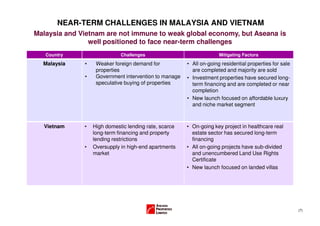

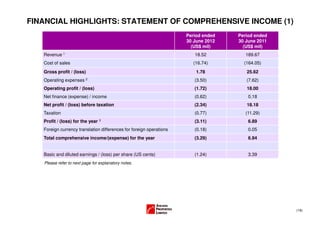

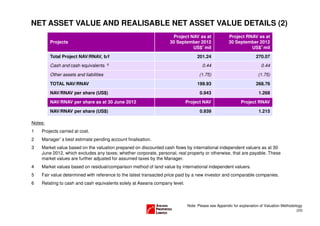

Aseana Properties Limited is a property developer focused on Malaysia and Vietnam. It provides a corporate presentation outlining its business model, investment focus, portfolio of projects, and challenges in the current market environment. The presentation discusses Aseana's diversified portfolio of residential and commercial projects across Malaysia and Vietnam, and provides updates on the performance and status of each project. It also summarizes the near-term challenges in the Malaysian and Vietnamese property markets and how Aseana is positioned to address them.