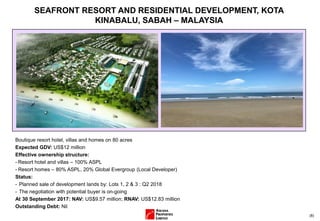

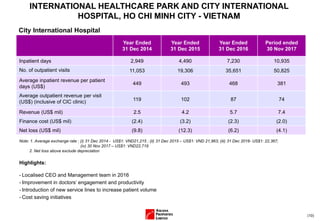

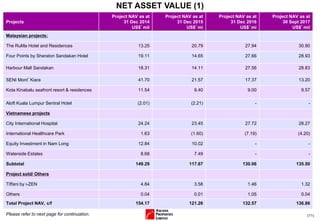

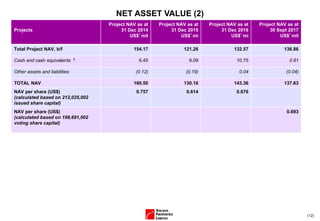

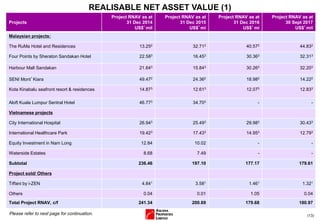

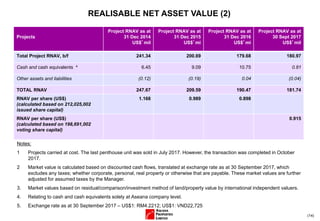

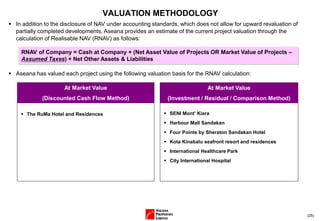

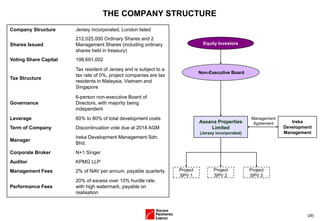

The document provides an overview of the current position of ASEANA PROPERTIES LIMITED as of September 30, 2017. It summarizes the company's seven remaining assets, which have a total net asset value of $135.50 million and total realizable net asset value of $179.61 million. For each asset, it outlines the ownership structure, development status, financial performance metrics from 2014-2017, and notes. It also includes tables summarizing the net asset values and realizable net asset values for each asset from 2014-2017.