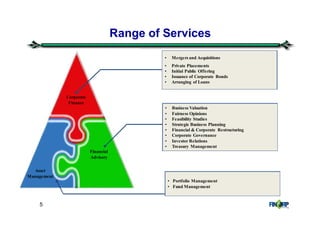

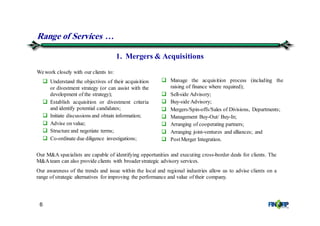

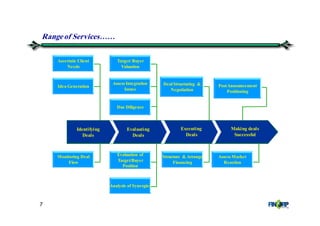

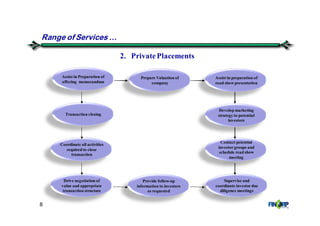

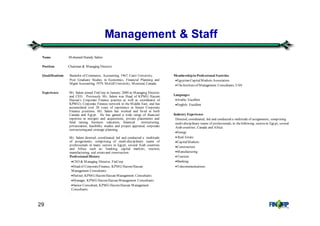

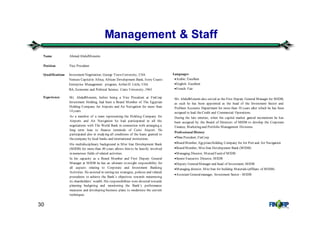

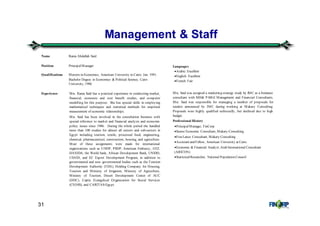

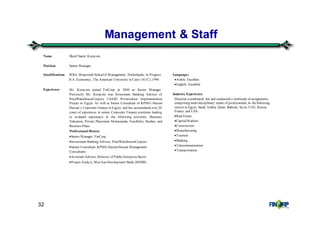

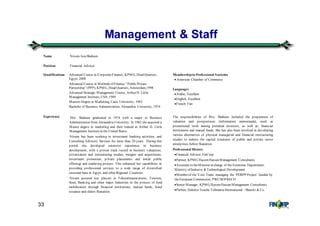

FinCorp is an investment banking firm established in Egypt in 1998 that provides services including mergers and acquisitions, private placements, IPOs, corporate bonds, loans, business valuation, and portfolio management. It has relationships with similar firms globally. The document provides an overview of FinCorp, its services, experience in sectors like real estate and manufacturing, and profiles of its professionals.