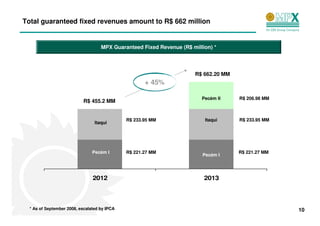

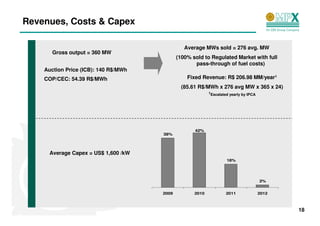

MPX Energia S.A. is a Brazilian power generation company that has secured contracts totaling 1,080 MW of installed capacity and 899 average MW of contracted energy. The company has guaranteed fixed revenues of R$662 million as of September 2008 from its power plants in Pecém I, Pecém II, and Itaqui. MPX has maintained a comfortable cash position since its IPO and began construction of its Pecém I plant in late June 2008.