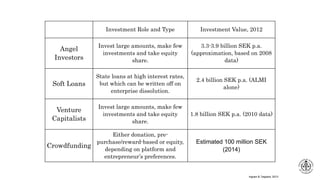

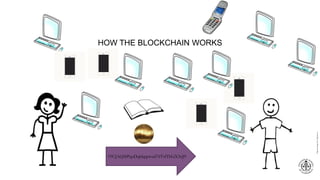

The document discusses the intersections of crowdfunding and blockchain technology, highlighting different types of crowdfunding such as donation-based, equity-based, and debt-based models. It outlines motivations for crowd investment, the impact of narratives on funding success, and the potential for digital platforms to democratize access to funding, particularly for women and other minorities. Additionally, it examines blockchain technology as a robust and democratic method for transactions, emphasizing its characteristics and implications for entrepreneurs and investors.