- Peter Hooper founded Crescent Pure in 2008 as a non-alcoholic, organic juice beverage infused with herbal stimulants and 80mg of caffeine. It sold out quickly and demand remained high.

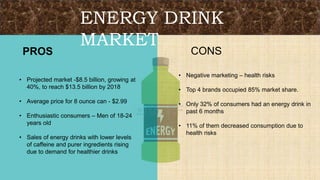

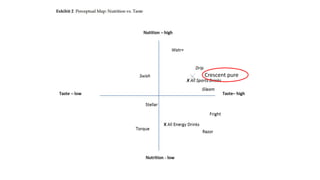

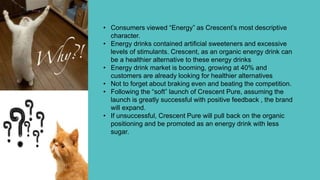

- Portland Drake Beverages acquired Crescent Pure in 2013 to expand into the functional beverage market. However, Crescent Pure faces competition from large energy drink brands and constraints in production capacity.

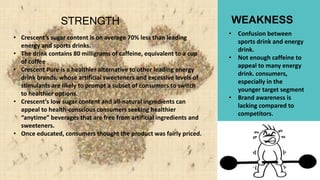

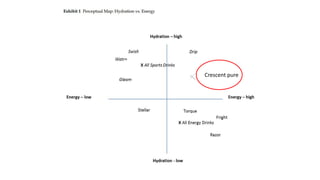

- A SWOT analysis found Crescent Pure's strengths were its lower sugar content and natural ingredients appealing to health-conscious consumers. However, it lacked brand awareness and some may not view its caffeine content as enough. The recommendation was to position Crescent Pure as an organic energy drink to target the