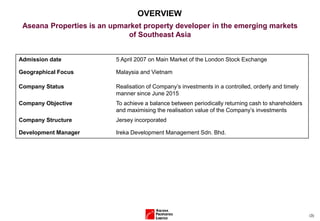

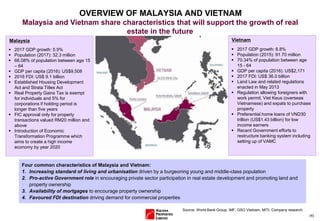

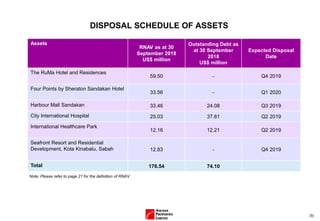

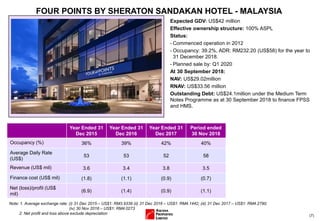

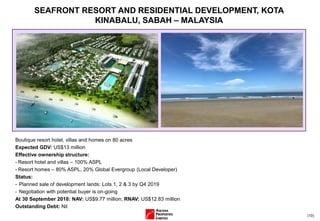

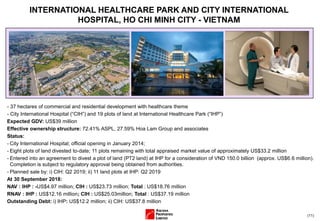

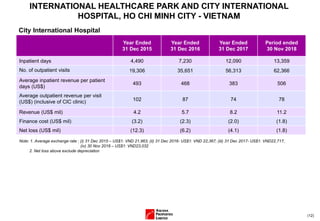

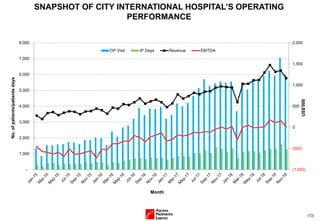

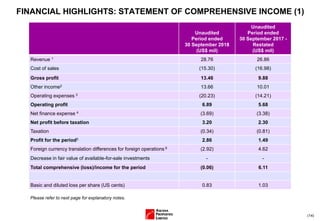

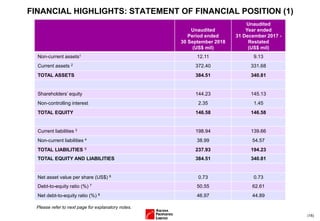

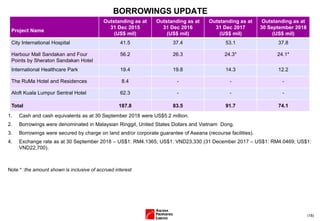

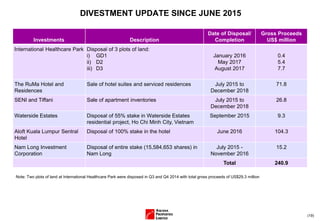

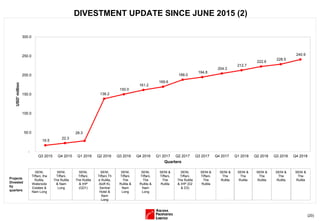

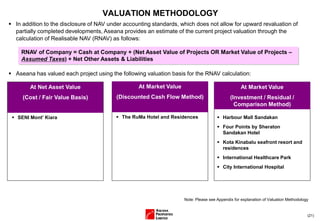

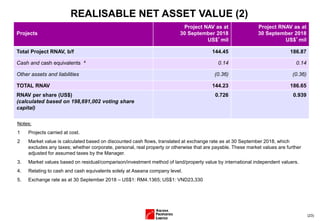

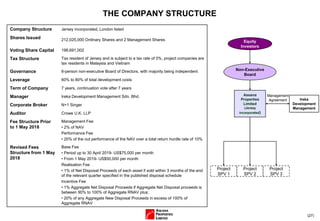

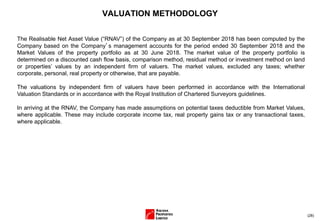

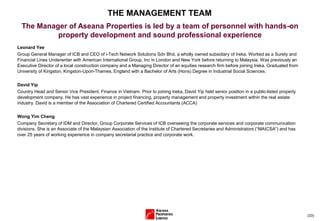

This corporate presentation by Aseana Properties Limited provides an overview of the company and its assets. It discloses that Aseana Properties is focused on upmarket property development in Malaysia and Vietnam, and is currently working to realize its investments in a controlled manner. The presentation outlines Aseana Properties' key assets, including development projects, hotels, retail properties, and a hospital. It provides details on the status and expected disposal dates for each asset. Financial information is also presented, such as operating performance metrics for the hotel and hospital assets.