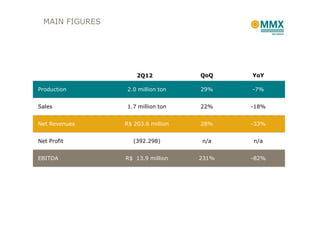

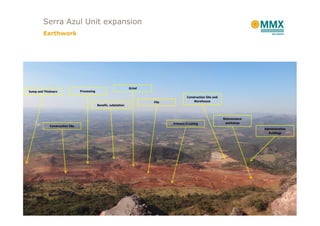

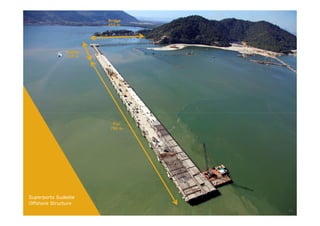

This document provides financial results and operational updates for MMX Mineração e Metálicos S.A. for the second quarter of 2012. Key highlights include a 29% increase in production to 2 million tons compared to the previous quarter, a 22% rise in sales to 1.7 million tons, and EBITDA growth of 231% to R$13.9 million. However, net revenues declined 28% year-over-year to R$203.6 million and a net loss was reported. The document also outlines progress on expansion projects at the Serra Azul unit and construction of the new Sudeste Superport facility.