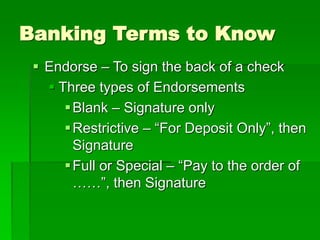

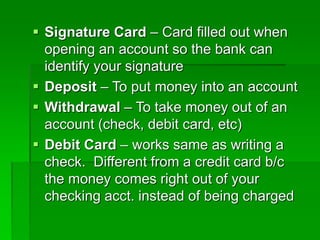

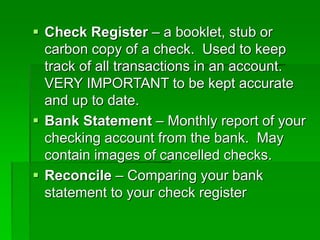

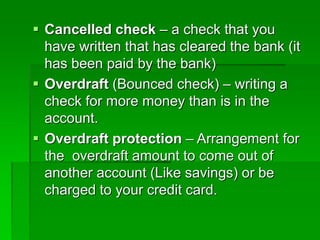

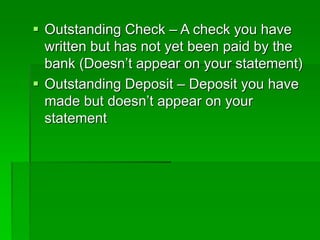

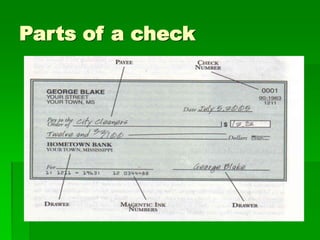

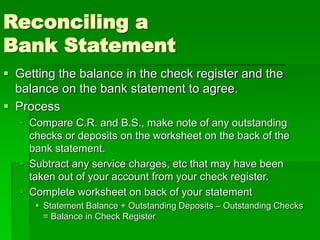

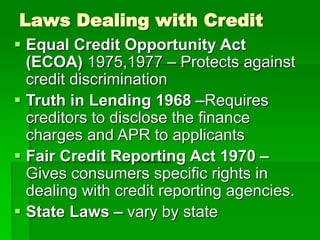

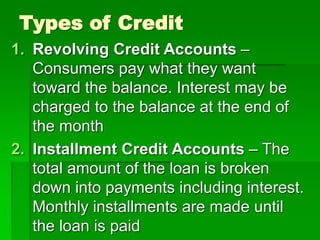

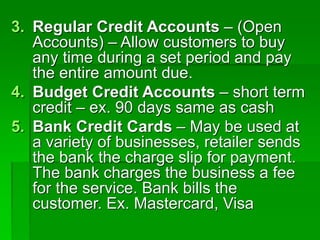

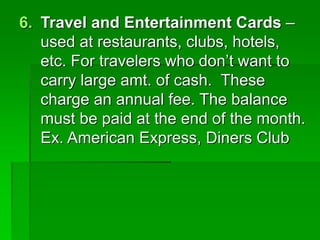

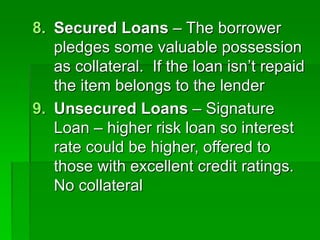

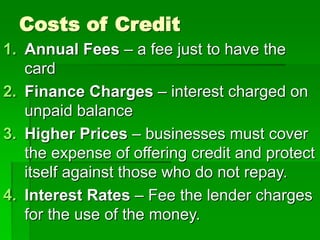

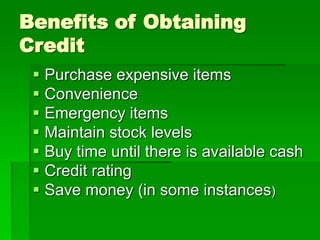

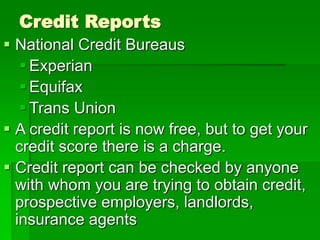

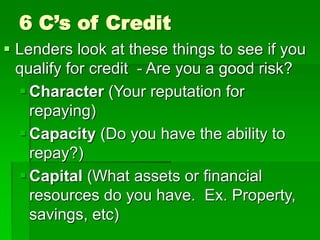

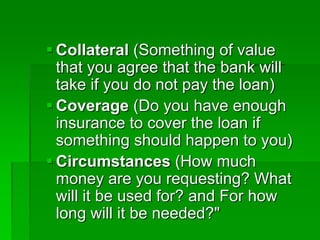

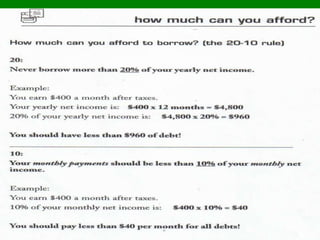

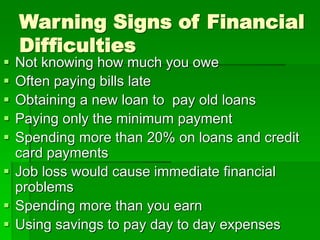

The document outlines essential banking and credit terms, including types of endorsements, account management concepts, credit types, and regulations protecting consumers. It defines key terms related to transactions, checks, and the importance of reconciling bank statements, as well as various types of credit accounts and their associated costs. Additionally, it discusses the criteria lenders use to assess creditworthiness, warning signs of potential financial difficulties, and the sources of credit available.