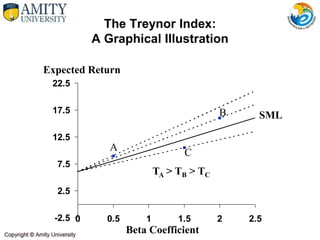

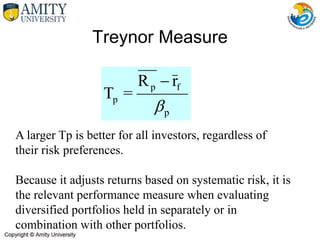

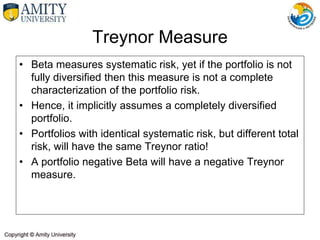

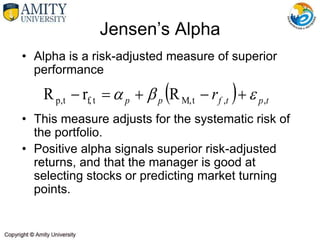

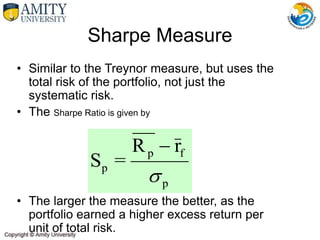

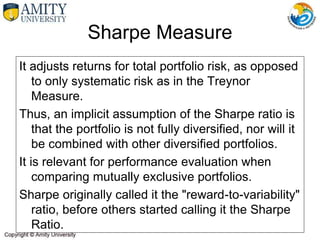

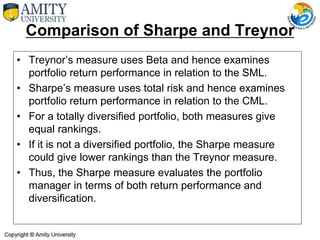

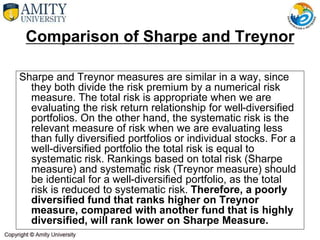

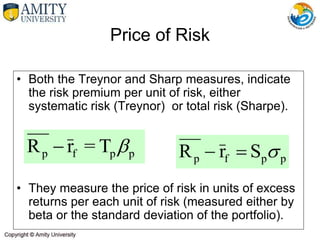

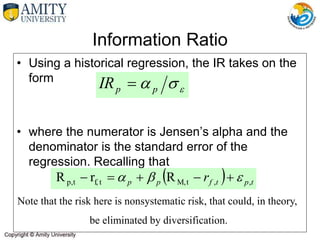

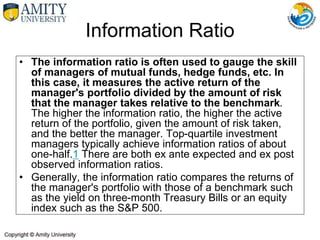

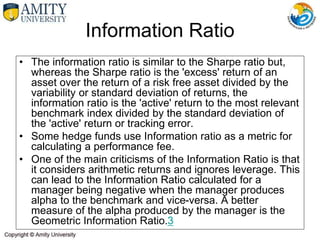

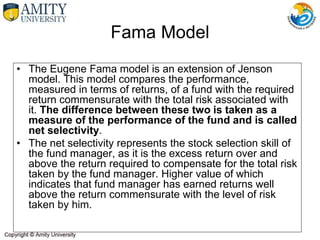

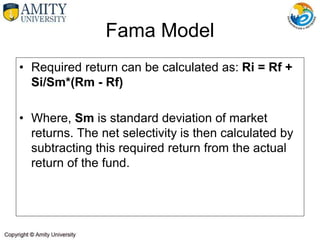

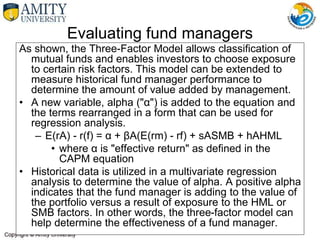

This document discusses various methods for measuring portfolio performance, including return-based measures like arithmetic mean, internal rate of return, and geometric mean. It also discusses risk-adjusted performance measures like the Sharpe ratio, Treynor ratio, Jensen's alpha, and information ratio. These risk-adjusted measures evaluate a portfolio's performance based on the risk taken, using either total risk or systematic risk. The Sharpe ratio uses total risk while the Treynor ratio and Jensen's alpha use only systematic risk.

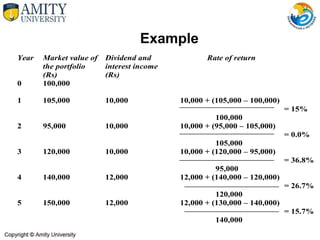

![A.M : (15.0 + 0.0 + 36.8 + 26.7 + 15.7) / 5 = 18.8%

10,000 10,000 10,000 12,000 12,000 +

150,000

IRR :100000 = + + + +

(1+r) (1+r)2 (1+r)3 (1+r)4 (1+r)5

r ≃ 17.65%

GM : [ (1.15) (1.00) (1.368) (1.267) (1.157)] 1/5 - 1 ≃ 18.2%

Example](https://image.slidesharecdn.com/cycle6pmsession4-221022080239-2a6be9f0/85/Cycle-6-PM-Session-4-ppt-26-320.jpg)

![IRR

PERIOD

1 2 3 4

RATE OF RETURN EARNED 10% 30% 20% -

PORTFOLIO A

1. BEGINNING VALUE BEFORE

INFLOW OR OUTFLOW 10,000 11,000 14,300 17,160

2. INFLOW (OUTFLOW) - - - (17,160)

3. AMOUNT INVESTED 10,000 11,000 14,300 -

4. ENDING VALUE 11,000 14,300 17,160 -

PORTFOLIO B

1. BEGINNING VALUE BEFORE

INFLOW OR OUTFLOW 10,000 11,000 3,900 4,680

2. INFLOW (OUTFLOW) - (8,000) - (4,680)

3. AMOUNT INVESTED 10,000 3,000 3,900 -

4. ENDING VALUE 11,000 3,900 4,680 -

17,160

A : 10,000 = r = 19.72%

(1+r)3

8,000 0 4680

B : 10,000 = + + r = 15.27%

(1+r) (1+r)2 (1+r)3

IRR REFLECTS INVESTMENT PERFORMANCE AS WELL AS THE EFFECT OF CONTRIBUTIONS AND

WITHDRAWALS .. TOTAL EXPERIENCE OF A FUND (a) INVESTMENET PERFORMANCE & (b) CASH

FLOWS.

G.M : [(1.10) (1.30) (1.20)] 1/3 - 1 = 0.1972 OR 19.72%](https://image.slidesharecdn.com/cycle6pmsession4-221022080239-2a6be9f0/85/Cycle-6-PM-Session-4-ppt-27-320.jpg)

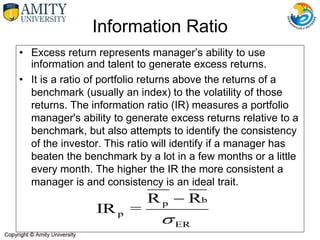

![• A high IR can be achieved by having a high return in the

portfolio, a low return of the index and a low tracking

error.

For example:

Manager A might have returns of 13% and a tracking

error of 8%

Manager B has returns of 8% and tracking error of 4.5%

The index has returns of -1.5%

Manager A's IR = [13-(-1.5)]/8 = 1.81

Manager B's IR = [8-(-1.5)]/4.5 = 2.11

Manager B had lower returns but a better IR. A high ratio

means a manager can achieve higher returns more

efficiently than one with a low ratio by taking

on additional risk. Additional risk could be achieved

through leveraging.

Information Ratio](https://image.slidesharecdn.com/cycle6pmsession4-221022080239-2a6be9f0/85/Cycle-6-PM-Session-4-ppt-50-320.jpg)

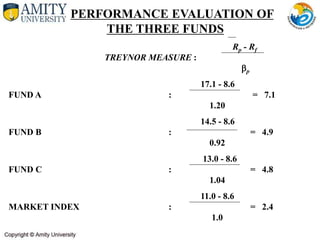

![Rp - Rf

SHARPE MEASURE :

p

17.1 - 8.6

FUND A : = 0.302

28.1

14.5 - 8.6

FUND B : = 0.299

19.7

13.0 - 8.6

FUND C : = 0.193

22.8

11.0 - 8.6

MARKET INDEX : = 0.117

20.5

JENSEN MEASURE : Rp - [Rf + p (RM - Rf )]

FUND A : 17.1 - [8.6 + 1.20 (2.4)] = 5.62

FUND B : 14.5 - [8.6 + 0.92 (2.4)] = 3.69

FUND C : 13.0 - [8.6 + 1.04 (2.4)] = 1.90

MARKET INDEX : O (BY DEFINITION)](https://image.slidesharecdn.com/cycle6pmsession4-221022080239-2a6be9f0/85/Cycle-6-PM-Session-4-ppt-70-320.jpg)