The document discusses credit scores and what they mean. It provides details on:

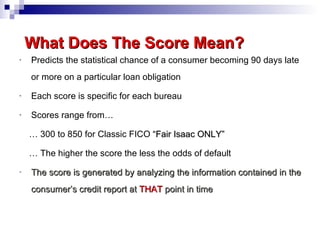

1. Credit scores range from 300 to 850 and are generated by analyzing a consumer's credit report, with higher scores indicating a lower risk of loan default.

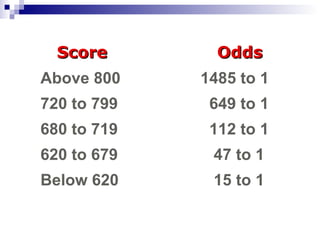

2. The odds of consumer default vary significantly depending on credit score, from 1 in 15 for scores below 620 to 1 in 1,485 for scores above 800.

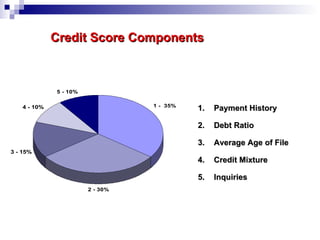

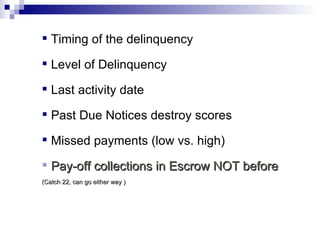

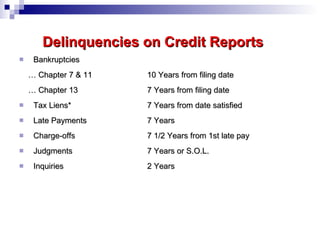

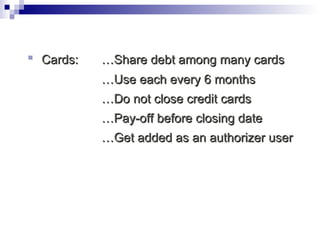

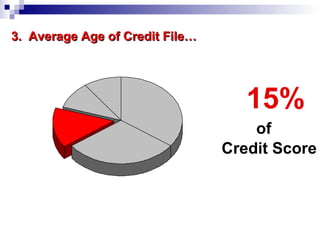

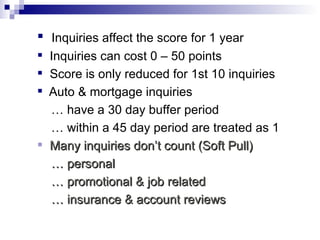

3. The five main components that determine a credit score and their relative weights are: payment history (35%), debt ratio (30%), age of credit (15%), credit mix (10%), and inquiries (10%).

![“ Mark of Excellence” Mark P. Moyes Certified Mortgage Planner __________________ (801) 999-0886 [email_address] www.MarkMoyes.com ](https://image.slidesharecdn.com/creditpresentation-091203215619-phpapp02/85/Understanding-Credit-NMLS-267431-1-320.jpg)