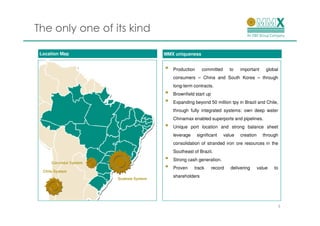

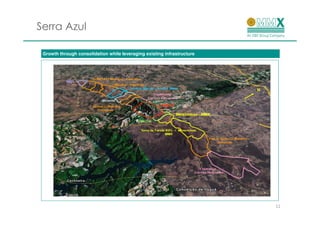

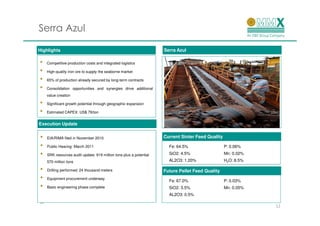

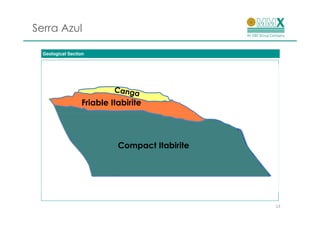

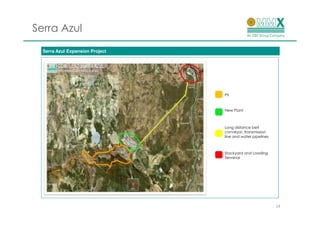

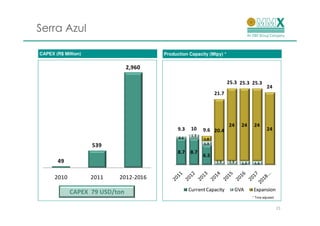

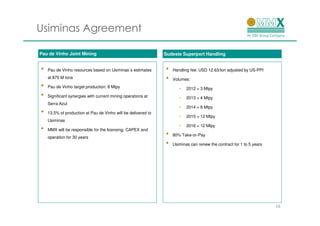

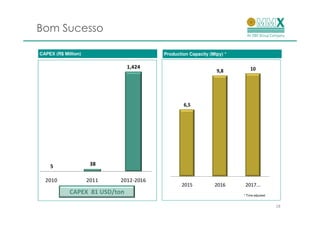

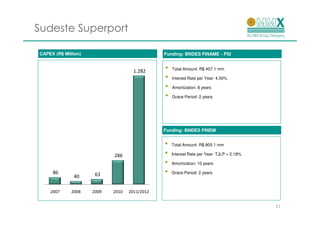

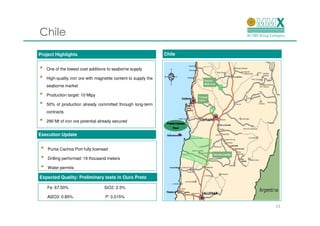

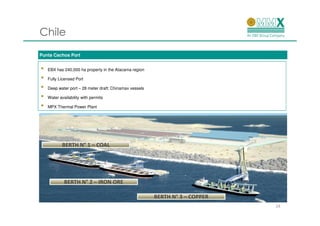

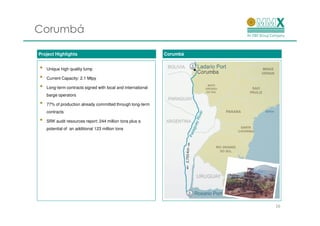

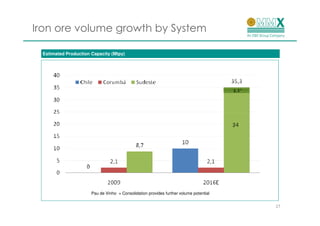

MMX is a Brazilian mining company that aims to create choices in seaborne iron ore supply. The presentation discusses MMX's unique integrated logistics systems and projects in Brazil and Chile that will allow expansion beyond 50 million metric tons per year of iron ore production. Key projects discussed include the Serra Azul and Bom Sucesso mines in Brazil, which will be connected to MMX's Sudeste Superport by railway. The port is expected to begin operations in the third quarter of 2012. MMX also discusses its Punta Cachos port project in Chile and existing Corumbá mine operations in Brazil.