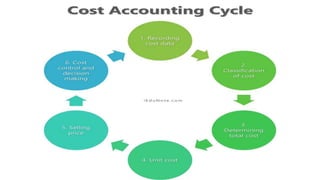

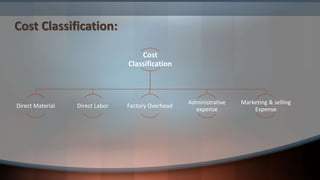

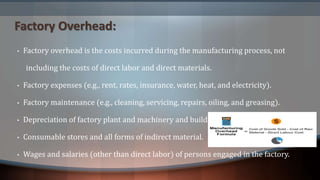

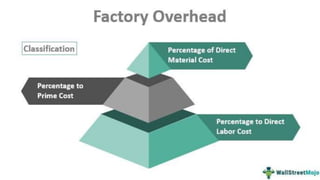

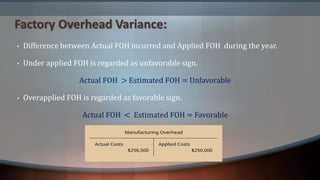

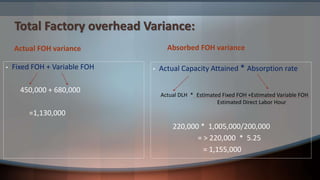

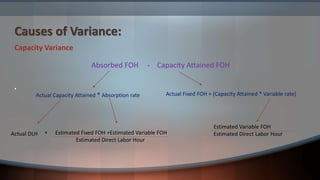

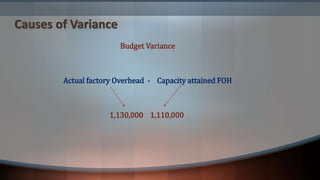

This document discusses factory overhead cost accounting, emphasizing the role of cost accounting in capturing production costs for better management decisions. It outlines various classifications of costs, detailing components of factory overhead, including expenses related to manufacturing and maintenance. Additionally, it explains the concepts of factory overhead variance, including under and overapplied overhead, and the factors leading to variances in budget and capacity.