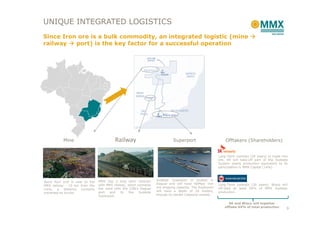

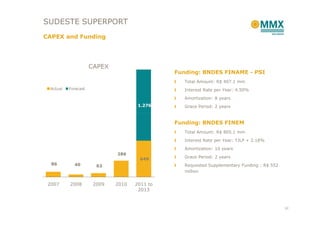

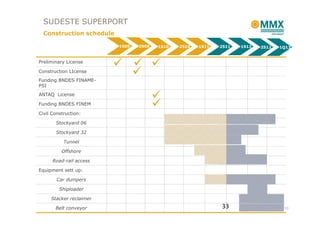

The document discusses MMX's integrated iron ore supply system in Brazil, including their Serra Azul mine expansion, railway contract with MRS, and Sudeste Superport. Key points are:

1) MMX is uniquely positioned with long-term contracts for iron ore supply to China and South Korea through their integrated mining, railway, and port assets.

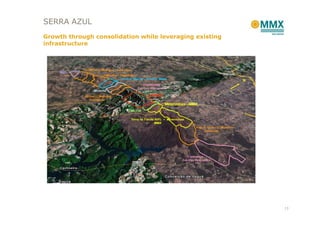

2) Their Serra Azul mine expansion will leverage existing infrastructure to consolidate iron ore resources and increase production capacity.

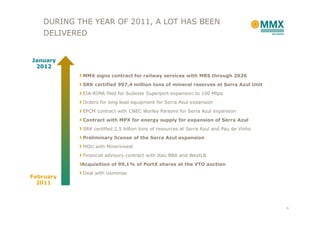

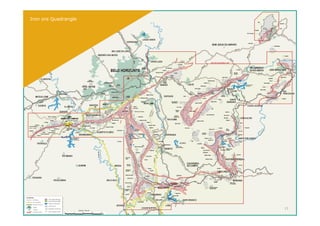

3) MMX signed a long-term railway contract with MRS through 2026 to transport iron ore from the Serra Azul mine to their Sudeste Superport.