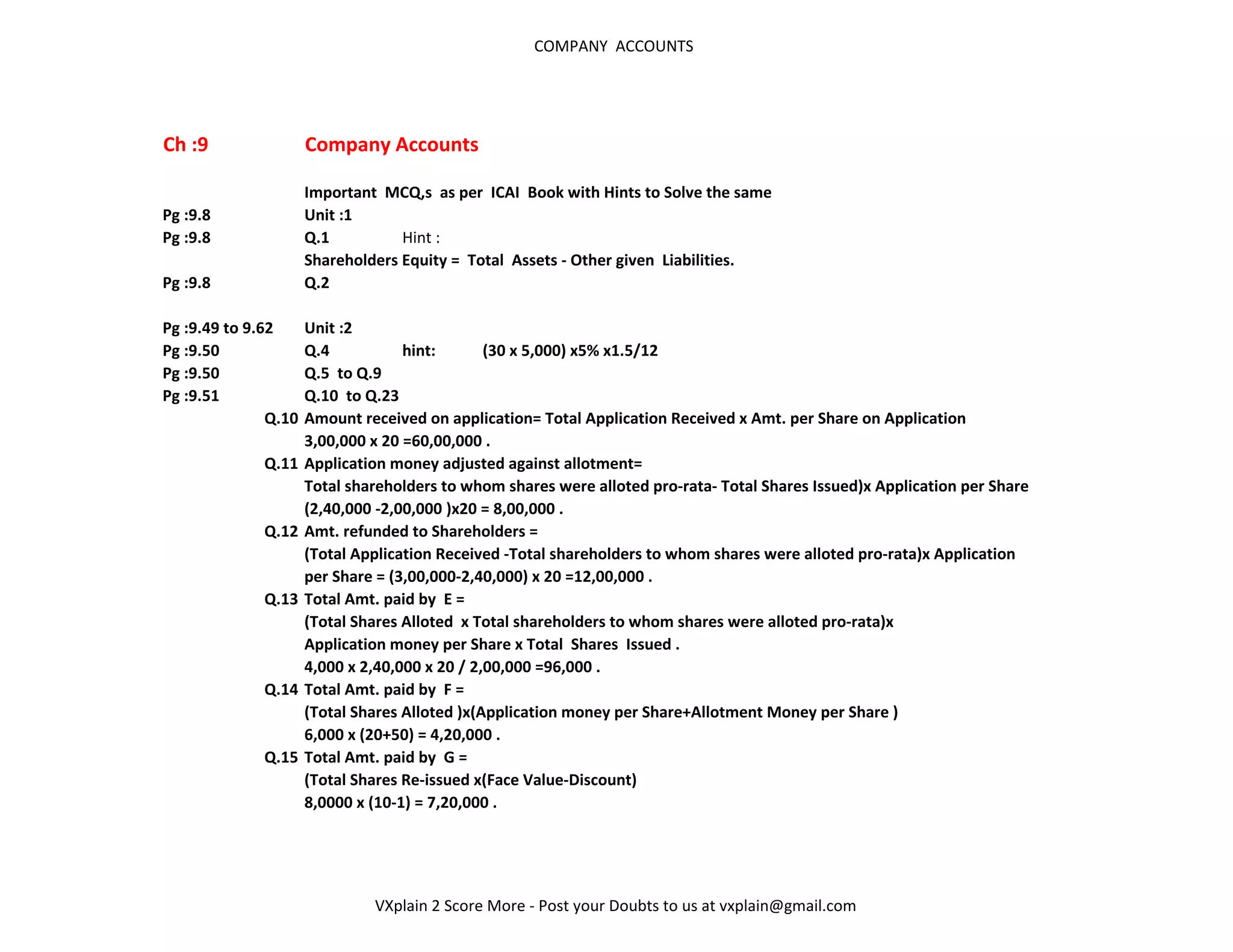

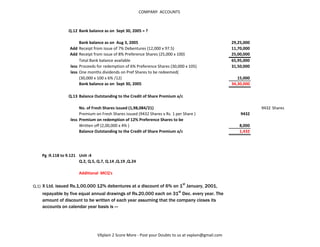

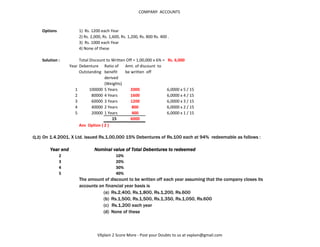

This document provides multiple choice questions and solutions related to company accounts. It covers topics like shareholders' equity, issue and redemption of shares, debentures, preference shares, dividends, and balance sheets. For example, it explains how to calculate the amount of dividend payable based on the proposed dividend rate and called-up equity share capital. It also shows calculations for determining the number of equity shares to be issued to raise funds for redeeming preference shares.