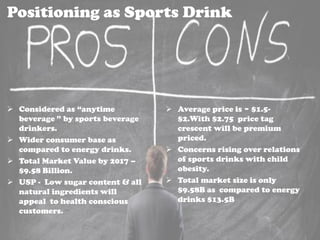

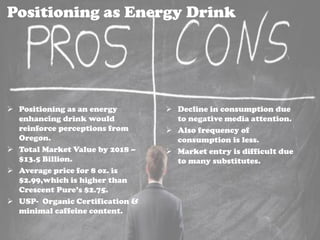

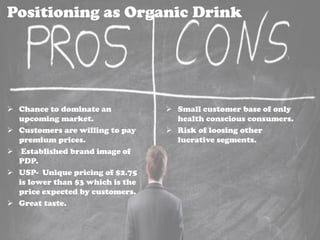

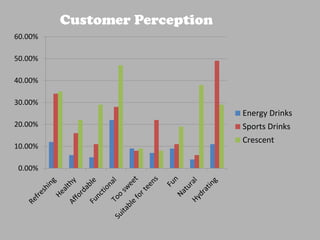

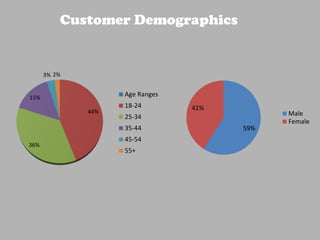

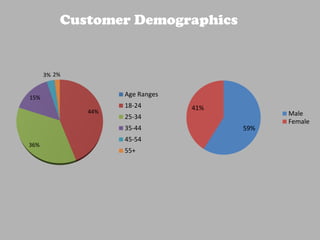

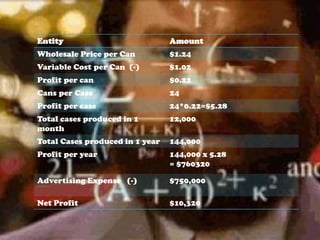

Portland Drake Beverages (PDP) acquired Crescent Pure in 2014. PDP must decide how to position Crescent Pure and is considering positioning it as an energy drink, sports drink, or organic drink. Positioning it as an organic drink allows Crescent Pure to dominate an upcoming market and appeal to health-conscious customers willing to pay premium prices, though it risks losing other customer segments. After analyzing customer demographics, perceptions of each option, and projected profits, PDP ultimately recommends positioning Crescent Pure as an organic energy drink to leverage the brand's reputation for natural ingredients while tapping into the large and lucrative energy drink market.