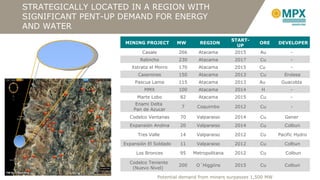

MPX Energia S.A. is a Brazilian energy company with the largest portfolio of integrated power generation projects in South America totaling over 14 GW. It has natural gas resources of over 11 Tcf and world-class coal assets in Colombia. MPX will have steady cash flow from its 3.7 GW of contracted power plants starting operations from 2012-2014. It is also developing large-scale power projects in Brazil, Chile and Colombia, totaling over 9 GW, integrated with natural gas and coal resources.