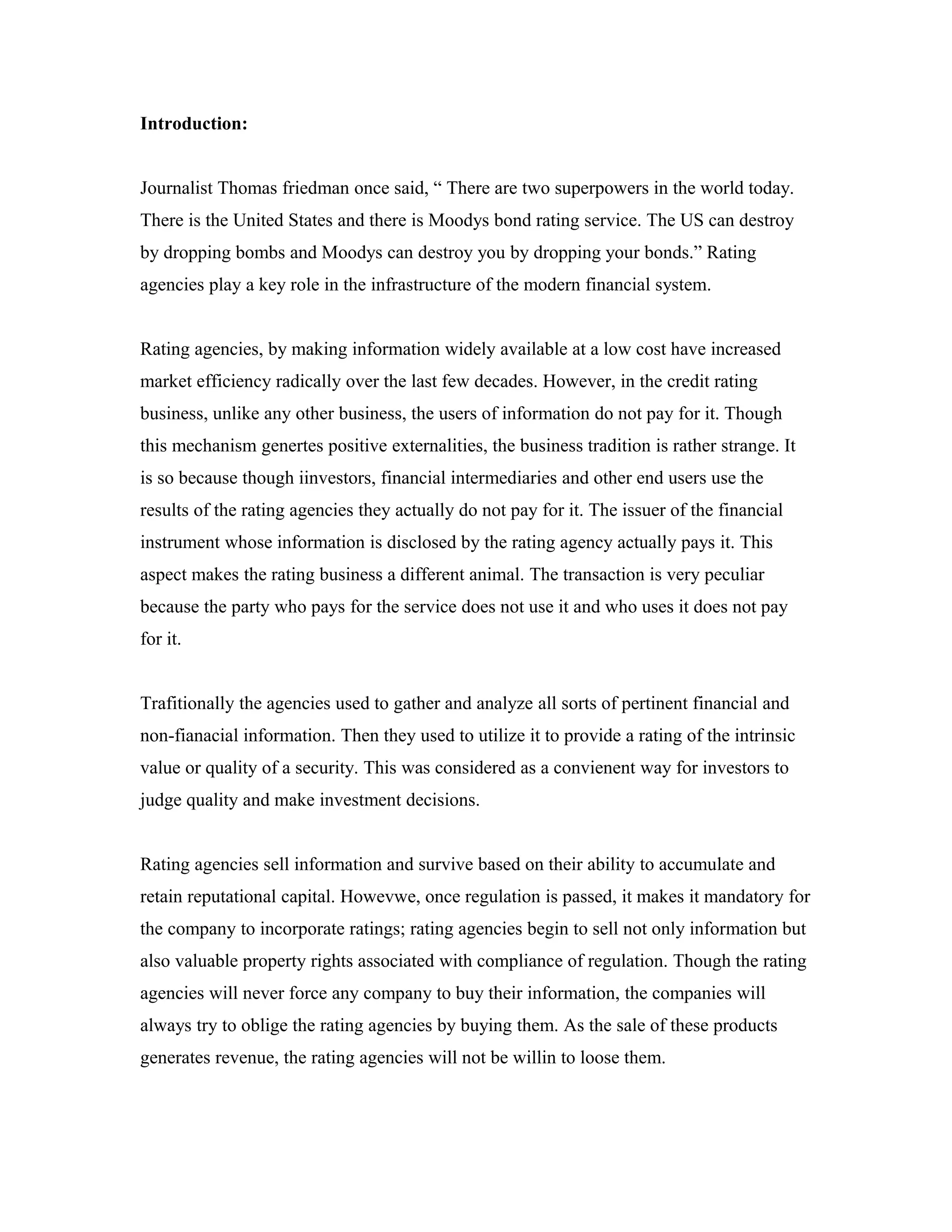

Credit rating agencies play a key role in the modern financial system by providing ratings that assess the creditworthiness and risk of default for debt instruments. While ratings agencies increase market efficiency through widely available low-cost information, their business model is unusual in that issuers, not investors or users, pay for ratings. This can potentially compromise the independence and objectivity of agency ratings. The role of ratings agencies has expanded over time as regulations increasingly require their use in investment and lending decisions. Factors like independence, credibility, disclosure, and a developed debt market are important for ratings to effectively fulfill their function of informing investors.