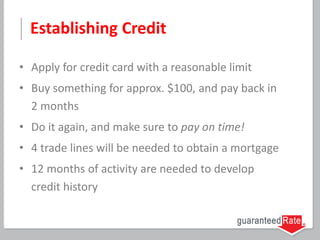

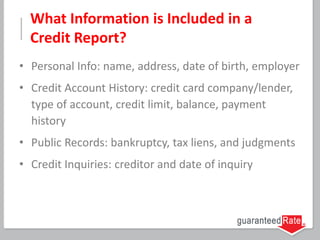

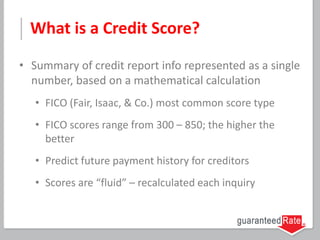

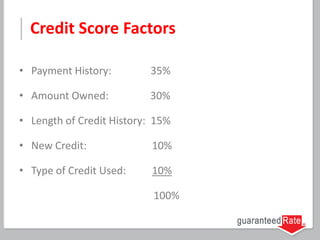

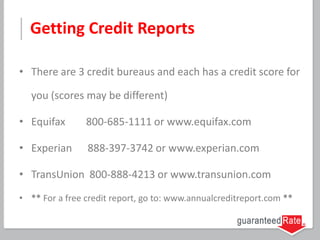

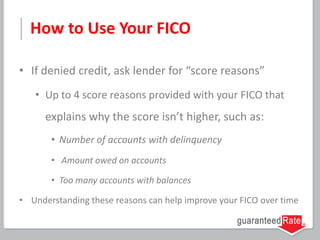

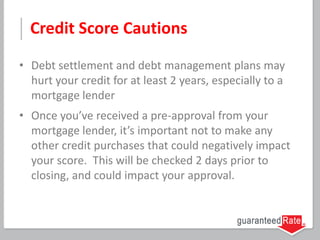

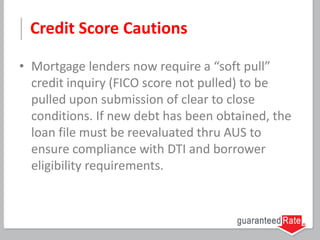

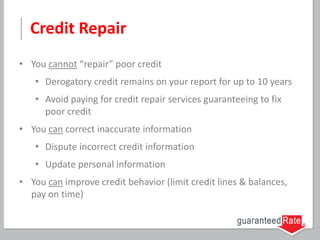

This document provides information about understanding credit scores. It discusses the purpose of credit reports, the information included in credit reports, factors that affect credit scores, how to obtain credit reports, and tips for credit repair. Specifically, it notes that credit reports are used to assess credit risk, include personal information and payment history, and credit scores range from 300-850. Payment history, debt amounts, credit history length, new credit, and credit types are the main factors impacting credit scores.