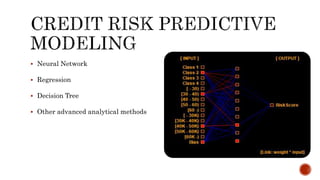

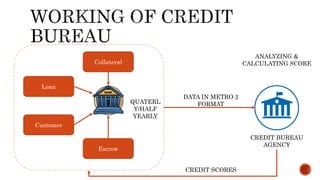

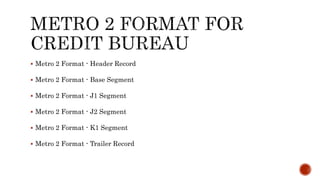

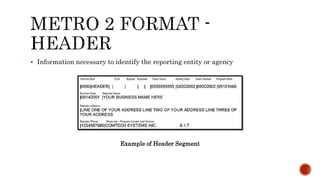

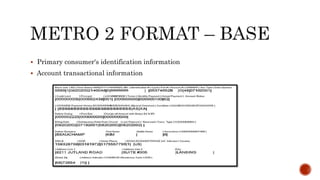

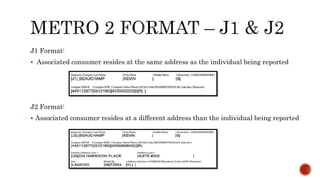

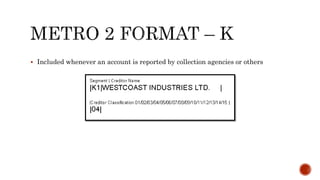

The document discusses credit risk analysis methods like credit risk scoring and predictive modeling. It lists the main credit bureaus in India like CIBIL, Equifax, and Experian that collect consumer credit data in the Metro 2 format, which includes different data segments. The credit bureaus analyze the data and calculate credit scores that are provided to lenders.