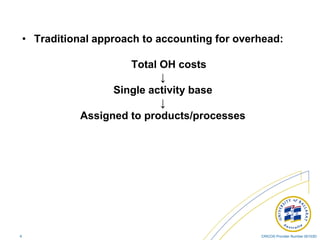

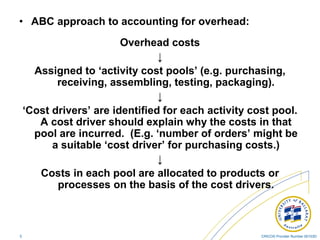

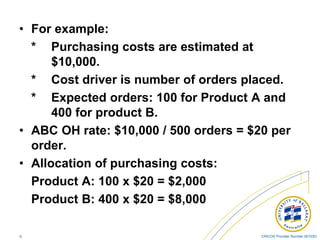

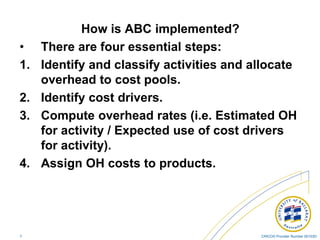

This document provides an overview of activity-based costing (ABC). It explains that ABC assigns overhead costs using multiple cost drivers rather than a single measure. The document outlines the basic ABC process of assigning costs to activity pools, identifying cost drivers, computing overhead rates, and assigning costs to products. It notes advantages of ABC include more accurate product costs and better decision making, while disadvantages include greater complexity. The document also provides a brief introduction to just-in-time processing.