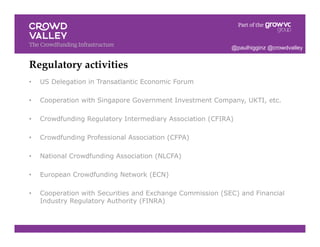

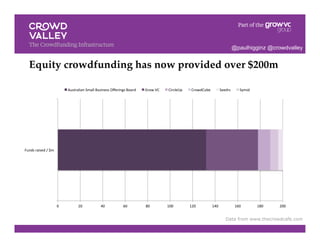

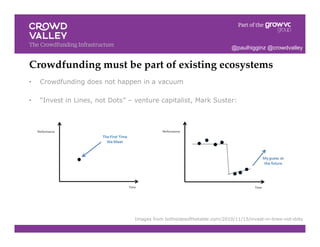

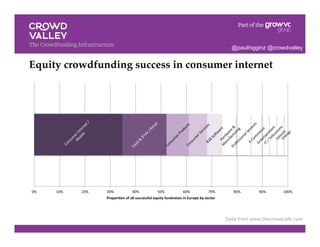

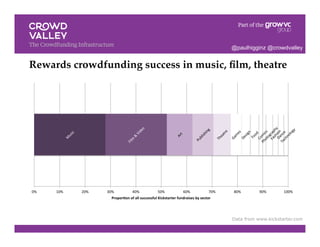

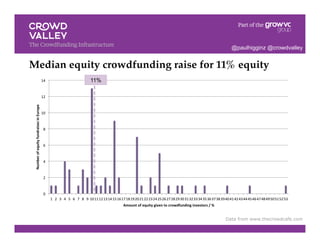

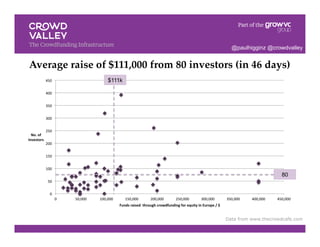

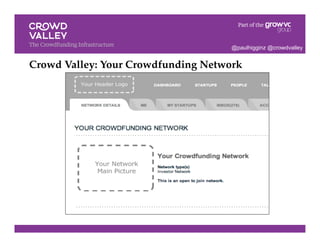

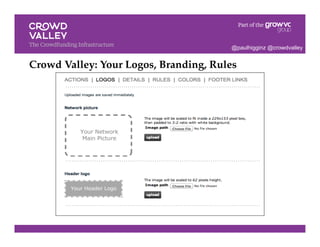

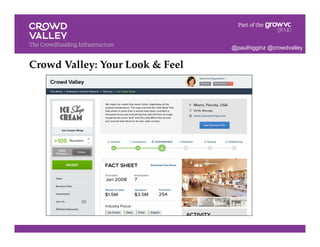

The document discusses the current state and future of crowdfunding in Europe, emphasizing the need for integration within existing entrepreneurial ecosystems. It highlights regulatory developments, successful platforms, and statistics about funding raised through equity crowdfunding. The speaker, Paul Higgins, outlines the importance of building networks and the potential for crowdfunding to evolve into more complex financial models.