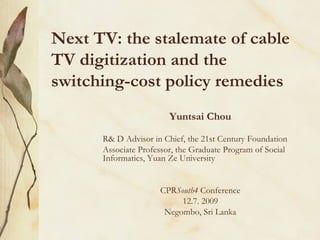

This document analyzes factors that affect the digitization of cable TV services using data from 16 Asia Pacific countries. It finds that higher cable TV penetration rates and switching costs reduce digitization, while increased penetration of substitute services like DBS increases digitization. It recommends policies to promote substitute services or deploy newer cable technologies to reduce analog expansion and subsidies to lower switching costs to spur digital adoption. Governments should consider rate deregulation if substitute services are limited and public funds are unavailable.

![the econometric analysis of 16 Asia Pacific countries 0.78 0.78 R² within 1348.17 1388.96 F statistic 41 41 observation 1.818* (0.790) 1.969** (0.750) GDP (gdpln) -0.085 (0.114) Interaction var. 2 (A_P) Dropped Tiering policy (tier) -0.187*** (0.043) -0.173*** (0.038) Tariff difference (diff) 0.622*** (0.154) 0.614*** (0.151) DBS (DBSln) -0.804* (0.334) -0.849** (0.326) cable TV (acableln) -15.962* (7.920) -18.911** (6.763) intercept Growth rate of digital cable TV [B] growth rate of digital cable TV [A] variable](https://image.slidesharecdn.com/cprsouth4981207-100512034715-phpapp01/85/CPR-South4-981207-7-320.jpg)