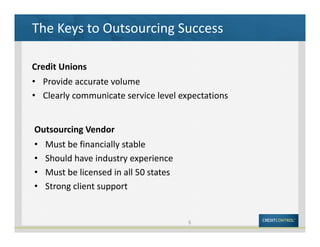

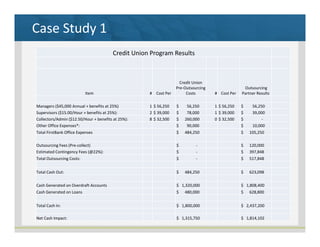

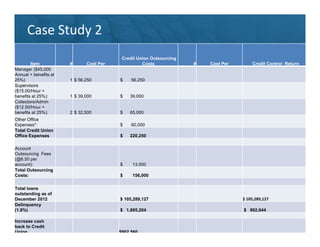

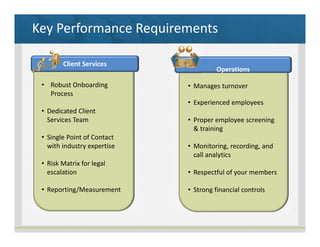

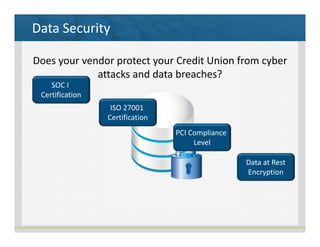

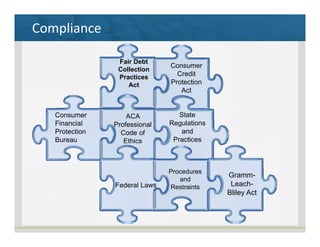

The document provides an overview of best practices for outsourcing receivables collections. It discusses the risks and benefits of outsourcing, as well as keys to success. Case studies show how two credit unions reduced costs and increased returns by outsourcing to Credit Control. The presentation emphasizes selecting a financially stable vendor with industry experience, strong client support, and national licensing. It also stresses the importance of accurate data, service level expectations, and compliance with numerous regulations to protect members' data and privacy.