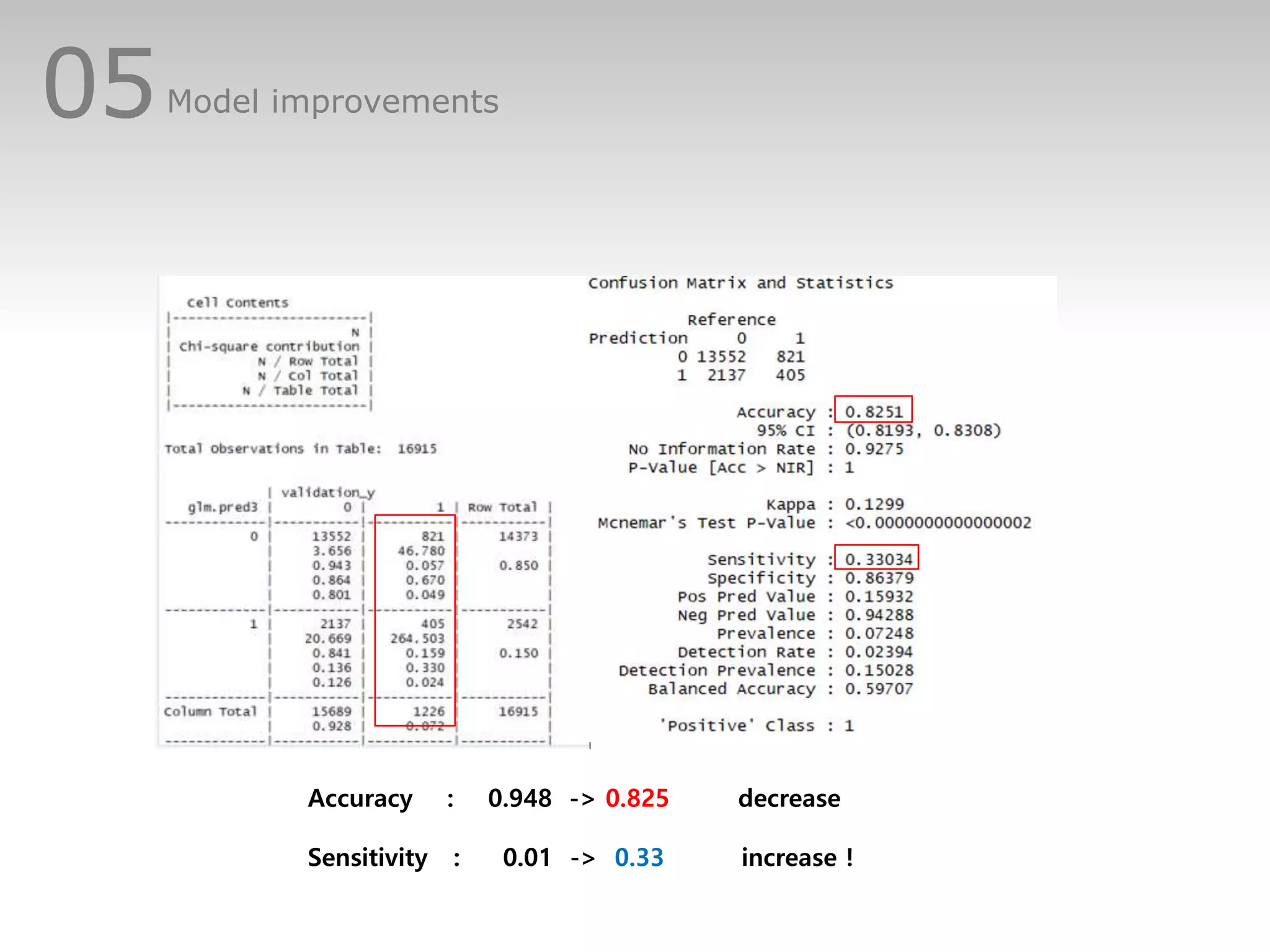

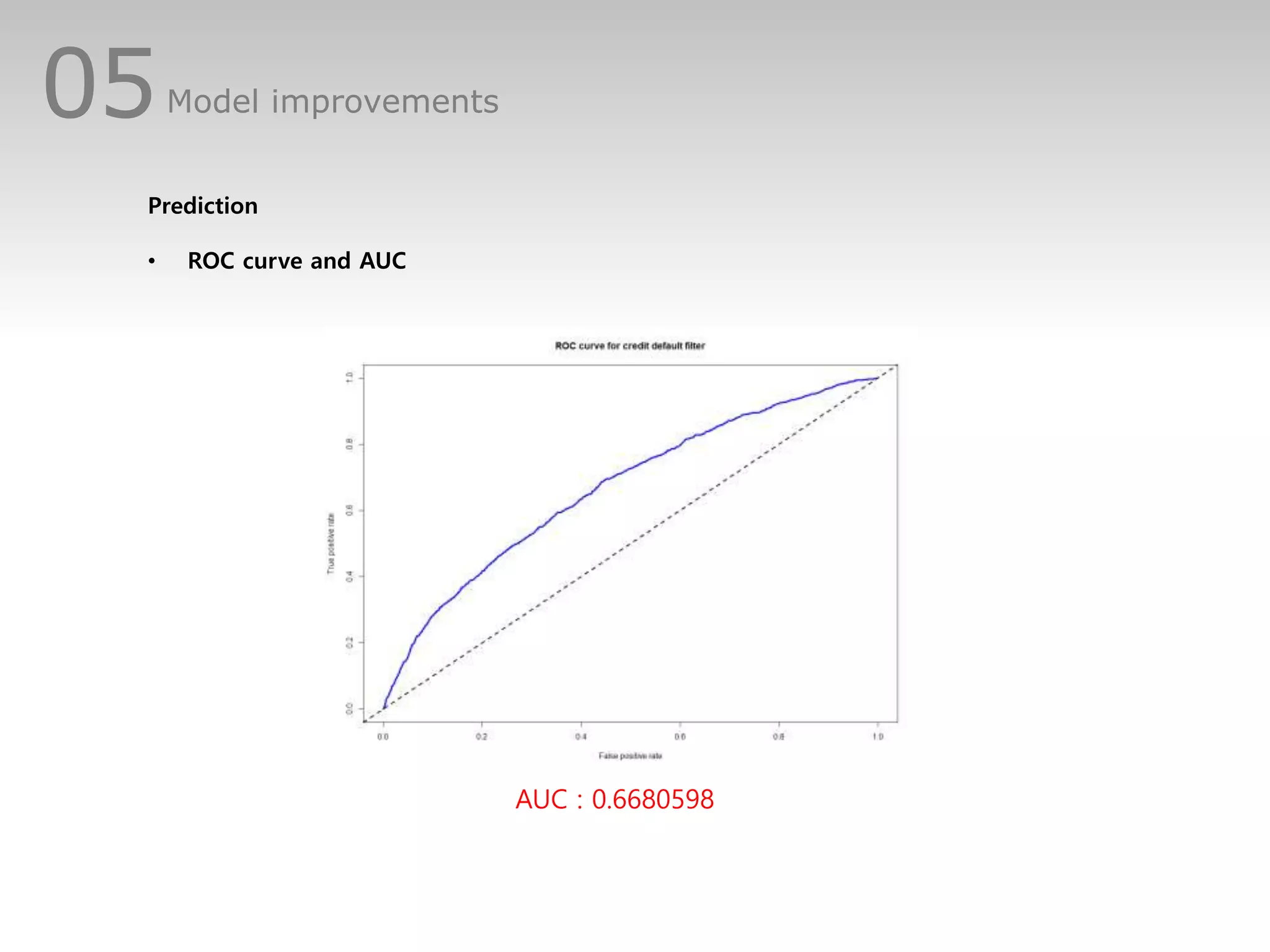

This document discusses predicting credit default risk using a Home Credit dataset. It summarizes analyzing the data using logistic regression, dealing with imbalanced classes and multicollinearity. Model improvements using SMOTE sampling and excluding correlated variables increased sensitivity from 0.01 to 0.33, though accuracy and AUC decreased. Further improvements could involve other models, and handling missing values without exclusion.

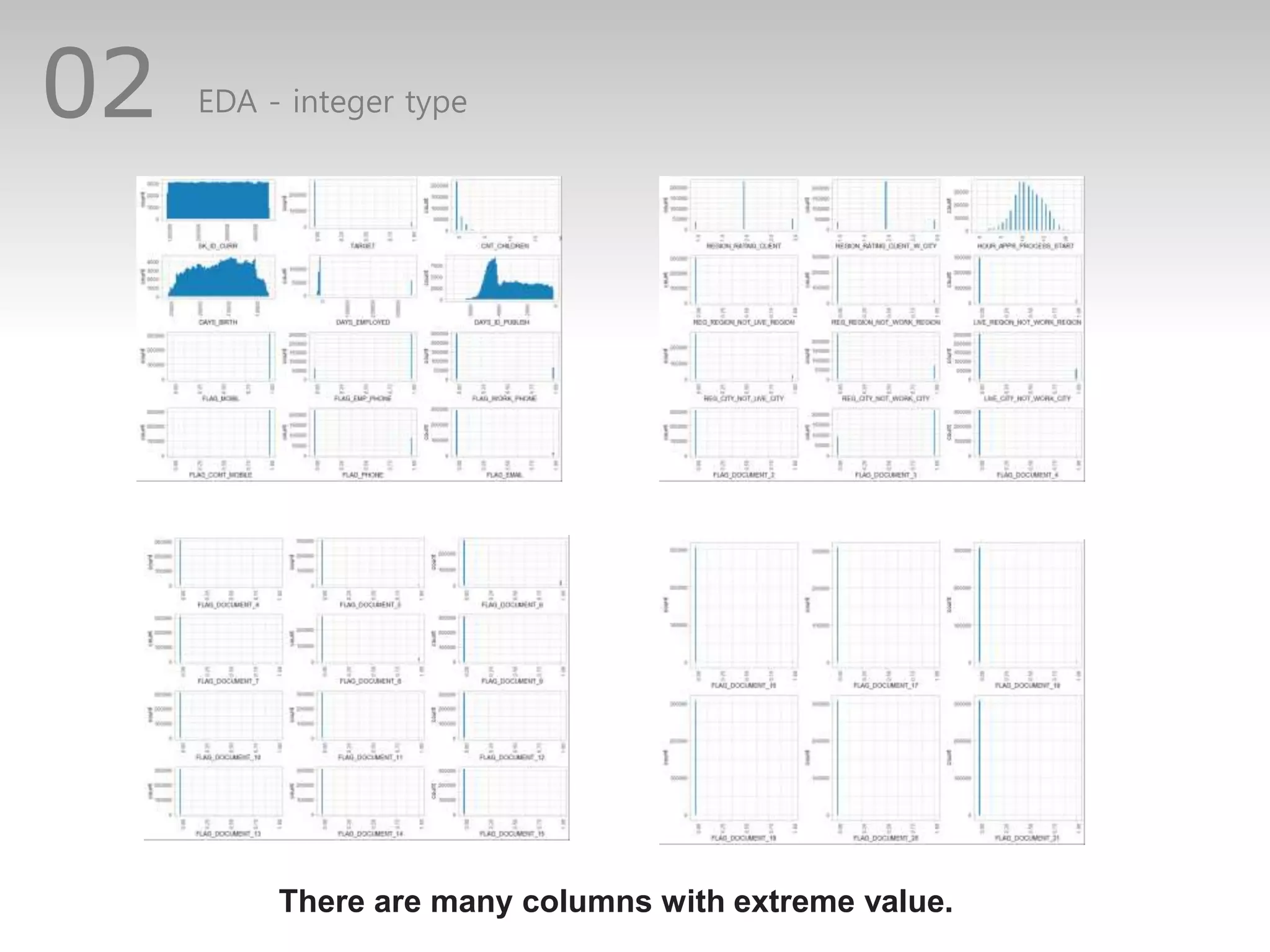

![02NULL Values

> mean(is.na(application)) [1] 0.2454355

Columns with null values greater than 50%

Too many null values

we assume that variables with

Large number of null values are

hard to present data

Decided to exclude those variables](https://image.slidesharecdn.com/creditdefaultrisk-181116123247/75/Credit-default-risk-14-2048.jpg)